KPI – March 2024: Recent Vehicle Recalls

KPI – March 2024: State of Manufacturing

KPI – March 2024: State of Business – Automotive Industry

KPI – March 2024: State of the Economy

KPI – March 2024: Consumer Trends

While consumer confidence, sentiment and demand posted conflicting results in February, data clearly shows small business owners remain skeptical amid rising national debt, high interest rates and stubborn inflation.

The Conference Board Consumer Confidence Index decreased to 106.7 (1985=100) in February, compared to a downwardly revised 110.9 in January. Furthermore, after three consecutive months of gains, data now suggests “there was not a material breakout to the upside in confidence at the start of 2024,” as previously considered.

On the contrary, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – remained relatively unchanged in March, dipping to 76.5 compared to 76.9 a month prior.

“After strong gains between November 2023 and January 2024, consumer views have stabilized into a holding pattern; consumers perceived few signals that the economy is currently improving or deteriorating,” says Joanne Hsu, director of Survey of Consumers.

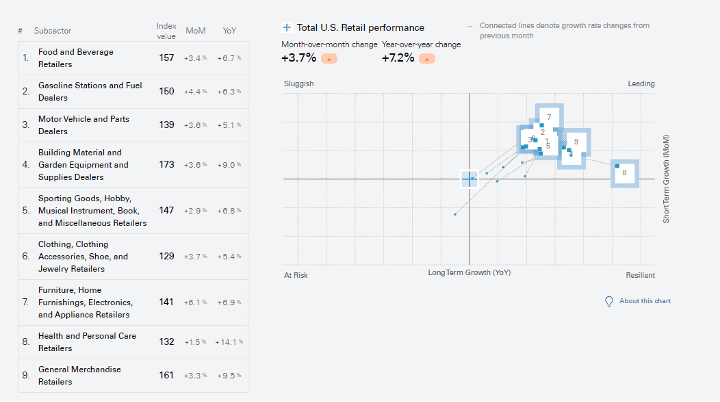

According to Fiserv, Inc. (NYSE: FI) – a leading global provider of payments and financial services technology – the latest Fiserv Small Business Index showed positive results with an index of 149, a six-point gain over January.

Specifically, sales activity increased a seasonally adjusted 3.7% month-over-month and 7.2% year-over-year. The largest spending increases at small businesses included Food Services and Drinking Places, Professional Services and Ambulatory Healthcare.

Meanwhile, consumer spending cooled in Insurance and Real Estate Rental and Leasing. Overall, Fiserv says sales growth was aided by gains in foot traffic, with retail small business transaction numbers at a five-year high.

In contrast, Sumathi Bala of CNBC reported “worrying signs” consumer spending could be heading for a slowdown amid persistent inflation and high borrowing costs. For example, (national) retail sales rose less than expected at 0.6% in February, while January’s decline was revised even lower to 1.1%.

Moreover, a recent Bank of America report highlighted “inflation is taking a toll on Americans,” as card spending was weak in February.

“More broadly, retail (i.e., goods and food services) spending has been slowing down over the last few quarters, as goods inflation has fallen sharply and services inflation has remained elevated,” according to the bank. “The risk is that sticky services inflation will further shrink retail’s wallet share, to the extent that real spending also slows down.”

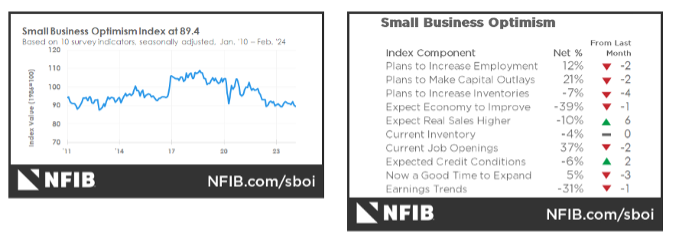

While the Fiserv Small Business Index paints a pretty picture for small businesses, owners continue to face strong headwinds. The NFIB Small Business Optimism Index decreased to 89.4 in February, marking the 26th consecutive month below the 50-year average of 98.

Twenty-three percent of small business owners pointed to inflation as the single most important challenge in operating their business – up three points from last month and replacing labor quality as the top problem.

Overall, 56% reported hiring or trying to hire in February – up 1 point from January. Another 51% of owners (91% of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill (up 2 points). In fact, 32% have openings for skilled workers (up two points) and 12% have openings for unskilled labor (down three points). According to respondents, difficulties in filling open positions is particularly acute in the construction, transportation and wholesale sectors.

“While inflation pressures have eased since peaking in 2021, small business owners are still managing the elevated costs of higher prices and interest rates,” says Bill Dunkelberg, NFIB chief economist.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of the nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Here are a few key data points explained in further detail throughout the report:

- Economic activity in the manufacturing sector contracted in February for the 16th consecutive month following one month of “unchanged” status (a PMI reading of 50%) and 28 months of growth prior to that, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 47.8% in February, down 1.3 percentage points from the 49.1% recorded in January.

- In February, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% on a seasonally adjusted basis, following a 0.3% rise in January, notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.2% before seasonal adjustment.

- Total new-vehicle sales for February 2024, including retail and non-retail transactions, are projected to reach 1,214,600 units – a 1.4% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

- According to RV Industry Association (RVIA), total RV shipments hit 22,674 units in January – a year-over-year increase of 11.1%.

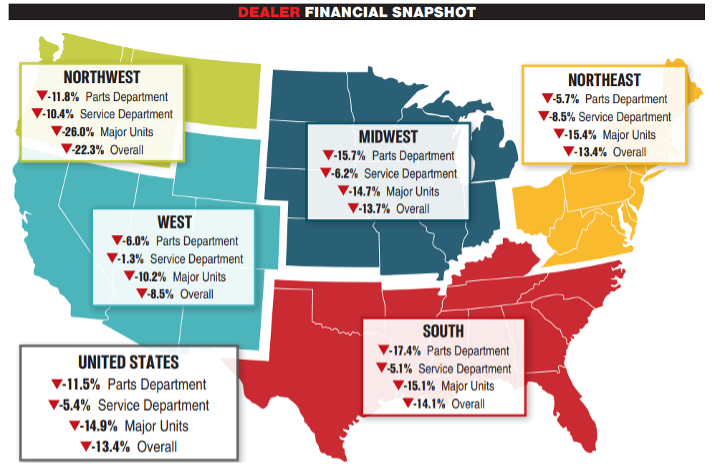

- Powersports Business says dealers across the country reported an overall combined revenue decline of 13.4% in January, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 14.9% in major units, 11.5% in parts and 5.4% in service.