KPI – February 2024: Recent Vehicle Recalls

KPI – February 2024: State of Manufacturing

KPI – February 2024: State of Business – Automotive Industry

KPI – February 2024: State of the Economy

KPI – February 2024: Consumer Trends

Consumer confidence, sentiment and demand climbed in January amid rising national debt, high interest rates and stubborn inflation. On the contrary, small business America remains skeptical of economic conditions.

The Conference Board Consumer Confidence Index rose to 114.8 (1985=100) in January, up from a downwardly revised 108.0 in December. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – jumped to 161.3 (1985=100), an increase from 147.2 last month.

The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – improved slightly to 83.8 (1985=100).

In addition, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – posted a score of 79.6 in the February preliminary results report.

“The fact that sentiment lost no ground this month suggests that consumers continue to feel more assured about the economy, confirming the considerable improvements in December and January across various aspects of the economy,” says Joanne Hsu, director of the University of Michigan Surveys of Consumers. “Consumers continued to express confidence that the slowdown in inflation and strength in labor markets would continue.”

According to Fiserv Inc. (NYSE: FI) – a leading global provider of payments and financial services technology – the latest Fiserv Small Business Index indicates consumers were consistent in their pace of spending at small businesses in January 2024, yielding an index of 138. Month-over-month sales growth across all small business was essentially flat at 0.1%, but year-over-year data proved consumer demand remains strong at 1.7% (though slowing compared to the annual pace of 2.6% in December).

Specifically, Fiserv says the national mix of small business spending in January is noteworthy. Consumers posted the biggest spending increases on insurance-related needs, building materials and DIY projects, as well as accommodations (hotels), while pulling back their spending on restaurants, clothing, certain personal services and specialty trade contractors.

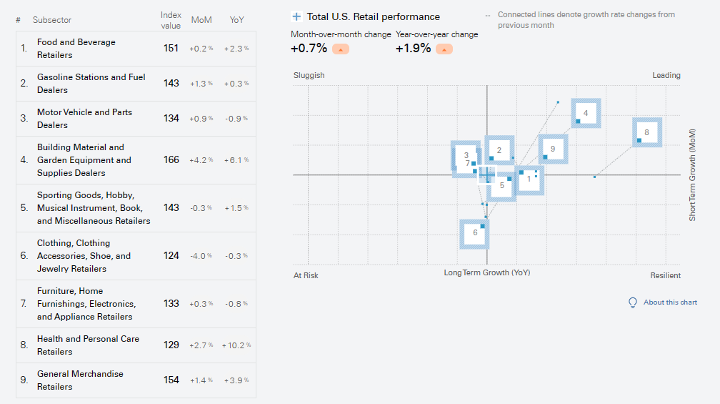

Nationally, the retail sector continued to outperform small business overall. The company reports foot traffic was even more impressive, signaling consumer demand for goods has continued to expand post-holiday.

Building materials, health and personal care, plus general merchandise led the growth.

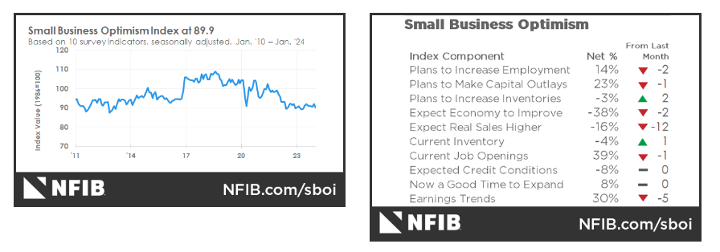

While consumer confidence, sentiment and demand posted an increase, small business owners remain pessimistic. As such, the NFIB Small Business Optimism Index decreased 2 points in January to 89.9, marking the 25th consecutive month below the 50-year average of 98.

One-in-five small business owners reported inflation as their single most important problem in operating the business – down 3 points from last month. Another 10% cited labor costs as their primary challenge, while 21% noted labor quality as a top issue.

Overall, 55% of owners reported hiring or trying to hire in January, with 89% of owners noting “few or no qualified applicants” for the positions they were trying to fill. Approximately 30% have openings for skilled workers and 15% have openings for unskilled labor.

The difficulty in filling open positions is particularly acute in the construction, manufacturing and non-professional services sectors.

“Small business owners continue to make appropriate business adjustments in response to the ongoing economic challenges they’re facing,” says Bill Dunkelberg, NFIB chief economist. “In January, optimism among small business owners dropped as inflation remains a key obstacle on Main Street.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Top Takeaways:

- Economic activity in the manufacturing sector contracted in January for the 15th consecutive month following one month of “unchanged” status (a PMI reading of 50%) and 28 months of growth prior to that, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 49.1% in January, up 2 percentage points from the seasonally adjusted 47.1% recorded in December.

- In January, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% on a seasonally adjusted basis after rising 0.2% in December, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.1% before seasonal adjustment.

- Total new-vehicle sales for January 2024, including retail and non-retail transactions, are projected to reach 1,087,900 units – a 1.5% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

- According to RV Industry Association (RVIA), manufacturers ended 2023 with 21,522 total RV shipments in December – closing the year at 313,174 overall units, down 36.5% year-over-year.

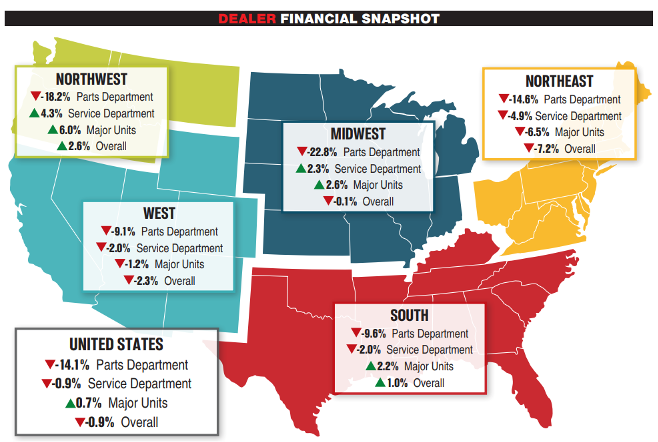

- Powersports Business says dealers across the country reported an overall combined revenue decline of 0.9% in December, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 0.7% in major units and 14.1% in the parts department.