KPI — October 2021: The Brief

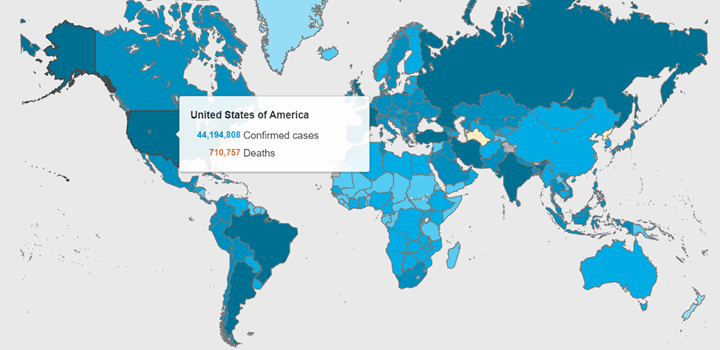

More than 238.5 million COVID-19 cases and 4.8 million deaths have been confirmed across 235-plus countries, areas or territories. Vaccination efforts remain a top priority, with an ultimate goal of reaching herd immunity. Approximately 6.3 billion doses have been administered globally, with 186.6 million Americans, or 56.2% of the total U.S. population, now fully vaccinated.

As COVID-19 cases rise across the U.S., the focus turns to those who are eligible for vaccination but have declined for a variety of reasons. Increased demand for “mandatory vaccination” is of growing concern among those who stand by lawful personal choice in health and medical decisions. Read full coverage about the Biden Administration’s pathway to mandatory vaccination and the legal implications here and here. An excerpt from USA Today is included below:

Biden’s pathway to enforce the mandate is through the Occupational Safety and Health Administration (OSHA), which can require businesses and large companies to put safety regulations in place to ensure the health and security of the people who work at a given company. No mandate has focused on employees like this, however; OSHA mandates have typically focused on work conditions at the property of the company. One exception is that OSHA has enforced companies requiring hepatitis B documentation, but that wasn’t technically a mandate.

“This isn’t OSHA’s first foray into vaccine law, but Biden’s mandate is by far the most extensive in using OSHA as a vehicle for requirement,” said Brian Dean Abramson, a leading expert on vaccine law.

Overall, Americans remain sharply divided over vaccine mandates, a topic sure to unfold even more in the coming months.

COVID-19 Cases by Country

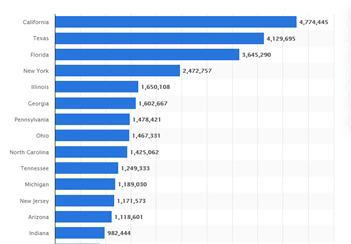

COVID-19 Cases by State

As of October 11, 2021, the state with the highest number of COVID-19 cases was California. Roughly 44 million cases have been reported across the U.S., with California, Texas, Florida and New York reporting the highest numbers.

COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

Vaccination rates are not the only numbers at a crossroads, as consumer sentiment and confidence tread water.

The Conference Board Consumer Confidence Index® declined again in September, following decreases in both July and August. The Index now stands at 109.3 (1985=100), down from 115.2 in August. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell to 143.4 from 148.9 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – fell to 86.6 from 92.8.

Meanwhile, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – slightly improved to 72.8 in September (compare to 80.4 in September 2020), according to the University of Michigan Survey of Consumers.

Despite declining consumer confidence numbers, shoppers continue to spend, said Jack Kleinhenz, chief economist at the National Retail Federation (NRF).

“There’s a saying that you should never underestimate the American consumer – and its corollary is that you should watch what consumers do, not what they say,” he added. Read the more in-depth economic analysis in the Consumer Trends section of this report.

Within the aftermarket, industry experts forecast online sales of auto parts and accessories to hit $19 billion by 2022. Buy Online Pick-Up In Store shopping channels are expected to post double-digit growth rates through 2024 – presenting a whole new revenue stream to automotive shops that seize the opportunity.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Below are a few key data points explained in further detail throughout the report:

- On the manufacturing side, the September Manufacturing PMI® registered 61.1%, an increase of 1.2 percentage points from an August reading of 59.9%. The data indicates expansion in the overall economy for the 16th month in a row after contraction in April 2020, according to supply executives in the latest Manufacturing ISM® Report On Business®.

- In September, the Consumer Price Index for All Urban Consumers increased .4% on a seasonally adjusted basis after rising .3% in August, according to the U.S. Bureau of Labor Statistics reported. Over the last 12 months, the all items index increased 5.4% before seasonal adjustment.

- LMC Automotive reported Global Light Vehicle (LV) sales slipped to 80 mn units/year in August, marking the lowest result in over a year.

- According to JD Power, total new vehicle sales for September 2021, including retail and non-retail transactions, are projected to reach 1,009,400 units – a 24.5% decrease from September 2020 and a 26.9% decrease from September 2019.

- In August, total RV shipments hit 52,819 units – an increase of 33.8% compared to August 2020. According to RV Industry Association (RVIA), the 52,819 shipments recorded last month set a new monthly record. It stands as the second most units to be shipped in any single month, behind only March 2021.

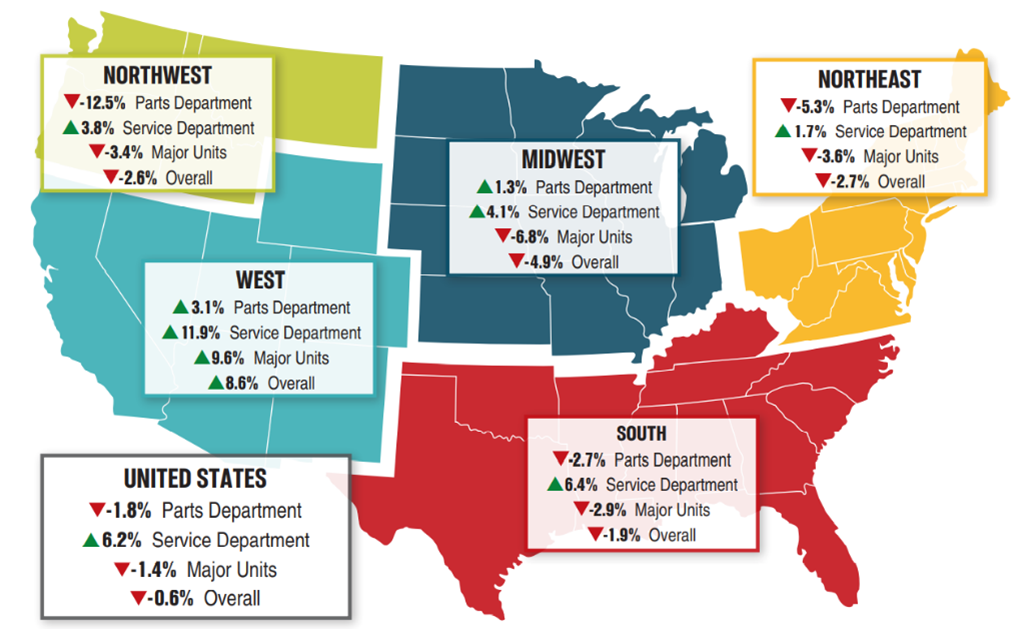

Revenue from new and pre-owned Major Units declined 1.4% in the August 2021 period vs. August 2020, according to composite data from more than 1,650 dealerships in the U.S. using the CDK Lightspeed DMS. Dealerships in the Midwest posted a 6.8% revenue decline in Major Unit sales on average to lead all regions during the period, while the Northeast followed with a 3.6% average decrease. The Northwest saw a 3.4% decline and the South a 2.9%. The lone caveat, said Powersports Business, was an increase in sales throughout the West, at 9.6%. Parts sales dipped into the red during the same period by 1.8% on average year-over-year, led by the Northwest at a 12.5% decline. The national average for Service revenue remained strong and saw a 6.2% overall increase.

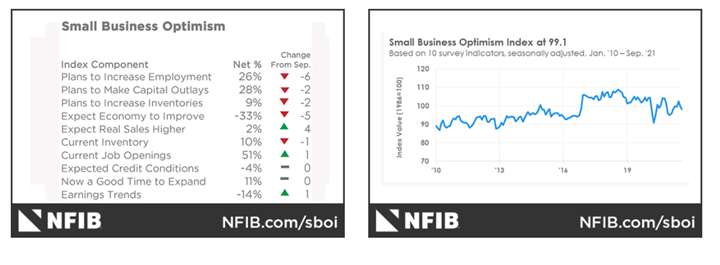

The NFIB Small Business Optimism Index decreased another point in September, now at 99.1.

“Small business owners are doing their best to meet the needs of customers, but are unable to hire workers or receive the needed supplies and inventories,” said Bill Dunkelberg, chief economist at NFIB. “The outlook for economic policy is not encouraging to owners, as lawmakers shift to talks about tax increases and additional regulations.”

Important takeaways, courtesy of NFIB:

- The NFIB Uncertainty Index increased five points to 74.

- Owners expecting better business conditions over the next six months decreased five points to a net negative 33%.

- Fifty-one percent of owners reported job openings that could not be filled, a 48-year record high for the third consecutive month.

- A net 42% of owners reported raising compensation, a 48-year record high. A net 30% of owners plan to raise compensation in the next three months, up four points from August’s record high reading. Twelve percent of owners cited labor costs as their top business problem and 28% said that labor quality was their top business problem – both record-high readings.

The monthly Key Performance Indicator Report is your comprehensive source for industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.

KPI — October 2021: State of Business: Automotive Industry

Key Performance Indicators Report — October 2021