KPI — August: The Brief

The widespread impacts of COVID-19 are laced with complexities and conundrums. From a public health standpoint, nearly six million Americans have been diagnosed with the novel coronavirus, 179,000 of which have died as a result. Statistically speaking, the economic effects have spared few, with tens of millions left unemployed to face new challenges brought on by such hardship.

“Measuring the social, health and economic impact of the coronavirus pandemic, along with policy efforts to address those effects, is of critical national importance,” explained Thesia I. Garner, Adam Safir and Jake Schild, co-authors of “Receipt and use of stimulus payments in the time of the Covid-19 pandemic.” This Beyond the Numbers feature is a first look at results from the stimulus payments questions and an insightful read.

Likewise, lest not forget the juxtaposition between many small businesses struggling to get by or having to close their doors for good, while other industries like RV and powersports are thriving.

This month’s Key Performance Indicator Report provides yet another objective wellness check on the overall health of our nation, from the state of manufacturing and automotive industry to current economic conditions and consumer trends.

For starters, the U.S. economy continues to claw its way out of the single largest quarterly contraction in 75 years, with a second quarter 2020 GDP rate of -32.9% (annualized rate compared to the first quarter of 2020), according to The Conference Board.

As such, federal, state and local governments remain focused on chipping away at the national unemployment rate, which registered at 10.2% in July. Optimistically, total nonfarm payroll employment rose by 1.8 million. For comparison: less than the increases of 4.8 million in June and 2.7 million in May but lower than the February level by 12.9 million.

Furthermore, the largest employment increases occurred in leisure and hospitality, government, retail trade, professional and business services, other services and health care. In particular, employment in leisure and hospitality was a bright spot (+592,000), accounting for approximately one-third of the gain in total nonfarm employment.

Below are a few key data points explored in further detail throughout the report:

- The July PMI® registered 54.2%, up 1.6 percentage points from the June reading of 52.6%.

- While global light vehicle (LV) sales may have fallen 6.8% year-over-year in July, according to LMC Automotive, data from the Jefferies Weekly Global Automotive Aftermarket Report points to momentous improvement from 3.72 million in April and 4.95 million in May to 6.4 million in June.

- Total new vehicle sales improved for the third consecutive month in July, with the SAAR totaling 14.5 million units—a year-over-year decline of 14.4% but up from the 13.1 million units reported in June.

- If the mid-month value of the Manheim Index holds for the full month, the Index will set a record high for the third consecutive month.

- Though OEMs face unprecedented challenges, SEMA points to positive signs in the automotive aftermarket.

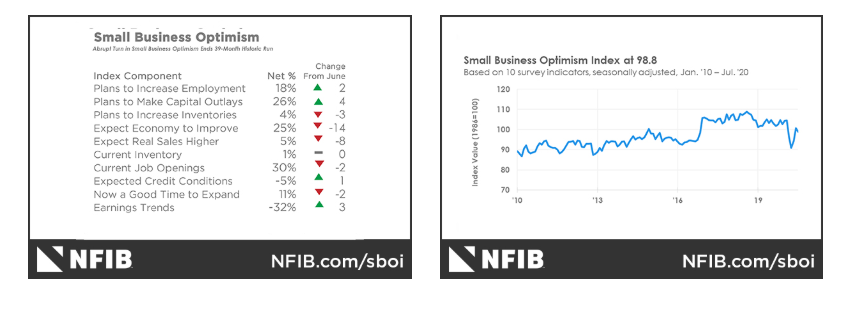

- NFIB’s Small Business Optimism Index fell 1.8 points to 98.8 in July, near the survey’s historical average, which is outlined directly below.

Overall, four of the 10 Index components improved, five declined, and one was unchanged. The NFIB Uncertainty Index increased seven points to 88, and reports of expected better business conditions in the next six months declined 14 points to a net 25%. Owners continue to temper their expectations of future economic conditions as the COVID-19 public health crisis is expected to continue, according to the Small Business Optimism Index.

“This summer has been challenging for many small business owners who are working hard to keep their doors open and remain in business,” said NFIB’s Chief Economist Bill Dunkelberg. “Small business represents nearly half of the GDP and this month we saw a dip in optimism. There is still plenty of work to be done to get businesses back to pre-crisis numbers.”

- Real sales expectations in the next three months decreased eight points to a net 5%.

- The percent of owners thinking it is a good time to expand decreased two points to 11% of owners.

- Earnings trends over the past three months improved three points to a net negative 32%.

- Job creation plans increased two points to a net 18%.

Readers are encouraged to study the most current Small Business Optimism Index, as well as review the complexities of economic recovery here. Also, follow the links to learn more about unemployment insurance and unemployment insurance relief during the COVID-19 outbreak, including contact information for state unemployment insurance offices.

The monthly Key Performance Indicator Report is your comprehensive source for industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.

KPI — August: State of Business: Automotive Industry

Key Performance Indicators Report — August 2020