KPI — September 2022: State of the Economy

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in August on a seasonally adjusted basis after being unchanged in July, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all items index increased 8.3% before seasonal adjustment.

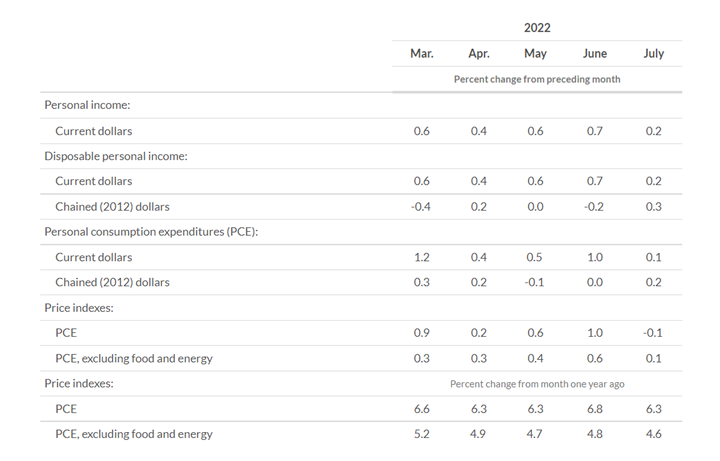

Recent income reporting paints its own grim picture. The real median household income rose from $66,657 in 2016 to $71,186 in 2020, an increase of 6.8% in only four years. Fast forward, and real median household income not only fell from $71,186 in 2020 to $70,784 in 2021, but also is further impacted by runaway inflation and higher interest rates.

“With high inflation persisting for over a year, a majority of Americans now say they are experiencing financial hardship from higher prices,” says Jeffrey Jones, Gallup senior editor. “Lower-income Americans were mainly affected early on, but most middle-income Americans and a substantial minority of upper-income Americans are now feeling the strain of higher prices.”

Increases in the shelter, food and medical care indexes were the largest of many contributors to the broad-based monthly all items increase. These increases were mostly offset by a 10.6% decline in the gasoline index. The food index continued to rise, increasing 0.8% over the month as the food at home index rose 0.7%. The energy index fell 5% month-over-month as the gasoline index declined, but the electricity and natural gas indexes increased.

The index for all items less food and energy rose 0.6% in August, a larger increase than in July. The indexes for shelter, medical care, household furnishings and operations, new vehicles, motor vehicle insurance and education were among those which increased ticked up. Meanwhile, airline fares, communication, as well as used cars and trucks declined.

The all items index increased 8.3% for the 12 months ending August. The all items less food and energy index rose 6.3% during the same timeframe. The energy index increased 23.8% for the 12 months ending August, a smaller increase than the 32.9% increase for the period ending July. The food index increased 11.4% over the last year, the largest 12-month increase since the period ending May 1979.

Employment

In August, the unemployment rate rose by 0.2 percentage point to 3.7% and the number of unemployed persons increased by 344,000 to six million.

“August’s increase in the Employment Trends Index also indicates the labor market is currently still adding jobs at a robust pace,” says Frank Steemers, senior economist at The Conference Board. “But with headwinds in the rest of the economy already evident, expect job growth to decelerate for the remainder of the year.”

Important Takeaways, Courtesy of the Bureau of Labor Statistics:

- The number of persons on temporary layoff was virtually unchanged at 782,000.

- Among the unemployed, the number of permanent job losers increased by 188,000 to 1.4 million.

- The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.1 million in August. The long-term unemployed accounted for 18.8% of all unemployed persons.

According to Bank of America, its proprietary measures of labor market momentum show an employment picture that is strong but slowing, due in large part to central bank policy tightening. Last month, Federal Reserve Chairman Jerome Powell argued there remains a path to controlling inflation without sparking a downturn. However, even he concedes the path continues to narrow as the Fed resorts to drastic interest rate hikes to knock down inflation. The Fed already raised benchmark interest rates four times this year – totaling 2.25 percentage points and bringing the federal funds rate to its highest level since December 2018.

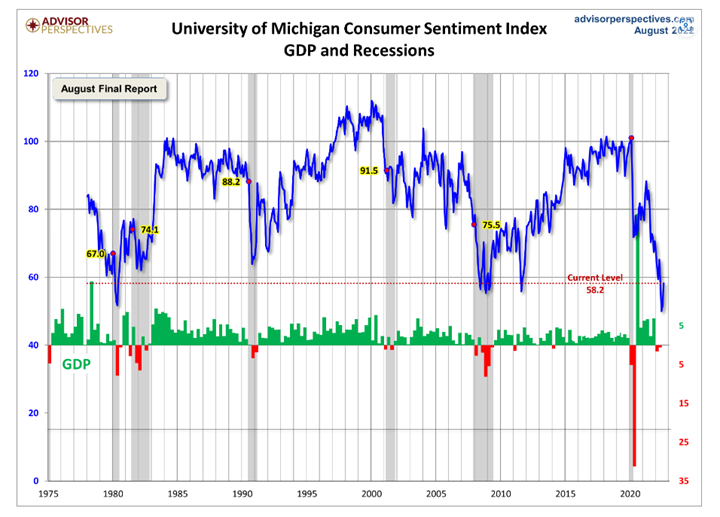

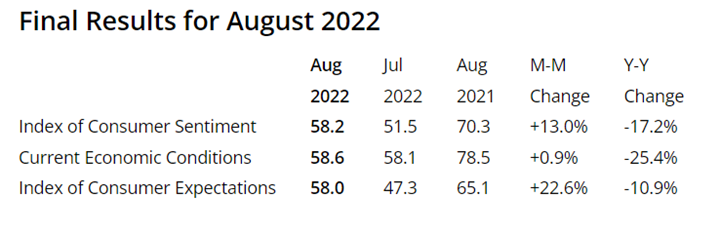

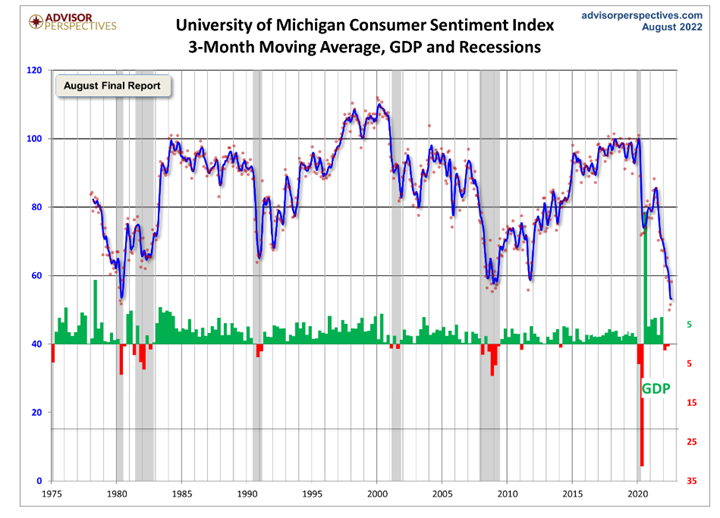

The truth, economists overwhelmingly agree, is the Federal Reserve is unlikely to tame inflation without pushing the American economy into a recession. In fact, approximately 72% expect a U.S. recession by the middle of next year, if not sooner. Gross domestic product – the measure of all goods and services produced – declined the first two quarters of 2022, thereby meeting a common definition of a recession.

“While the US labor market is currently still robust, the recent behavior of the Index signals that slower job gains should be expected over the next several months. This would bring the labor market in line with the rest of the economy, where economic activity already has been slowing,” says Steemers.

The Conference Board Employment Trends Index™ (ETI) increased in August to 119.06, up from an upwardly revised 118.20 in July 2022.

By Demographic

Unemployment rates among the major worker groups: adult women – 3.3%; adult men – 3.5%; teenagers – 10.4%; Asian – 2.8%; White – 3.2%; Hispanic – 4.5%; and Black – 6.4%.

By Industry

Total nonfarm payroll employment increased by 315,000 in August. Notable job gains occurred in professional and business services, health care and retail trade.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in professional and business services added 68,000 jobs. Gains occurred in computer systems design and related services (+14,000), management and technical consulting services (+13,000), architectural and engineering services (+10,000) and scientific research and development services (+6,000), while legal services lost jobs (-9,000). Over the past 12 months, professional and business services added 1.1 million jobs.

- Employment in health care employment rose by 48,000, with job gains in offices of physicians (+15,000), hospitals (+15,000) and nursing and residential care facilities (+12,000). Health care has added 412,000 jobs over the year. Despite this growth, employment in health care is below its February 2020 level by 37,000, or 0.2%.

- Retail trade added 44,000 jobs and 422,000 jobs over the past 12 months. In August, employment increased in general merchandise stores (+15,000), food and beverage stores (+15,000), health and personal care stores (+10,000) and building material and garden supply stores (+7,000). Employment in furniture and home furnishings stores continued to trend down (-3,000).

- Manufacturing employment continued to trend up (+22,000), with gains concentrated in durable goods industries (+19,000). Manufacturing has added 461,000 jobs over the year.

“In 2023, the labor market may look very different from today. With the U.S. increasingly likely to fall into recession before the end of 2022, the pace of hiring will probably slow and the number of jobs openings will decrease,” Steemers says. “On the other hand, attracting and retaining workers may continue to be difficult. Labor shortages may continue to be a challenge for businesses, and even if they ease during a coming recession, they could soon reappear after economic activity picks up again. Therefore, employers may try to hold onto their workers.”

Review all employment statistics here.

KPI — September 2022: Consumer Trends

Key Performance Indicators Report — September 2022