KPI — June: State of the Manufacturing Sector

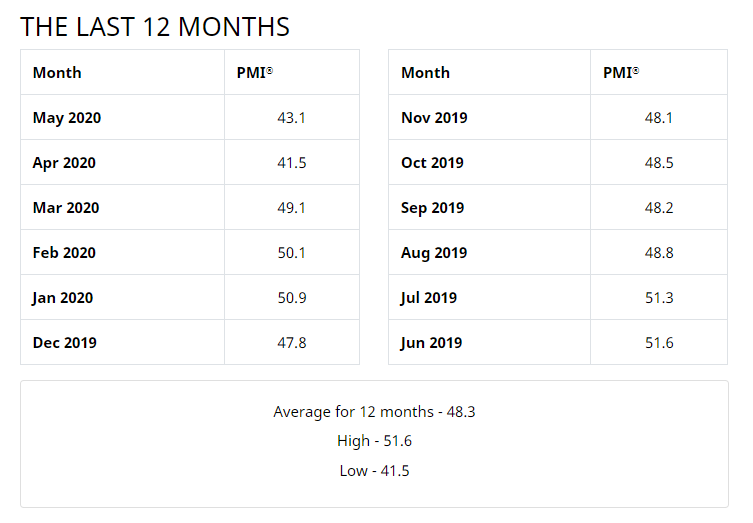

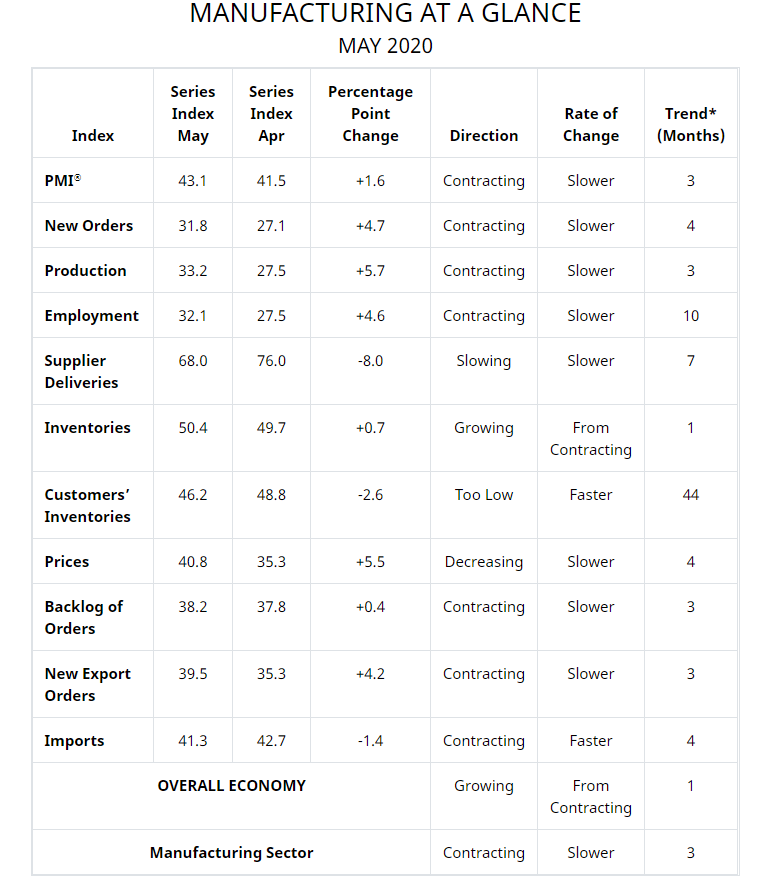

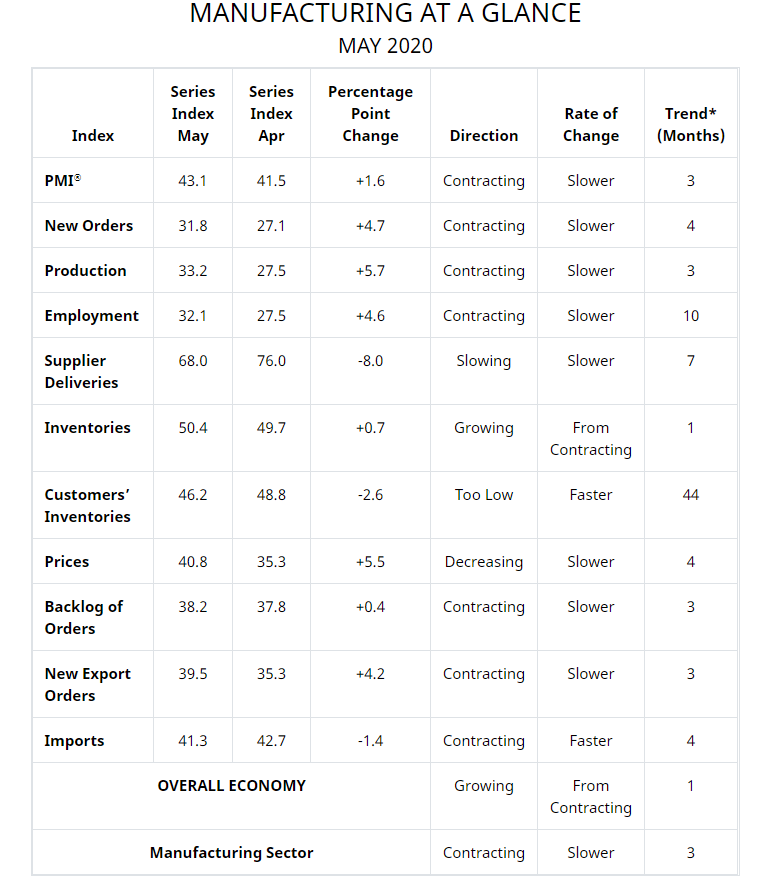

Economic activity in the manufacturing sector contracted in May. The overall economy returned to expansion after one month of contraction, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The May PMI® registered 43.1%, up 1.6 percentage points from the April reading of 41.5%.

The Report On Business® measures its data using the Purchasing Manager’s Index (PMI), which is an indicator of economic health in the manufacturing sector. A reading above 50% indicates that the manufacturing economy is generally expanding, while below 50% indicates that it is generally contracting. All data and analysis are courtesy of Institute for Supply Management.

“Three months into the manufacturing disruption caused by the coronavirus (COVID-19) pandemic, comments from the panel were cautious (two cautious comments for every one optimistic comment) regarding the near-term outlook. As was the case in April, the PMI® indicates a level of manufacturing-sector contraction not seen since April 2009; however, the trajectory improved,” said Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

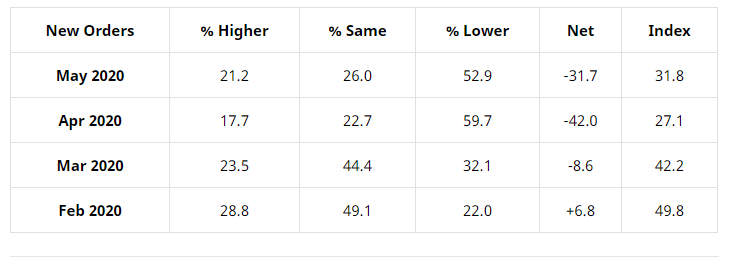

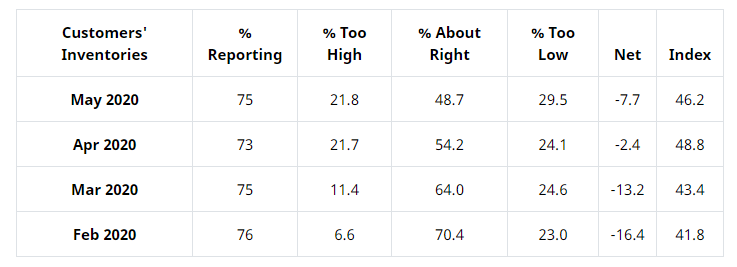

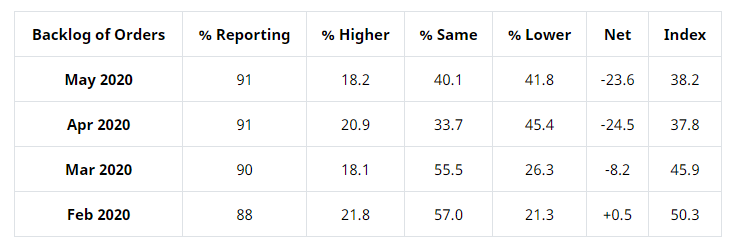

- Demand contracted heavily again, with the (1) New Orders contracting at a strong level, again pushed by New Export Orders contraction; both indexes contracted at slower rates, (2) Customers’ Inventories Index returning to a level considered a positive for future production, and (3) Backlog of Orders Index remaining in strong contraction territory, in spite of weak production during the period.

ISM®’s New Orders Index was 31.8% in May, an increase of 4.7 percentage points compared to the 27.1% reported in April. This indicates that new orders contracted for the fourth consecutive month.

ISM®’s Customers’ Inventories Index was 46.2% in May, which is 2.6 percentage points lower than the 48.8% reported for April, indicating that customers’ inventory levels were considered too low. “Customers’ inventories are too low for the 44th consecutive month and took a step away from ‘about right’ territory in May, a potential positive for future production,” explained Fiore.

ISM®’s Backlog of Orders Index was 38.2% in May, a 0.4-percentage point increase compared to the 37.8% reported in April, indicating order backlogs contracted for the third consecutive month. Notwithstanding April’s figure, this is the index’s lowest reading since March 2009 (37.6%).

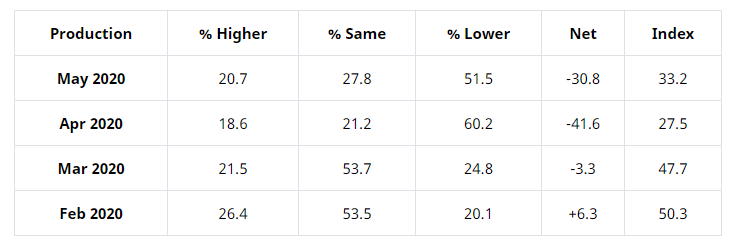

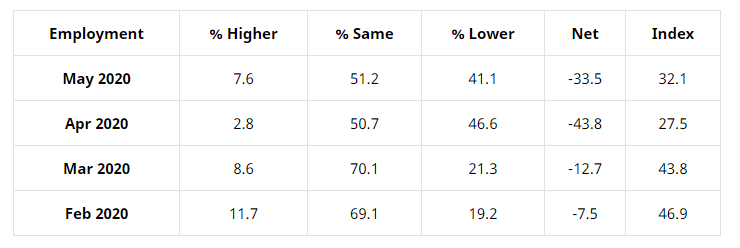

- Consumption (measured by the Production and Employment indexes) contributed positively (a combined 10.3-percentage point increase) to the PMI® calculation, with many panelists classified as non-essential beginning to return to work in late May.

The Production Index was 33.2% in May, indicating that production contracted for the third straight month. This is the second-lowest figure since January 2009, when the index registered 32.3%.

ISM®’s Employment Index was 32.1% in May, 4.6 percentage points higher than the April reading of 27.5%. This is the index’s second-lowest reading since March 2009, when it registered 30.5%. “This is the 10th consecutive month of employment contraction, but at a slower rate compared to April. All six big industry sectors experienced strong employment contraction as a result of furloughs and layoffs due to a lack of new orders and stay-at-home directives. Employees returning to work in late May will positively impact the index in June,” explained Fiore.

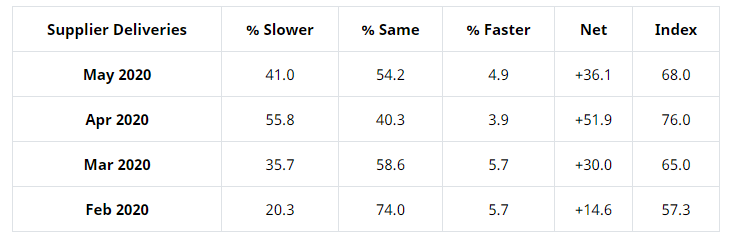

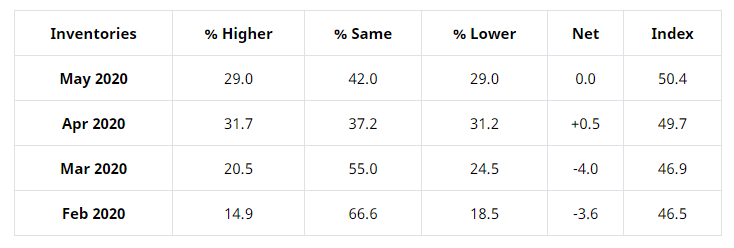

- Inputs—expressed as supplier deliveries, inventories and imports—strengthened again due to supplier delivery issues that were partially offset by continuing imports sluggishness. The delivery issues were the result of disruptions in domestic and global supply chains, driven primarily by supplier plant shutdowns. Inventory expanded due to issues with throughput and demand weakness. Inputs contributed negatively (a combined 7.3-percentage point decrease) to the PMI® calculation. (The Supplier Deliveries and Inventories indexes directly factor into the PMI®; the Imports Index does not.) Prices continued to contract (but at a slower rate in May), supporting a negative outlook.

The delivery performance of suppliers to manufacturing organizations was slower in May, as the Supplier Deliveries Index registered 68%. This is 8 percentage points lower than the 76% reported in April. The reading is the index’s second-highest since June 2018 (68.2%), and the percentage-point decrease is the largest since an 8.2-point drop in October 1981.

The Inventories Index registered 50.4% in May, 0.7 percentage point higher than the 49.7% reported for April. Inventories expanded for the first time since May 2019, when the index registered 51.4%.

“The coronavirus pandemic impacted all manufacturing sectors for the third straight month. May appears to be a transition month, as many panelists and their suppliers returned to work late in the month. However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders. Among the six biggest industry sectors, Food, Beverage & Tobacco Products remains the only industry in expansion. Transportation Equipment; Petroleum & Coal Products; and Fabricated Metal Products continue to contract at strong levels,” said Fiore.

Of the 18 manufacturing industries, six reported growth in May: Nonmetallic Mineral Products; Furniture & Related Products; Apparel, Leather & Allied Products; Food, Beverage & Tobacco Products; Paper Products; and Wood Products. Conversely, 11 industries reported contraction: Printing & Related Support Activities; Primary Metals; Transportation Equipment; Petroleum & Coal Products; Fabricated Metal Products; Machinery; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; Chemical Products.

• Commodities Up in Price: Alcohols; Crude Oil; Freight (2); Personal Protective Equipment (PPE) (2); PPE—Gloves (3); and PPE—Masks (2).

• Commodities Down in Price: Acrylate Monomers; Aluminum (4); Base Oils; Copper (4); Corn (2); Diesel Fuel (3); Methanol; Nylon; Oil Based Products; Packaging Materials; Plastic Products; Polypropylene; Solvents; Steel; Steel—Carbon; Steel—Cold Rolled; Steel—Hot Rolled (4); Steel—Stainless (2); and Steel Products (2).

• Commodities in Short Supply: Alcohols; Disinfectants & Soaps (2); Disinfectant Wipes; Hand Sanitizer (3); N95 Masks (2); PPE; PPE—Gloves (3); and PPE—Masks (3).

Note: The number of consecutive months the commodity is listed is indicated after each item.

What Industry Professionals Are Saying

• “Despite the COVID-19 issues, we are seeing an increase of quoting activity. This has not turned into orders yet, but it is a positive sign.” (Computer & Electronic Products)

• “Current conditions in the automotive, construction, oil and gas, agriculture equipment and tube/pipe markets are all adversely impacting our business results.” (Chemical Products)

• “We see an issue with suppliers that are affecting production. At the same time, social distancing measures in [the] manufacturing plant and customer demand are impacting the rate of production.” (Transportation Equipment)

• “Increased COVID-19 sales in the food business has really stressed our production capabilities.” (Food, Beverage & Tobacco Products)

• “Fuel sales demand are beginning to rebound in May as stay-at-home orders are lifted across the country.” (Petroleum & Coal Products)

• “Returning to full production for automotive, ramp-up will still depend on speed of automotive start-ups. We have built up inventory to stock. Ready to ship.” (Fabricated Metal Products)

• “Business activity remains strong for consumable applications and very weak in durable segments.” (Plastics & Rubber Products)

• “We have been fortunate that most of our customer base is considered to be a part of the critical workforce, so we have been running at around 80% of our normal production volume.” (Primary Metals)

• “Getting out from under several suppliers being closed worldwide. Also, looking at what really needs to be in China.” (Machinery)

• “We see a lot of positive signs, despite what’s going on. People seem to continue to be building and looking to projects for fall of 2020 and beyond. There is good optimism out there.” (Nonmetallic Mineral Products)

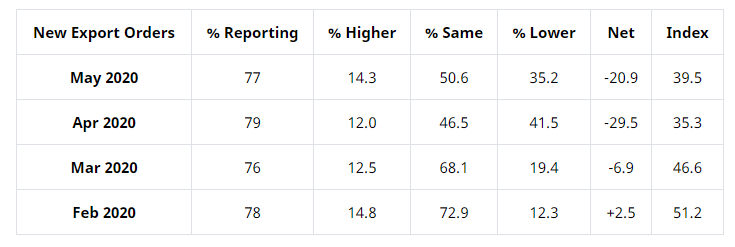

New Export Orders*

ISM®’s New Export Orders Index was 39.5% in May, up 4.2 percentage points compared to the April reading of 35.3%. It is the second-lowest reading since March 2009 (39.4%). “The New Export Orders Index again contracted heavily, but at a slower rate compared to April. One of the six big industry sectors, Food, Beverage, Alcohol & Tobacco Products, expanded softly,” added Fiore.

During May, Paper Products and Food, Beverage & Tobacco Products reported growth in new export orders, while the other 12 industries noted a decrease—Nonmetallic Mineral Products; Transportation Equipment; Printing & Related Support Activities; Miscellaneous Manufacturing; Fabricated Metal Products; Primary Metals; Furniture & Related Products; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; Machinery; Computer & Electronic Products; and Chemical Products.

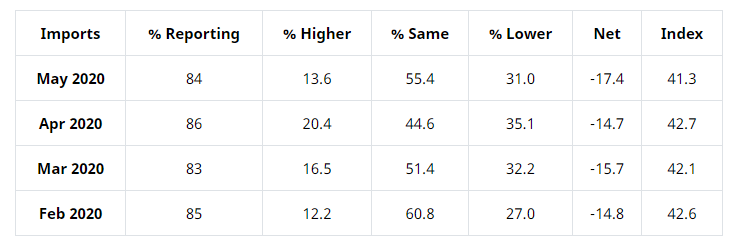

Imports*

ISM®’s Imports Index was 41.3% in May, down 1.4 percentage points compared to the 42.7% reported during April. “For the fourth consecutive month, imports were in contraction territory. This is the index’s lowest reading since May 2009, when it registered 38.5%. Imports contraction continues due to a lack of demand in the U.S. manufacturing economy, as well as suppliers continuing to experience difficulty in refilling the inventory pipeline as a result of the Lunar New Year and COVID-19 impacts,” explained Fiore.

Apparel, Leather & Allied Products; Paper Products; and Food, Beverage & Tobacco Products reported growth in imports during May, while the remaining 12 industries noted a decrease—Printing & Related Support Activities; Transportation Equipment; Primary Metals; Furniture & Related Products; Machinery; Miscellaneous Manufacturing; Chemical Products; Nonmetallic Mineral Products; Fabricated Metal Products; Computer & Electronic Products; Plastics & Rubber Products; and Electrical Equipment, Appliances & Components.