KPI — June 2023: The Brief

The Conference Board Consumer Confidence Index® declined to 102.3 (1985=100) in May, down from an upwardly revised 103.7 in April. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased to 148.6 (1985=100) from 151.8 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – dipped slightly to 71.5 (1985=100) from 71.7. For context, the Expectations Index is below 80 since February 2022 (with the exception of a brief uptick in December 2022) – a level which often signals recessionary times.

Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 59.2 in May. The 7% month-over-month decline is attributed to growing concern surrounding economic health.

In addition, survey data shows year-ahead expectations for the economy receded to 4.2% after increasing to 4.6% in April. Long-run inflation expectations inched up for the second straight month but remained within the narrow 2.9-3.1% range for 21 of the last 22 months.

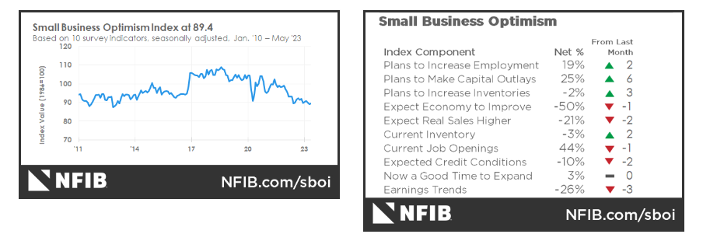

According to the current NFIB Small Business Optimism Index, 63% of owners reported hiring or trying to hire in May, yet 44% confirmed job openings remain hard to fill. NFIB noted the difficulty in filling open positions is particularly acute in the construction, transportation and manufacturing sectors.

“Overall, small business owners are expressing concerns for future business conditions,” says Bill Dunkelberg, chief economist at NFIB. “Supply chain disruptions and labor shortages will continue to limit the ability of many small firms to meet the demand for their products and services, while less severe than last year’s experience.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

Current Top Takeaways:

- Economic activity in the manufacturing sector contracted in May for the seventh consecutive month following a 28-month period of growth, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The May Manufacturing PMI® registered 46.9%, 0.2 percentage point lower than April.

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in May on a seasonally adjusted basis, says the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 4% before seasonal adjustment.

- While The NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, it is the 17th consecutive month below the 49-year average of 98.

- Total new-vehicle sales for May 2023, including retail and non-retail transactions, are projected to reach 1,337,700 units – a 15.6% year-over-year increase, according to a joint forecast from J.D. Power and LMC Automotive.

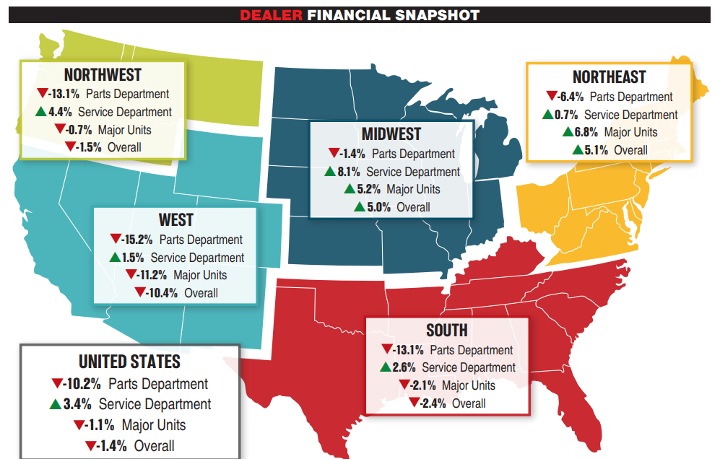

- Powersports Business says dealers across the country reported an overall revenue decrease of 1.4% (on top of the 1.7% loss in March), according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 10.2% in parts revenue and 1.1% in sales revenue, but up 3.4% in service revenue.

KPI — June 2023: State of Business

Key Performance Indicators Report — June 2023