KPI — July 2023: The Brief

The Conference Board Consumer Confidence Index® increased to 109.7 (1985=100) in June, up from 102.5 a month ago. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – rose to 155.3 (1985=100) from 148.9. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – increased to 79.3 (1985=100) from 71.5. Despite improvement, expectations remain below 80 – a level historically associated with recessionary fears.

Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 64.4 in June, up from 59.2 a month prior.

In addition, all index components improved considerably in June, led by a 19% surge in long-term business conditions and 16% increase in short-run business conditions. Data indicates the sharp rise in sentiment is largely attributed to a simmering in inflation, along with stability in labor markets. While consumer confidence and sentiment are on the rise, small businesses continue to feel the burn.

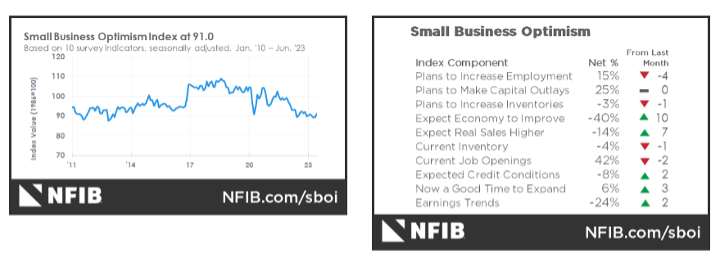

According to the current NFIB Small Business Optimism Index, inflation and labor quality are tied as the top small business concerns, with 24% of owners reporting each as their single most pressing problem. In addition, NFIB noted the difficulty in filling open positions is particularly acute in the construction, transportation and manufacturing sectors.

“Halfway through the year, small business owners remain very pessimistic about future business conditions and their sales prospects,” says Bill Dunkelberg, NFIB chief economist. “Inflation and labor shortages continue to be great challenges for small businesses. Owners are still raising selling prices at an inflationary level to try to pass on higher inventory, labor and energy costs.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

Current Top Takeaways:

- Economic activity in the manufacturing sector contracted in June for the eighth consecutive month following a 28-month period of growth, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The June Manufacturing PMI® registered 46%, 0.9 percentage point lower than the 46.9% recorded in May.

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2% in June on a seasonally adjusted basis after increasing 0.1% in May, notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3% before seasonal adjustment.

- While The NFIB Small Business Optimism Index increased 1.6 points in June to 91.0, it is the 18th consecutive month below the 49-year average of 98.

- Total new-vehicle sales, including retail and non-retail transactions, are projected to reach 1,381,200 units – a 22.6% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

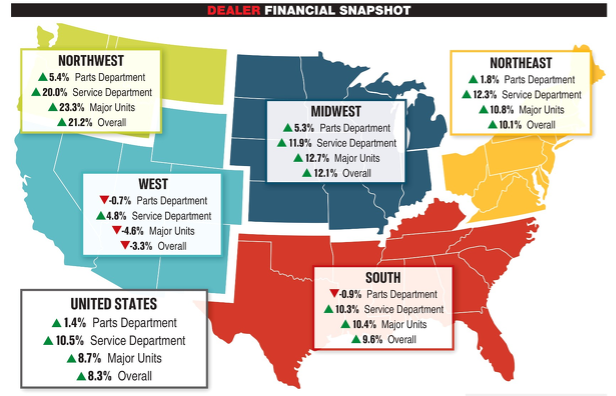

- Powersports Business says dealers across the country reported an overall revenue growth of 8.3% in May, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were up 8.7% in new and pre-owned sales.

KPI — July 2023: State of Business

Key Performance Indicators Report — July 2023