KPI — July 2023: State of the Economy

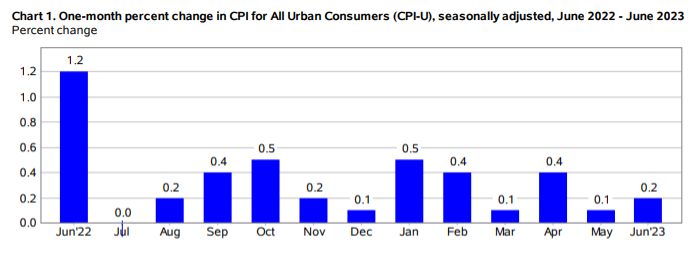

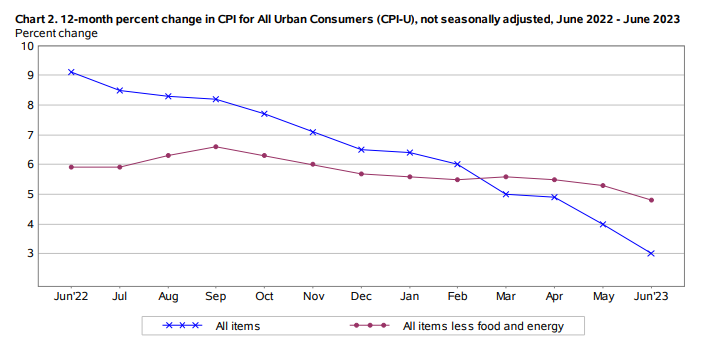

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2% in June on a seasonally adjusted basis after increasing 0.1% in May, notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Categories on the rise in May include shelter, motor vehicle insurance, apparel, recreation and personal care. The indexes for airline fares, communication, used cars and trucks, as well as household furnishings and operations decreased month-over-month.

- The all-items index increased 3% year-over-year, the smallest 12-month increase since March 2021. The all items less food and energy index rose 4.8%. The energy index decreased 16.7% year-over-year, while food jumped 5.7%.

Employment

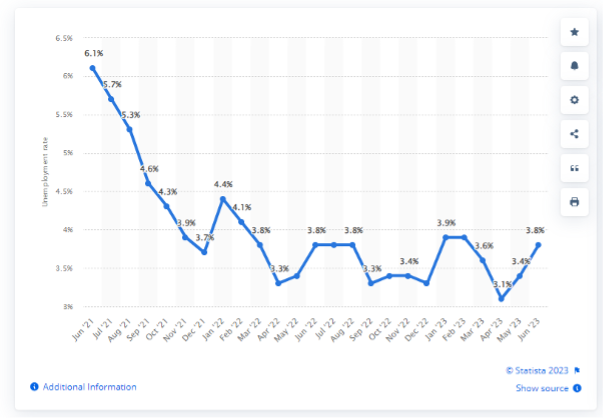

Total nonfarm payroll employment increased by 209,000 in June – below economic predictions of 225,000-240,000 net job gains and the lowest monthly gain recorded since December 2020. In addition, the unemployment rate and number of unemployed persons increased to 3.6% and 6 million, respectively, according to the U.S. Bureau of Labor Statistics. The labor force participation rate was unchanged at 62.6%, with the long-term unemployed (those jobless for 27 weeks or more) accounting for 18.5% of the total unemployed.

There continues to be a tug of war between the overall economy and labor market, according to economists.

“In the post-pandemic economy, we’re experiencing some structural and demographic change that have resulted in an economy that’s far less sensitive to interest rates compared to previous business cycles,” explains Joe Brusuelas, RSM US chief economist. “So, when I see the job gains at this pace, my sense here is that we’re going to need some additional help in terms of cooling overall inflation, in core services [excluding housing], for the Fed to finally wrap up its efforts to restore price stability.”

Brusuelas says he anticipates that the Fed will resume its rate-hiking ways during its upcoming policymaking meeting later this month and increase its benchmark rate by yet another quarter point.

“We’re not yet there at the peak in the interest rate hike cycle, but we’re getting closer to it,” he says.

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.4%, teenagers – 9.8%, Asian – 2.8%, White – 3.1%, Hispanic – 4.3% and Black – 5%.

Last month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.3%, teenagers – 11%, Asian – 3.2%, White – 3.1%, Hispanic – 4.4% and Black – 6%.

Monthly unemployment rate in the U.S. from June 2021 to June 2023 (seasonally-adjusted).

By Industry

Current job gains data is nearly 100,000 positions lower than May’s stronger-than-expected 306,000 performance, according to news reports. However, job growth continues to trend up across government, health care, social assistance and construction.

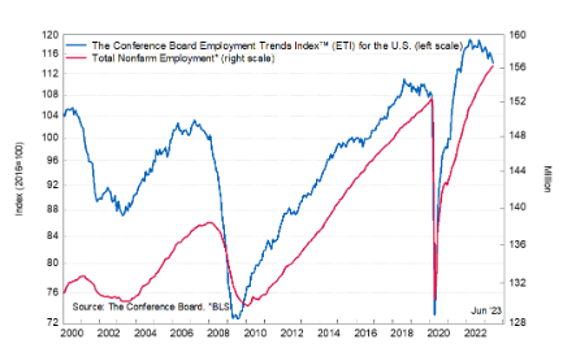

“We’re still in a very tight job market, especially compared to pre-pandemic conditions,” notes Selcuk Eren, senior economist at The Conference Board. “While signs of cooling have emerged, they’re proceeding at a very slow pace. Among the components of the Employment Trends Index™ (ETI), job openings have been trending downwards since the highs reached a year ago, yet remain well above pre-pandemic levels. The number of employees working in temporary help services has been falling since November 2022. As an important early indicator for hiring, this previews slower job gains and eventually job losses in other industries,” he continues.

The Conference Board Employment Trends Index™ (ETI) decreased to 114.31 in June. The Employment Trends Index is a leading composite index for employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in government increased by 60,000. Employment continued to trend up in state government (+27,000) and local government (+32,000). Overall, government has added an average of 63,000 jobs per month thus far in 2023, more than twice the average of 23,000 per month in 2022.

- Health care added 41,000 jobs. Job growth occurred in hospitals (+15,000), nursing and residential care facilities (+12,000), as well as home health care services (+9,000). Offices of dentists lost 7,000 jobs. Health care has added an average of 42,000 jobs per month thus far this year, similar to the average gain of 46,000 per month in 2022.

- Employment in construction continued to trend up (+23,000). Employment in the industry has increased by an average of 15,000 per month thus far this year, compared with an average of 22,000 per month in 2022. In June, employment in residential specialty trade contractors increased (+10,000).

Click here to review more employment details.

“Looking ahead, we expect the Fed’s rate hikes to have a more visible negative impact on job growth by the end of 2023 and into the first half of 2024. By the middle of next year, we forecast the unemployment rate to peak at around 4.5% and labor force participation to fall to 62.1% — compared to current levels of 3.6% and 62.6% respectively,” says Eren.

KPI — July 2023: Consumer Trends

Key Performance Indicators Report — July 2023