KPI — July 2022: The Brief

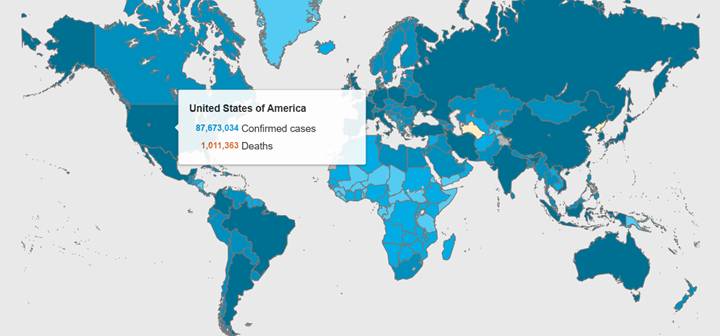

More than 555.4 million COVID-19 cases and 6.3 million deaths are confirmed across the globe. Vaccination efforts remain a top priority among health and government officials, with the ultimate goal of reaching herd immunity. Approximately 67% of Americans are fully vaccinated, according to recent CDC data. Experts estimate 70%-85% of the population must be vaccinated in order to reach herd immunity.

To date, nearly 88 million cases were reported across the U.S, with California, Texas and Florida claiming the highest numbers, according to Statista. COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

COVID-19 Cases by Country

The Conference Board Consumer Confidence Index® fell to 98.7 (1985=100) – down 4.5 points from 103.2 in May and the lowest level since February 2021 (Index, 95.2). The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, declined marginally to 147.1 from 147.4 last month. Meanwhile, the Expectations Index – derived from consumers’ short-term outlook for income, business and labor market conditions – decreased sharply to 66.4 from 73.7. This, too, is a record-low level since March 2013 (Index, 63.7).

Similarly, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions –declined sharply to 50 in June, according to the University of Michigan Survey of Consumers. It is the lowest reading on record, inclusive of consumers across income, age, education, geographic region, political affiliation, stockholding and homeownership status.

Inflation remains a weighty concern to consumers, with 47% blaming inflation for eroding their living standards – just one point shy of the all-time high last reached during the Great Recession. In particular, consumers expressed the highest level of uncertainty over long-run inflation since 1991, continuing a drastic increase that began in 2021.

In January 2021, when President Joe Biden took office, the inflation rate was 1.4% – below the target set by the Federal Reserve. After the passage of the American Rescue Plan, however, which effectively secured $1.9 trillion in additional government spending, the inflation rate nearly tripled in a four-month span and hit 4.16% by April. At the time, President Biden dismissed economic fears and took a “transitory” approach to a bloating inflation rate. While it hovered at 5.2% – 5.3% between July and October 2021, it swelled to 7.48% by January 2022 – before Russia’s invasion of Ukraine. Inflation climbed to 8.25% in April, 8.582% in May and now 9.1% in June, a greater hike than economists predicted.

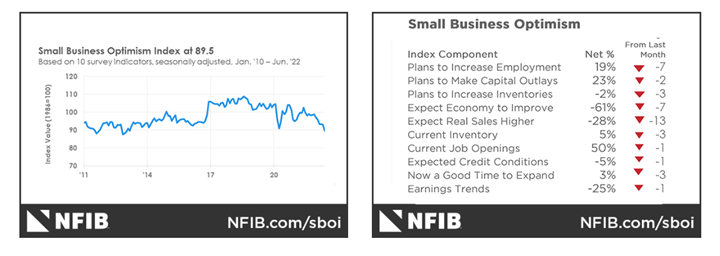

Inflation is not only a top concern among consumers, but also business owners as well. The NFIB Small Business Optimism Index dropped 3.6 points in June to 89.5, marking the sixth consecutive month below the 48-year average of 98. Small business owners expecting better business conditions over the next six months decreased seven points to a net negative 61%, the lowest level recorded in the 48-year survey.

“As inflation continues to dominate business decisions, small business owners’ expectations for better business conditions have reached a new low,” said Bill Dunkelberg, chief economist at NFIB. “On top of the immediate challenges facing small business owners, including inflation and worker shortages, the outlook for economic policy is not encouraging either as policy talks have shifted to tax increases and more regulations.”

Key Data Points, Courtesy of NFIB:

- The net percent of owners who expect real sales to be higher decreased 13 points from May to a net negative 28%, a severe decline.

- Fifty percent of owners reported job openings that could not be filled, down one point from May, but historically very high.

- The net percent of owners raising average selling prices decreased three points to a net 69% seasonally adjusted, following May’s record high reading.

- A net 5% of owners viewed current inventory stocks as “too low” in June, down three points from May and still surprisingly high. By industry, shortages are reported most frequently in manufacturing (19%), retail (18%), agriculture (18%), construction (16%) and non-professional services (15%). A net negative 2% of owners plan inventory investment in the coming months.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

This Month’s Top Takeaways:

- The June Manufacturing PMI® registered 53%, down 3.1 percentage points from the reading of 56.1% in May, according to supply executives in the latest Manufacturing ISM® Report On Business®.

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3% in June on a seasonally adjusted basis after rising 1% in May, notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 9.1% before seasonal adjustment.

- LMC Automotive reports Global Light Vehicle (LV) sales improved to 76 million units per year in May but remains down 10% year-over-year. Supply chain bottlenecks remain the key issue for the global automotive industry, with manufacturers unable to meet demand in most regions. At the time of writing, June data was unavailable.

- JD Power predicts total new-vehicle sales for June 2022, including retail and non-retail transactions, to reach 1,133,000 units – a 15.8% decrease from June 2021.

- The RV industry continues to post record numbers, with RV wholesale shipments projected to exceed 549,000 units by year-end 2022, according to the Summer 2022 issue of RV RoadSigns, the quarterly forecast prepared by ITR Economics for the RV Industry Association (RVIA).

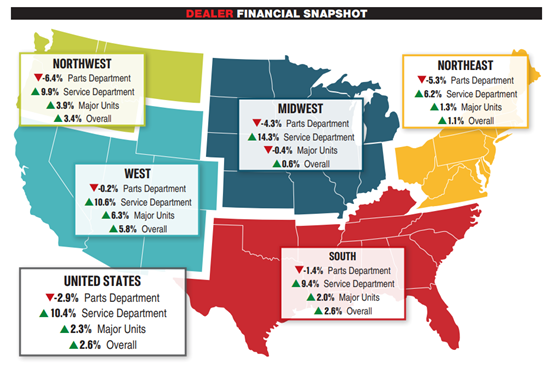

- Powersports Business reports revenue from new and pre-owned unit sales bounced back in May after consecutive months of decline. Unit sales revenue increased by 2.3% on average, with the West (6.3% growth) and Northwest (3.9% growth) securing the top spots. Revenue from new and pre-owned unit sales declined by 2.1% in April after dropping 4.8% in March vs. a year ago. Service department revenue increased again, with a 10.4% gain on average, following 7.8% growth in April, 4.7% growth in March and 4.6% growth in February. Parts sales declined in May year-over-year, down 2.9%, following a trend that saw a 6.1% dip in April after an 8% drop in March. All regions showed a decline in parts revenue on average, with the Northwest down 6.4%. Combined, the average dealership experienced a revenue increase of 2.6% during May, following a decrease of 1.4% in April, a 4.2% decline in March and an 11.3% gain in February on average. All regions experienced overall growth on average. The West also led in service department growth during May with a 10.4% average increase, following 9.6% growth in April and 8.4% gains in March.

KPI — July 2022: State of Business — Automotive Industry

Key Performance Indicators Report — July 2022