KPI — February 2023: State of the Economy

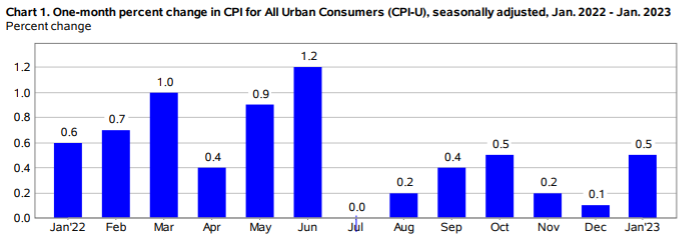

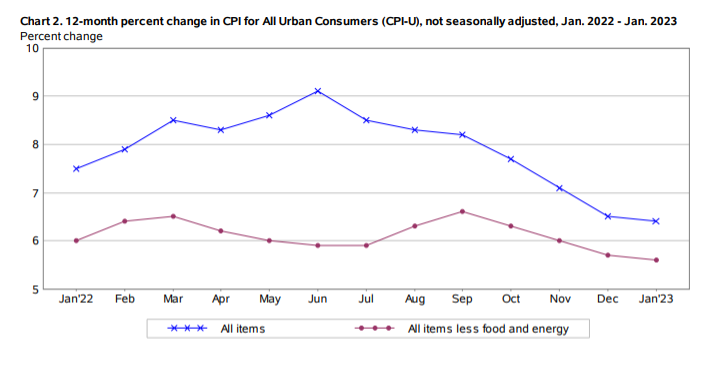

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5% in January on a seasonally adjusted basis, after increasing 0.1% the month prior, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index rose 6.4% before seasonal adjustment – the smallest 12-month increase since the period ending October 2021.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Categories on the rise in January include shelter, motor vehicle insurance, recreation, as well as apparel and household furnishings and operations. The indexes for used cars and trucks, medical care and airline fares declined month-over-month.

- The all items less food and energy index rose 5.6%, with the energy index increasing 8.7% and the food index up 10.1%.

Employment

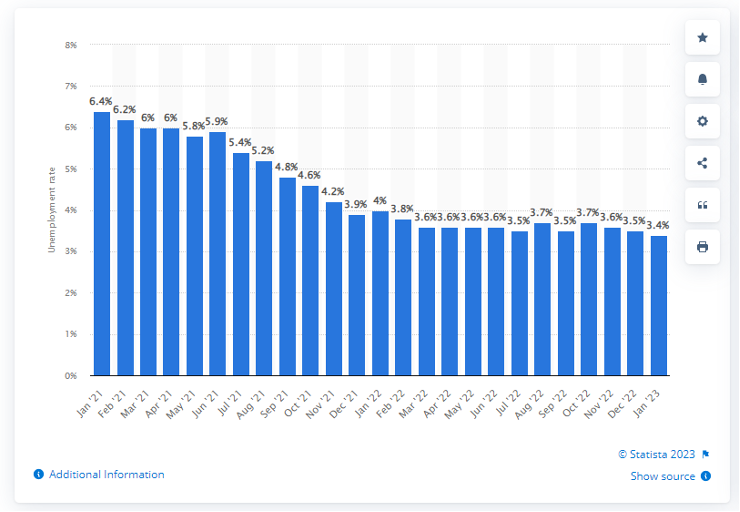

In January, the unemployment rate and number of unemployed persons were relatively unchanged at 3.4% and 5.7 million, respectively, according to the U.S. Bureau of Labor Statistics. Similarly, the labor force participation rate remains 62.4%, with the long-term unemployed (those jobless for 27 weeks or more) accounting for 19.4% of the total unemployed.

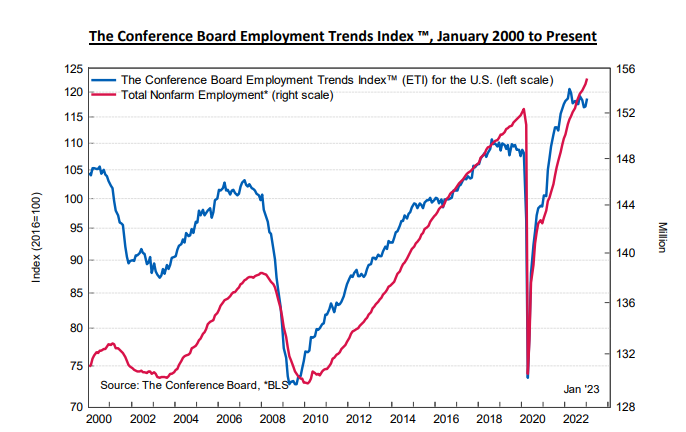

“Despite rapid interest rate hikes, which were expected to reduce labor demand, we haven’t seen widespread layoffs [yet]. Indeed, hiring was outsized and broadly based in the January employment report. Robust hiring continues to keep the Employment Trends Index™ (ETI) at a very high level, and the economy is still experiencing significant job gains in industries where labor shortages have been most acute,” says Selcuk Eren, senior economist at The Conference Board.

The Conference Board Employment Trends Index™ (ETI) rose to 118.74 in January, up from an upwardly revised 117.06 in December 2022.

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.2%, teenagers – 10.3%, Asian – 2.8%, White – 3.1%, Hispanic – 4.5% and Black – 5.4%.

Last month, unemployment rates among the major worker groups: adult men – 3.1%; adult women – 3.2%; teenagers – 10.4%; Asian – 2.4%; White – 3%; Hispanic – 4.1%; and Black – 5.7%.

Monthly unemployment rate in the U.S. from January 2021 to January 2023 (seasonally-adjusted).

By Industry

Total nonfarm payroll employment rose by 517,000 in January, exceeding a market estimate of 187,000. According to current data, job growth was widespread, led by gains in leisure and hospitality, professional and business services and health care. Employment also increased in government, partially reflecting the return of workers from a strike.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in leisure and hospitality increased by 128,000. Food services and drinking places added 99,000 jobs month-over-month, while employment continues to trend up in accommodation (+15,000). Employment in leisure and hospitality remains below pre-pandemic levels by 495,000, or 2.9%.

- Employment in professional and business services rose by 82,000, led by gains in professional, scientific and technical services (+41,000).

- Construction is up 25,000, reflecting an employment gain in specialty trade contractors (+22,000). Employment in the construction industry grew by an average of 22,000 per month in 2022.

Review all employment statistics here.

Overall job growth climbed, despite the Federal Reserve’s efforts to slow the economy and course-correct inflation from its highest level since the early 1980s.

“It was a phenomenal report,” says Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. “This brings into question how we’re able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there’s still a lot of pent-up demand for workers [whose] companies have really struggled to staff appropriately.”

However, in a post-meeting news conference, Fed Chairman Jerome Powell admitted the labor market “remains extremely tight” and “out of balance.” As of December, for example, he points to approximately 11 million job openings (or just shy of two for every available worker). According to Eren, one sign of “rebalancing in the labor market” may be slower wage growth. Currently, hourly wage growth remains above pre-pandemic levels but is on a “declining trend” after reaching 5.9% last year. Moreover, while the labor market continues to push back against the Fed’s incessant interest rate hikes, economists are not ruling out a recession.

“Our base case is still a recession likely toward the latter part of the year,” adds Andrew Patterson, senior economist at Vanguard. “One report is not indicative of a trend, but certainly if we continue to see upside surprises, our baseline is up for discussion. Though, this does increase the marginal probability of a soft landing.”

KPI — February 2023: Consumer Trends

Key Performance Indicators Report — February 2023