KPI — February 2023: Consumer Trends

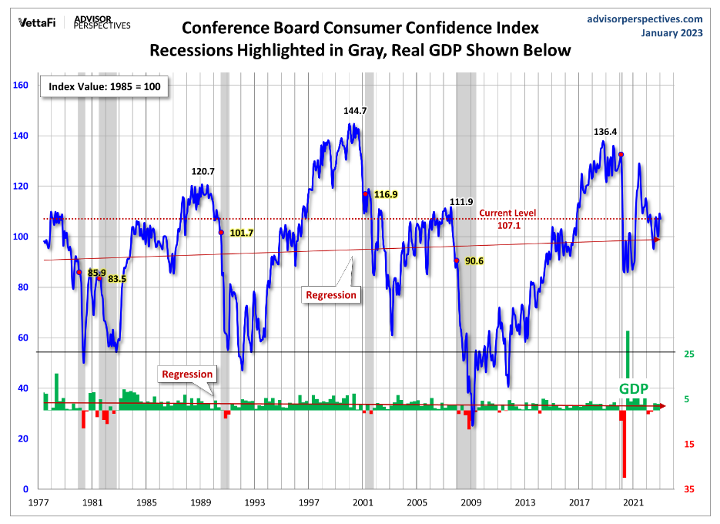

The Conference Board Consumer Confidence Index® decreased in January following an upwardly revised increase in December 2022. The Index now stands at 107.1 (1985=100), down from 109 in December (an upward revision). The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – increased to 150.9 (1985=100) from 147.4 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – fell to 77.8 (1985=100) from 83.4. An Expectations Index below 80 often signals a recession within the next year.

According to recent data, consumer confidence declined most in households earning less than $15,000 and among those under 35 years old. While consumers were less upbeat about the short-term outlook for jobs and predict business conditions to worsen in the near term, they expect income levels to remain relatively stable in the months ahead.

Purchasing plans for automobiles and appliances held steady, but fewer consumers plan to buy a home. Consumers’ expectations for inflation ticked up slightly from 6.6% to 6.8% over the next 12 months, but inflation expectations are down from their peak of 7.9% last June, explained Ataman Ozyildirim, senior director of economics at The Conference Board.

The chart evaluates the historical context for this index as a coincident indicator of the economy. Toward this end, Advisor Perspectives highlighted recessions and included GDP.

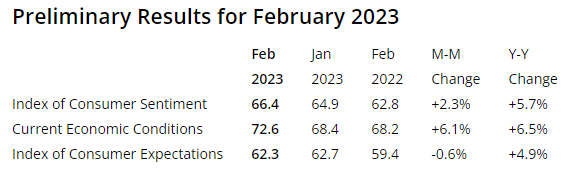

The Consumer Sentiment Index February Preliminary Report is currently 66.4, up 1.5 (2.3%) from the January final, according to the University of Michigan Survey of Consumers.

Important Takeaways, Courtesy of Survey of Consumers:

- Following three consecutive months of increases, sentiment is now 6% above a year ago but still 14% below two years ago (prior to the current inflationary episode).

- Overall, high prices continue to worry consumers despite the recent moderation in inflation. In addition, sentiment remains more than 22% below its historical average since 1978.

- Consumers are poised to exercise greater caution with their spending in the months ahead.

- Year-ahead inflation expectations rebounded to 4.2% this month, from 3.9% in January and 4.4% in December. Long-run inflation expectations remained at 2.9% for the third straight month and stayed within the narrow 2.9-3.1% range for 18 of the last 19 months.

“Uncertainty over short-run inflation expectations ticked up recently and continues to be notably elevated, indicating the potential for continued volatility in expected year-ahead inflation,” says Joanne Hsu, director at Survey of Consumers.

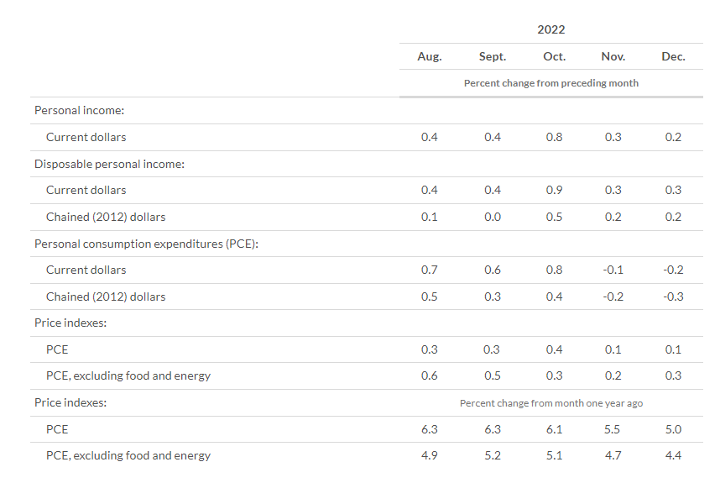

Consumer Income & Spending

According to the U.S. Bureau of Economic Analysis (BEA), in December 2022 personal income increased $80.1 billion (0.4%), disposable personal income (DPI) increased $49.2 billion (0.3%) and personal consumption expenditures (PCE) decreased $41.6 billion (0.2%).

In addition, personal outlays decreased $39.2 billion in December. Personal saving was $637.5 billion and the personal saving rate – personal saving as a percentage of disposable personal income – was 3.4%.

Important Takeaways, Courtesy of BEA:

- The $41.6 billion decrease in current-dollar PCE in December reflected a decrease of $95 billion in spending for goods and a $53.4 billion increase in spending for services. Within goods, decreases were widespread and led by gasoline, as well as motor vehicles and parts. Within services, the largest contributors to the increase were spending for housing, transportation (mainly air transportation) and health care.

- The PCE price index increased 0.1%. Excluding food and energy, the PCE price index increased 0.3%. Real DPI increased 0.2% and Real PCE decreased 0.3%. Goods decreased 0.9% and services were unchanged.

- The PCE price index increased 5% year-over-year in December. Prices for goods increased 4.6%, while prices for services climbed 5.2%. Food prices soared 11.2% and energy prices rose 6.9%. Excluding food and energy, the PCE price index increased 4.4% year-over-year.

Key Performance Indicators Report — February 2023