KPI – December 2023: The Brief

KPI – December 2023: State of Manufacturing

KPI – December 2023: Consumer Trends

KPI – December 2023: State of the Economy

KPI – December 2023: Recent Vehicle Recalls

GLOBAL LIGHT VEHICLE SALES

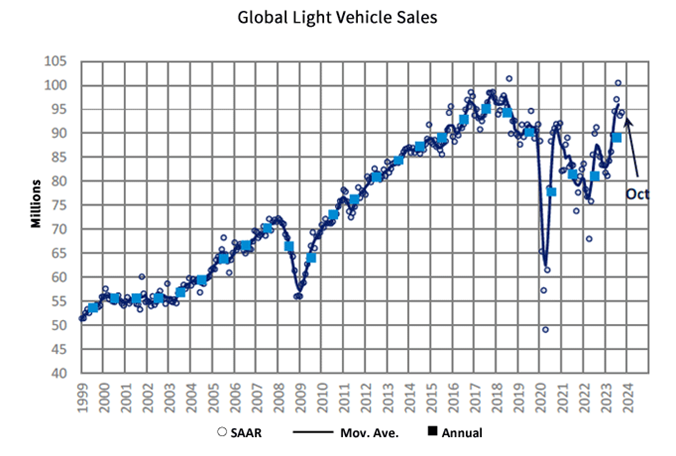

In October, the Global Light Vehicle (LV) selling rate was in line with an upwardly adjusted September figure of 94 million units per year. Overall, sales posted a monthly 11% gain and 10% year-over-year.

While growth in the U.S. was impacted by the UAW strikes through October, other key markets recorded double-digit growth (although experts admit this is partly due to 2022 being a weak base for comparison). Chinese wholesale volume swelled 11%, led by strong exports and supported by the “burgeoning domestic market.” In addition, Western Europe increased 13% and Eastern Europe grew 49%.

The outlook for November is positive, with the selling rate holding steady above the 90-million-unit level for a sixth consecutive month. Sales volume is expected to reach 7.8 million, or 11% year-over-year growth. Sales in China, for example, are forecast to increase 23% and lead total gains.

“With a little more than one month to go in 2023, the outlook for global light vehicle sales has been revised upward yet again based on the strength in China. The 2023 forecast now stands at 89.3 million units, up 700,000 units from a month ago and now at a 10% growth rate from 2022. The latest assessment puts the global market in striking distance to finish at 90 million units, which would be the first time since 2019,” says Jeff Schuster, group head and executive vice president of automotive at GlobalData.

“While the market is still in recovery mode, there is some risk that the economies around the world slow in 2024, adding pressure on the level of growth expected next year. The outlook for 2024 is holding at 92.3 million units, an increase of 3% from 2023. The market may be reaching the end of true pent-up demand from the pandemic unless there is a marked reduction in transaction prices around the world,” he continues.

Image Source: GlobalData Global Light Vehicle Sales Update (October 2023) – MarkLines Automotive Industry Portal

U.S. NEW VEHICLE SALES

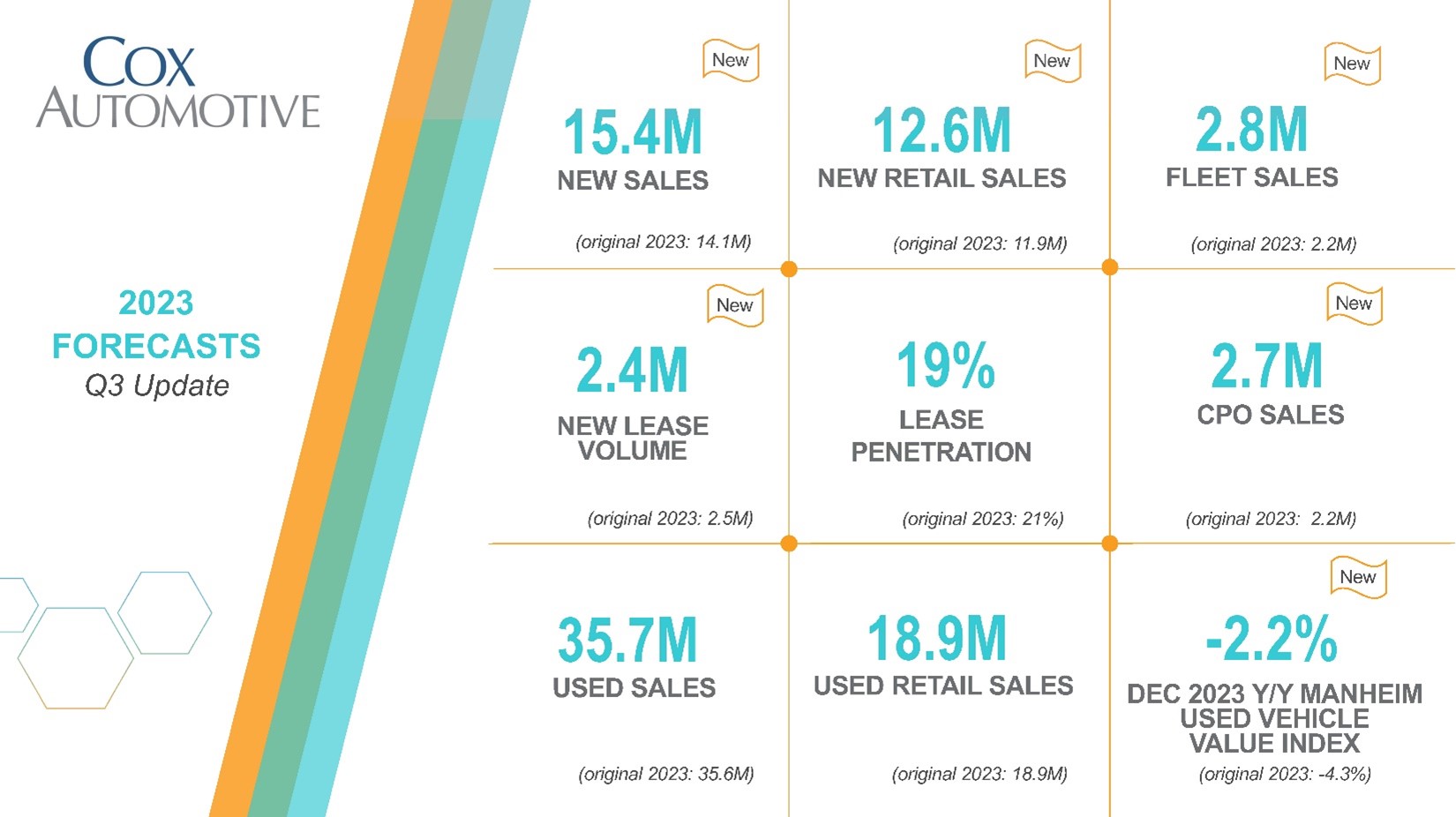

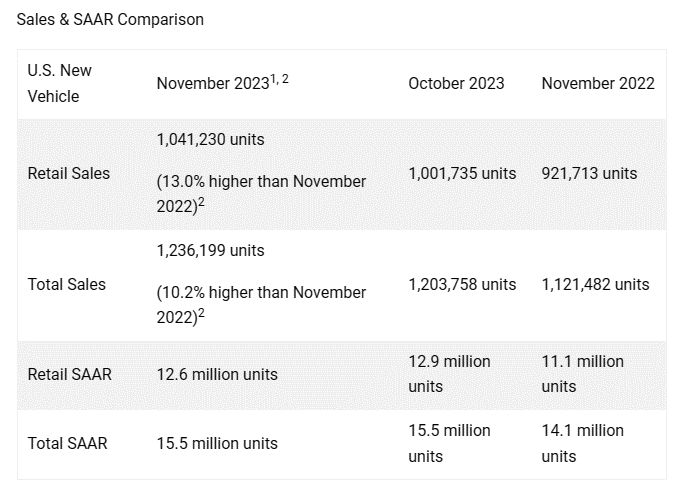

Total new-vehicle sales for November 2023, including retail and non-retail transactions, are projected to reach 1,236,000 units—a 10.2% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

“November results indicate a robust performance with double-digit, year-over-year sales growth and record consumer expenditures for the month. The consumer expenditure record was due to strong sales growth, which outweighed a 1.9% decline in transaction prices,” says Thomas King, president of the data and analytics division at J.D. Power.

“Sales growth is being enabled by improving vehicle availability. Despite the nearly six-week UAW work stoppage, retail inventory levels in November are expected to finish around 1.6 million units, a 7.5% increase from last month and 43.7% increase compared with November 2022, but still over 40% below pre-pandemic levels,” he continues.

IMPORTANT TAKEAWAYS, COURTESY OF J.D. POWER:

- Retail buyers are on pace to spend $44.5 billion on new vehicles, up $3.9 billion year-over-year.

- Trucks/SUVs are expected to account for 79% of new vehicle retail sales this month.

- The average new vehicle retail transaction price is on pace to reach $45,332.

- Average incentive spending per unit is expected to hit $2,247, up from $1,089 last year.

- Average interest rates for new vehicle loans are expected to hit 7.3%, up 95 basis points year-over-year.

- Total retailer profit per unit, which includes grosses, finance and insurance income, is expected to be $3,002 in November. While this is 28.7% lower than a year ago, it is more than double the amount in November 2019.

- Fleet sales are expected to total 194,969 units, down 2.4% year-over-year on a selling day adjusted basis. Overall, fleet volume is expected to account for 15.8% of total light-vehicle sales, down from 17.8% a year ago.

“Now that the UAW work stoppage is in the rearview mirror, the industry can refocus on production, product launches and year-end sales promotions. The trends seen in November are poised to continue. Incremental enhancements in vehicle availability are expected to further improve the pace of new-vehicle sales, while per-unit prices and profitability are anticipated to experience measured moderation. Despite the challenges posed by rising interest rates and declining used vehicle values, the overall health of the new vehicle industry remains robust,” King says.

Review comprehensive Q3 2023 new vehicle sales data and analysis HERE, courtesy of Cox Automotive.

U.S. USED MARKET

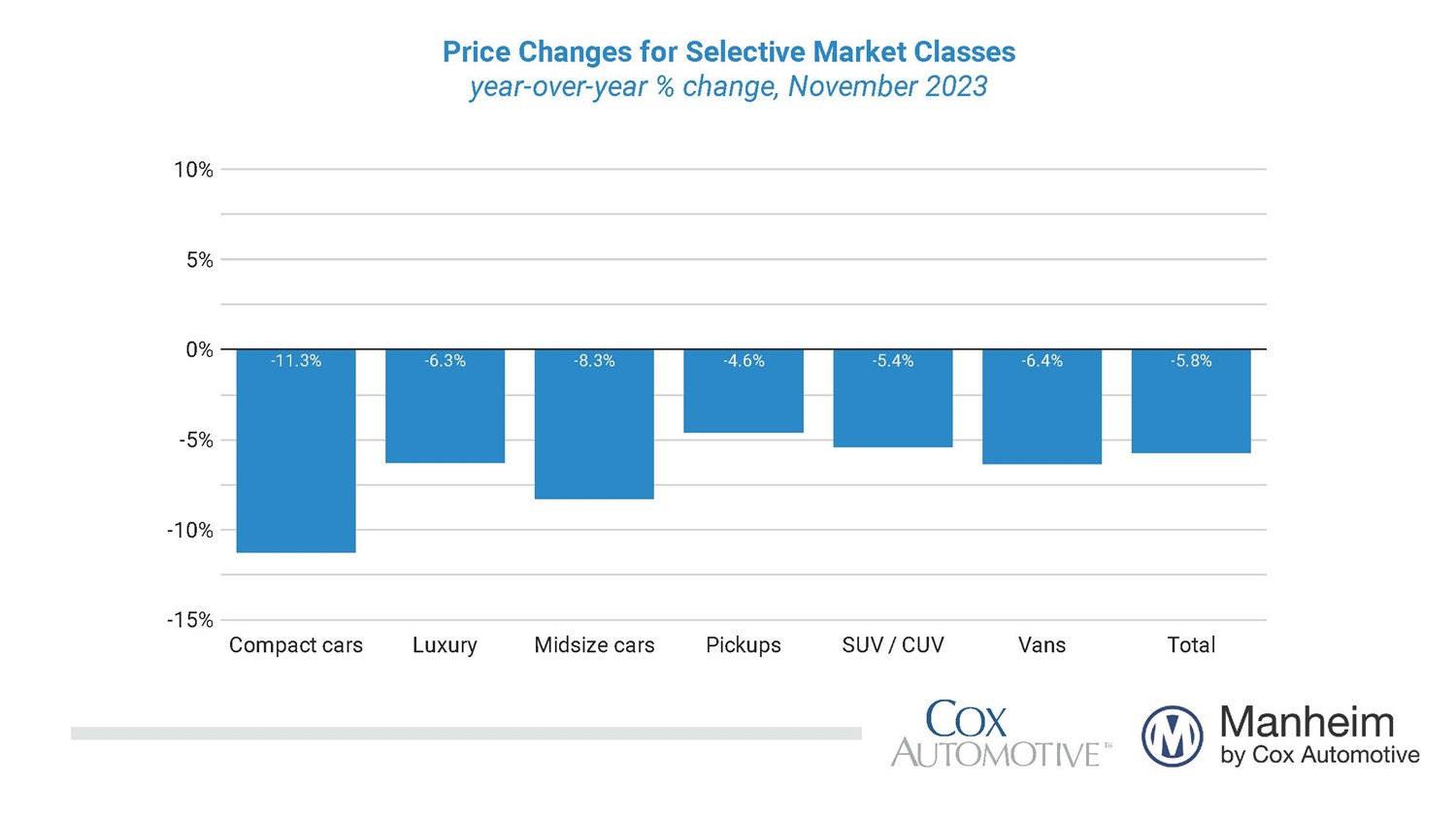

Wholesale used-vehicle prices (on a mix, mileage and seasonally adjusted basis) decreased 2.1% in November. The Manheim Used Vehicle Value Index (MUVVI) dropped to 205.0, down 5.8% year-over-year.

According to Manheim, the major market segments saw seasonally adjusted prices that were lower year-over-year in November. Compared to last year, pickups and SUVs decreased less than the industry at large, down 4.6% and 5.4%, respectively. Compact cars performed the worst, down 11.3%.

In addition, mid-size cars, vans and luxury vehicles dipped to 8.3%, 6.4% and 6.3%, respectively. Compact cars, pickups, mid-size cars, SUVs and vans all dipped month-over-month, at 2%, 3.2%, 2.4%, 2.3% and 2.1%, respectively.

Overall, used-vehicle prices experienced a modest drop from the previous year but remain relatively close to their historical peak levels. For example, J.D. Power says the average trade-in equity during October is trending toward $8,501, down $830 from a year ago but nearly double the amount of pre-pandemic levels.

“Despite facing higher interest rates, the used market has remained strong—a result of the lower prices of used vehicles and the continued need for transportation among consumers,” adds Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive.