KPI – December 2023: The Brief

KPI – December 2023: State of Manufacturing

KPI – December 2023: State of Business

KPI – December 2023: State of the Economy

KPI – December 2023: Recent Vehicle Recalls

CONSUMER TRENDS

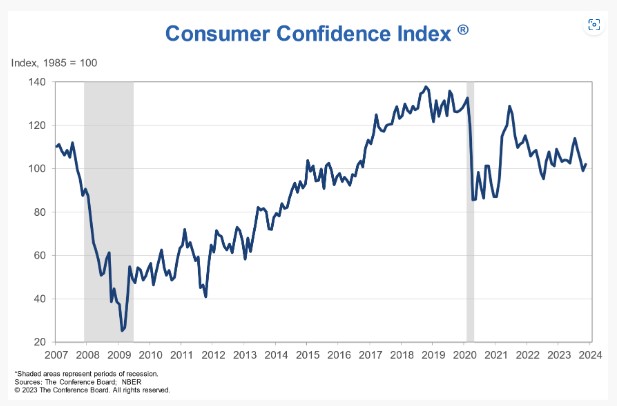

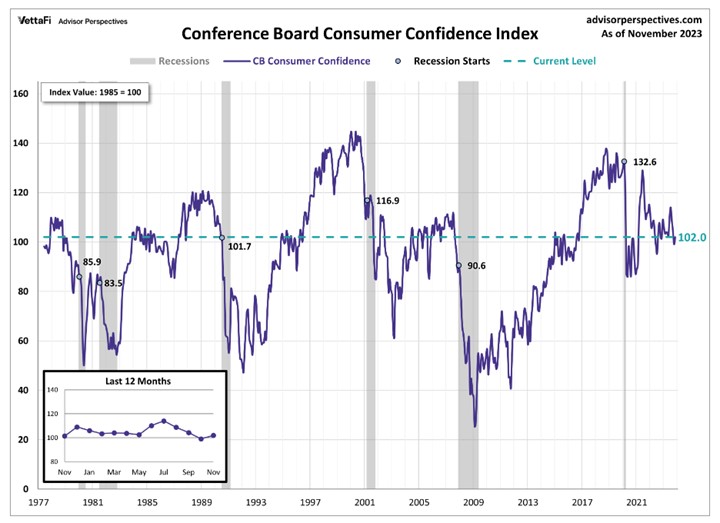

The Conference Board Consumer Confidence Index increased to 102.0 (1985=100) in November, up from a downwardly revised 99.1 in October. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—ticked down to 138.2 (1985=100), compared to 138.6 a month prior.

Meanwhile, the Expectations Index—based on consumers’ short-term outlook for income, business and labor market conditions—rose to 77.8 (1985=100), up from its downwardly revised reading of 72.7 in October.

According to Dana Peterson, chief economist at The Conference Board, November’s increase in consumer confidence was concentrated primarily among householders ages 55 and up. Conversely, confidence among householders ages 35-54 declined slightly.

While general improvements were recorded across the spectrum of income groups surveyed in November, she says write-in responses revealed that consumers remain preoccupied with rising prices, war and higher interest rates.

Although the consumer price index declined by roughly two-thirds since the summer of 2022, the cumulative increase in prices over the past three years is close to 20%.

In addition, overall assessments of the present situation ticked down in November, driven by less optimistic views on current job availability, which outweighed slightly improved views on the state of business conditions.

“Consumer expectations for the next six months recovered in November, reflecting improved confidence about future business conditions, job availability and incomes. Compared to last month, expectations that interest rates will rise in the year ahead ticked down, but consumers’ outlook for stock prices continued to weaken in November,” she says.

Similarly, the University of Michigan Survey of Consumers—a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situations, buying attitudes and overall economic conditions—finished at 61.3, a 3.9% month-over-month decrease.

Data also shows long-run inflation expectations rose to 3.2% in November, with consumers skeptical of controlling runaway costs.

“Younger and middle-aged consumers exhibited strong declines in economic attitudes this month, while sentiment of those 55 and older improved from October,” explains Joanne Hsu, director of Survey of Consumers.

CONSUMER INCOME & SPENDING

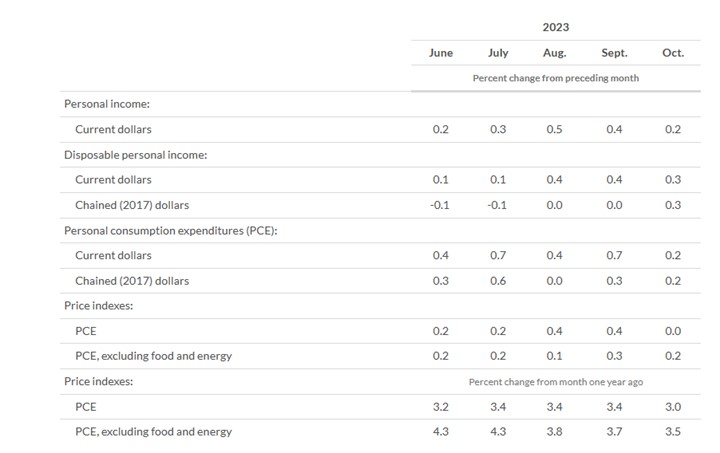

According to the U.S. Bureau of Economic Analysis (BEA), in October 2023 personal income increased $57.1 billion (0.2%), while disposable personal income—personal income less personal current taxes—increased $63.4 billion (0.3%) and personal consumption expenditures (PCE) rose to $41.2 billion (0.2%).

In addition, personal outlays—the sum of personal consumption expenditures, personal interest payments and personal current transfer payments—increased $43.8 billion in October. Personal saving was $768.6 billion in October, with the personal saving rate—personal saving as a percentage of disposable personal income—at 3.8%.

IMPORTANT TAKEAWAYS, COURTESY OF BEA:

- In October, the $41.2 billion increase in current-dollar PCE reflected an increase of $53.1 billion in spending for services that was partly offset by a $11.9 billion decrease in spending for goods. Within services, the largest contributors to the increase included health care (led by hospital and nursing home services), housing and utilities (led by housing) and other services (led by international travel). Within goods, the largest contributors to the decrease were motor vehicles and parts (led by new motor vehicles) and gasoline and other energy goods.

- The PCE price index increased 3% year-over-year. Prices for goods and services increased 0.2% and 4.4%, respectively. Food prices increased 2.4%, while energy prices decreased 4.8%. Excluding food and energy, the PCE price index increased 3.5% year-over-year.