KPI — December 2021: The Brief

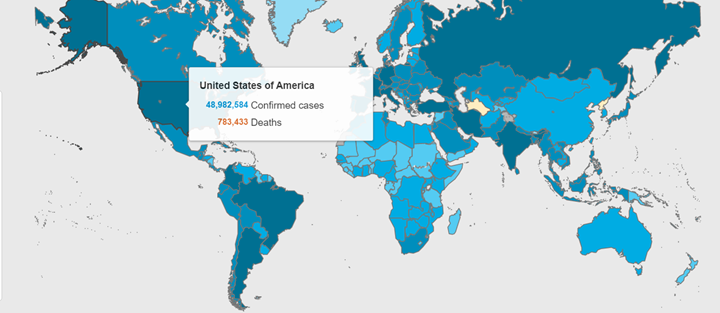

More than 266.5 million COVID-19 cases and 5.2 million deaths have been confirmed across the globe. Vaccination efforts remain a top priority, with the ultimate goal of reaching herd immunity. Approximately 7.8 billion doses have been administered globally, with 199.6 million Americans, or 60.1% of the total U.S. population, now fully vaccinated.

COVID-19 Cases by Country

While the CDC is monitoring the severity of illness and death associated with the new omicron variant, the focus turns to the unvaccinated. Increased demand for “mandatory vaccination” is of growing concern among those who stand by lawful personal choice in health and medical decisions. As a recap:

The Biden administration plans to circumvent the unvaccinated by means of immunization requirement through Occupational Safety and Health Administration (OSHA), a decision calling into question the authority vs overreach of the federal government.

In recent months, OSHA released its long awaited emergency temporary standard (ETS), which calls for employers with 100 or more employees to either implement a vaccine mandate or ensure workers are undergoing weekly COVID-19 testing and wearing face masks at work. The rule covers temporary workers, seasonal workers and minors.

In response, state attorneys general are challenging the vaccine and testing requirements in court. Thus far, the Biden administration received a string of legal losses connected to federal vaccine mandates. Most recently, U.S. District Court for the Western District of Louisiana Judge Terry Doughty ruled the Biden administration does not have the constitutional authority to bypass Congress. He blocked the Biden administration’s emergency regulation requiring vaccines for nearly all health care workers in facilities funded through the Centers for Medicare or Medicaid Services.

“If the executive branch is allowed to usurp the power of the legislative branch to make laws, two of the three powers conferred by our Constitution would be in the same hands,” he wrote. “If human nature and history teach anything, it is that civil liberties face grave risks when governments proclaim indefinite states of emergency.”

Overall, Americans remain sharply divided over vaccine mandates, a topic sure to unfold even more in coming months.

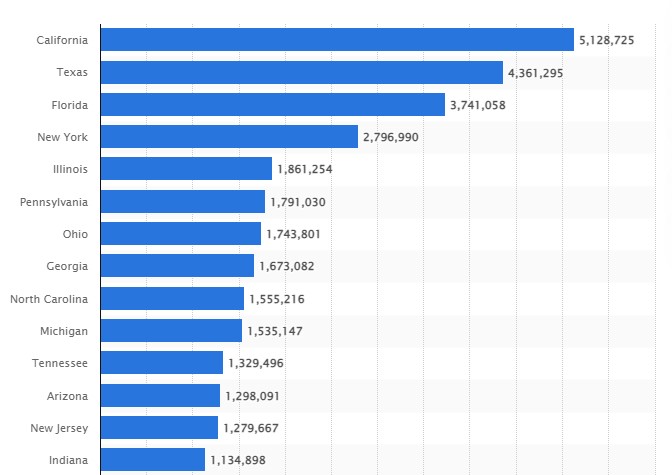

Over 49 million cases have been reported across the U.S., with California, Texas, Florida and New York reporting the highest numbers. California reported the highest number of COVID-19 cases as of December 8, 2021, despite some of the strictest COVID-19 safety measures in the country

COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

Meanwhile, The Conference Board Consumer Confidence Index® decreased in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.6 in October. The Present Situation Index–based on consumers’ assessment of current business and labor market conditions–fell to 142.5 from 145.5 last month. The Expectations Index–based on consumers’ short-term outlook for income, business and labor market conditions–fell to 87.6 from 89.0.

Similarly, The Consumer Sentiment Index–a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions–declined sharply in November. At 67.4, “Consumers expressed less optimism in the November 2021 survey than any other time in the past decade about prospects for their own finances as well as for the overall economy,” according to the University of Michigan Survey of Consumers.

Despite a range of complex challenges – from consumer confidence and sentiment to supply chain woes and beyond – the National Retail Federation (NRF) is forecasting 2021 holiday sales growth between 8.5% – 10.5% year-over-year. This figure includes online and other non-store sales, which NRF predicts will increase between 11% – 15%.

In fact, thus far, the 2021 holiday season appears to be on track to exceed the original forecast – leading to record spending despite supply chain disruptions, inflation and challenges like the new COVID-19 omicron variant, said Chief Economist Jack Kleinhenz.

With 4 in 5 shoppers expecting a seamless omnichannel shopping experience, Buy Online Pick-Up In Store shopping channels are expected to post double-digit growth rates through 2024 – presenting a whole new revenue stream to automotive shops that seize the opportunity.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

- The November Manufacturing PMI® registered 61.1%, an increase of .3 percentage points from the October reading of 60.8%. This figure indicates expansion in the overall economy for the 18th month in a row after a contraction in April 2020, according to supply executives in the latest Manufacturing ISM® Report On Business®.

- LMC Automotive reported Global Light Vehicle (LV) sales increased slightly in October, improving from 73 mn units/year to 76 mn units/year.

- According to JD Power, total new vehicle sales in November 2021, including retail and non-retail transactions, are projected to reach 1,061,900 units – a 14.8% decrease compared to November 2020.

- In September, total RV shipments hit 55,014 units – an increase of 32.2% compared to the 41,600 units shipped during September 2020. According to reports from RV PRO, this is a new all-time high for the number of RVs shipped in any previous month and any previous quarter.

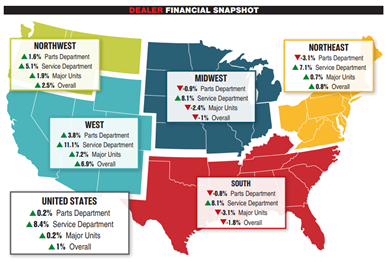

- According to Powersports Business, the Major Unit sales market correction from 2020 continued into Fall 202. Revenue from new and pre-owned Major Units increased 0.2% in September 2021 vs. September 2020. On average, dealerships in the West posted a 7.2% revenue increase in Major Unit sales. The Northwest followed with a 1.9% average increase, and the Northeast recorded a 0.7% increase. Both the South and Midwest decreased in sales by an average of 3.1% and 2.4%, respectively. Parts sales increased 0.3% year-over-year, led by the West with a 3.8% increase; the Northeast had a 3.1% decrease. Meanwhile, the national average for Service revenue remained strong and saw an 8.4% overall increase, again led by the West (11.1%) and Midwest (8.1%).

- As reported last month, the NFIB Small Business Optimism Index decreased from 99.1 in September to 98.2 in October. The next monthly NFIB report will be released Tuesday, December 14, 2021.

KPI — December 2021: State of Business: Automotive Industry

Key Performance Indicators Report — December 2021