KPI — April 2023: The Brief

Consumer confidence and sentiment remain mixed as costly inflation and ongoing labor shortages continue to impact consumers and business owners alike.

The Conference Board Consumer Confidence Index® increased slightly in March to 104.2 (1985=100), a small uptick from 103.4 in February. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased to 151.1 (1985=100) from 153.0 last month. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – rose to 73.0 (1985=100) from 70.4 in February (a slight upward revision). During 12 of the last 13 months, however, the Expectations Index registered below 80 – a level which often signals a recession ahead.

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 62.0 in March, a significant dip from 67.0 in February. Consumer sentiment is tracking slightly up in preliminary reporting for April, at 63.5.

One-year inflation expectations fell to 3.8%, the lowest since April 2021. An overall decline in sentiment was focused among “lower-income, less-educated and younger consumers, as well as consumers with the top tercile of stock holdings,” explains Joanne, director of Survey of Consumers.

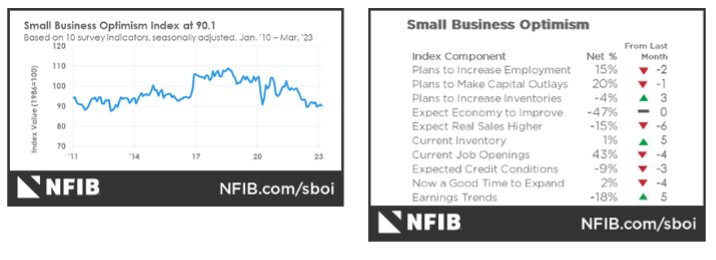

According to the current NFIB Small Business Optimism Index, 24% of owners reported inflation as their single most important business problem – down four points from last month. In addition, small business owners expecting better business conditions over the next six months remain at a net negative 47%.

According to the report, a seasonally adjusted net 15% of owners plan to create new jobs in the next three months. However, 26% of owners cited few qualified applicants for open positions and 27% reported none. Another 11% of owners cited labor costs as their top business problem, with 23% pointing to labor quality as their top business problem.

“Small business owners are cynical about future economic conditions,” says Bill Dunkelberg, NFIB chief economist. “Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

This Month’s Top Takeaways:

- Economic activity in the manufacturing sector contracted in March for the fifth consecutive month following a 30-month period of growth, according to the nation’s supply executives in the most recent Manufacturing ISM® Report On Business®. The March Manufacturing PMI® registered 46.3%, 1.4 percentage points lower than the 47.7% recorded a month ago. The Manufacturing PMI® is at its lowest level since May 2020, when it registered 43.5%.

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in March on a seasonally-adjusted basis, says the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 5% before seasonal adjustment.

- NFIB’s Small Business Optimism Index decreased 0.8 points in March to 90.1, marking the 15th consecutive month below the 49-year average of 98.

- Total new vehicle sales for March 2023, including retail and non-retail transactions, are projected to reach 1,330,700 units – a 6.2% year-over-year increase, according to a joint forecast from J.D. Power and LMC Automotive.

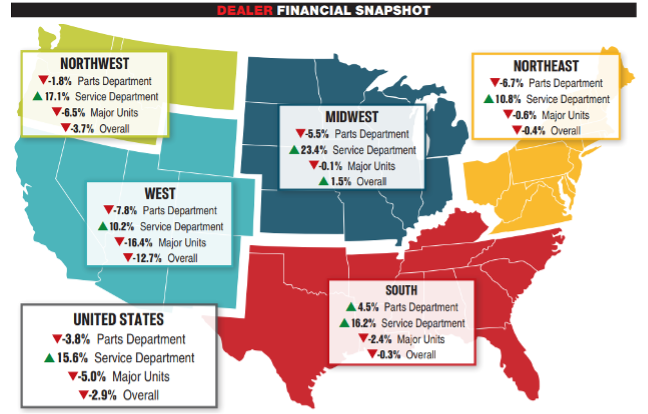

- Powersports Business says dealers across the country reported an overall revenue decrease of 2.9% in February, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 3.8% in parts revenue and 5% in sales revenue, but up 15.6% in service revenue.

KPI — April 2023: State of Business

Key Performance Indicators Report — April 2023