KPI — April 2022: The Brief

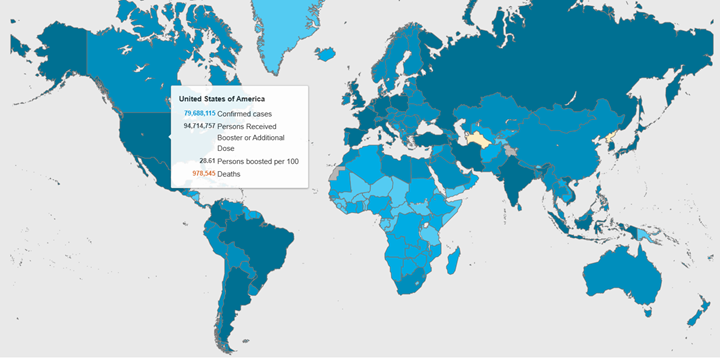

More than 449.1 million COVID-19 cases and 6.1 million deaths have been confirmed across the globe. Vaccination efforts remain a top priority among health and government officials, with the ultimate goal of reaching herd immunity. Approximately 11.2 billion vaccine doses have been administered around the world, with 219 million Americans, or 66.4% of the total U.S. population, now fully vaccinated.

As of April 11, 2022, the state with the highest number of COVID-19 cases was California. More than 80 million cases have been reported across the U.S., with California, Texas, Florida and New York reporting the highest numbers, according to Statista.

COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

The Conference Board Consumer Confidence Index® increased slightly in March, after a tumble in February. The Index now stands at 107.2 (1985=100), up from 105.7 in February. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – improved to 153.0 from 143.0 last month. However, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – declined to 76.6 from 80.8.

Similarly, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – is pacing up 10.6% in early April, according to the University of Michigan Survey of Consumers.

“The April survey offers only tentative evidence of small gains in sentiment, which is still too close to recession lows to be reassuring. There are still significant sources of economic uncertainty that could easily reverse the April gains, including the impact on the domestic economy from Putin’s war and the potential impact of new COVID variants,” says Richard Curtin, Surveys of Consumers chief economist.

The Ukraine-Russia war is expected to result in further economic impacts, from higher prices to dampened spending and investment, says Federal Reserve Chair Jerome Powell.

“Just how big a blow the conflict ends up delivering to the global economy will depend on its length and scope, the severity of Western sanctions and the possibility that Russia might retaliate,” according to economic contributors at Bloomberg. “There’s the potential for other twists too, from an exodus of Ukrainian refugees to a wave of Russian cyberattacks.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report:

• The March Manufacturing PMI® registered 57.1%, a decrease of 1.5 percentage points from the February reading of 58.6%, according to supply executives in the latest Manufacturing ISM® Report On Business®.

• The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2% in March on a seasonally adjusted basis after rising .8% in February, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 8.5% before seasonal adjustment – the largest increase since 1981.

• LMC Automotive reports Global Light Vehicle (LV) sales fell to 75 million units per year in March 2022.

• According to JD Power, total new-vehicle sales in March 2022, including retail and non-retail transactions, are projected to reach 1,188,300 units – a 28.9% year-over-year decrease.

• The RV industry continues to post impressive numbers, with the RV Industry Association (RVIA) reporting 53,722 units shipped by OEMs in February – an 11.3% year-over-year increase.

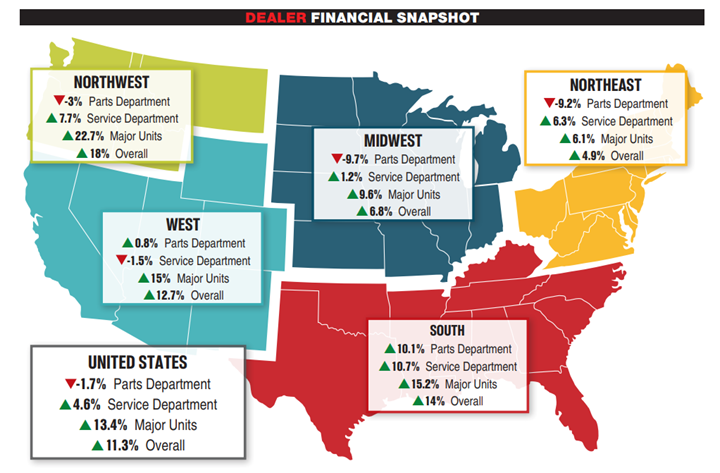

• Powersports Business reports Major Unit sales skyrocketed in February, up 13.4% year-over-year on average, according to composite data from more than 1,700 dealerships in the U.S. that use the CDK Lightspeed DMS. Revenue from new and pre-owned Major Units grew by 13.4.% on average to lead all segments and service posted a 4.6% increase, while parts sales dipped 1.7%+/-. Combined, the average dealership had a revenue increase of 11.3% in February, a solid gain compared to 3% the month prior. Dealerships in the Northwest (22.7%) and South (15.2%) saw the largest revenue increase in Major Unit sales. In service, the South recorded 10.7% growth to lead all regions. In parts, dealers in the South averaged 10.1% revenue growth, with the Midwest up 0.8% on average.

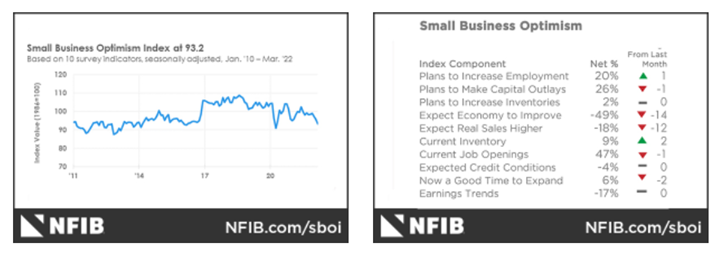

• The NFIB Small Business Optimism Index decreased in March by 2.4 points to 93.2, the third consecutive month below the 48-year average of 98. “Inflation has impacted small businesses throughout the country and is now their most important business problem,” says Bill Dunkelberg, chief economist at NFIB. “With inflation, an ongoing staffing shortage and supply chain disruptions, small business owners remain pessimistic about their future business conditions.”

Key Takeaways, Courtesy of NFIB

- Owners expecting better business conditions over the next six months decreased 14 points to a net negative 49%, the lowest level recorded in the 48-year-old survey.

- Forty-seven percent of owners say job openings cannot be filled, a decrease of one point from February.

- The net percent of owners raising average selling prices increased four points to a net 72% (seasonally adjusted), the highest reading in the survey’s history.

- Inflation has replaced labor quality as the number one problem facing small businesses, with 31% pointing to soaring prices as their greatest challenge – up five points from the month before and the highest reading since early 1981.

KPI — April 2022: State of Business — Automotive Industry

Key Performance Indicators Report — April 2022