KPI — April 2021: The Brief

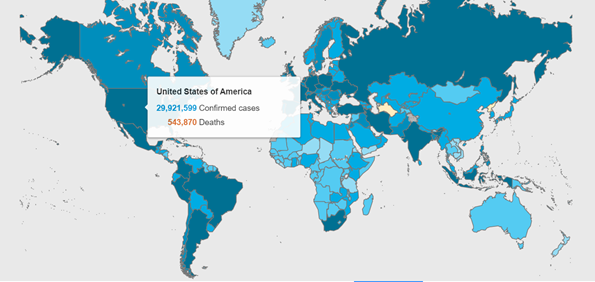

Nearly 130 million COVID-19 cases and 2.8 million deaths have been confirmed across 235+ countries, areas or territories.

Vaccination efforts continue to ramp up. Most recently, Moderna Inc. announced clinical trials for children between the ages of six months to less than 12 years. The study is being conducted in collaboration with the National Institute of Allergy and Infectious Diseases (NIAID)—part of the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA) with the Office of the Assistant Secretary for Preparedness and Response at the U.S. Department of Health and Human Services. Read more about the Phase 2/3 KidCOVE study here.

Similarly, healthy pediatric participants between the ages of six months and 11 years have entered vaccination testing with Pfizer-BioNTech. Both clinical trials are “a crucial step in obtaining federal regulatory clearance to start vaccinating young kids and controlling the pandemic,” reported CNBC.

Important Headlines:

- The U.S. Food and Drug Administration issued an emergency use authorization (EUA) for Janssen Pharmaceuticals, a pharmaceutical company headquartered in Beerse, Belgium and owned by Johnson & Johnson. “The authorization of this vaccine expands the availability of vaccines, the best medical prevention method for COVID-19, to help us in the fight against this pandemic, which has claimed over half a million lives in the United States,” said acting FDA Commissioner Janet Woodcock, M.D. Public health officials are pleased with the efficiency of the vaccine—a single dose without cumbersome, cold-storage obstacles; however, some groups are pushing back on issues of morality.

- More than 550 million doses of the coronavirus vaccines have been administered across 140 countries worldwide, but there are vast differences in the pace of progress across different parts of the world. Read about those disparities here.

- Review a list of important questions and answers, per Children’s Hospital of Philadelphia® (CHOP).

- As reported last month, a UK trial was launched to determine if administering different COVID vaccines for first and second doses is as effective as using the same type of vaccine twice, reported BBC News. “The idea is to provide more flexibility with vaccine rollout and help deal with any potential disruption to supplies. Scientists say mixing jabs could also possibly give even better protection,” added BBC News.

COVID-19 Cases by Country

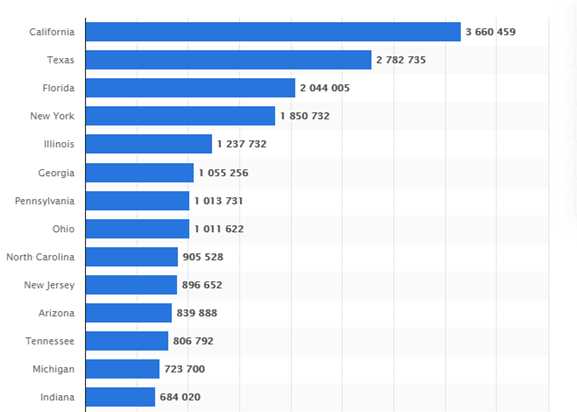

COVID-19 Cases by State

As of March 29, 2021, the state with the highest number of COVID-19 cases was California which, coincidentally, also imposed some of the strictest government orders throughout the pandemic. Over 30 million cases have been reported across the United States, with California, Texas, Florida and New York reporting the highest numbers. COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

The U.S. is navigating toward recovery, with increased vaccination and, according to recent reports, possible multi-step stimulus plans underway. Undoubtedly, economic impacts remain widespread and challenges are ahead, but consumers remain hopeful.

The Consumer Sentiment Index—a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions—finished at 84.9 in March 2021, up from a preliminary estimate of 83 and above market forecasts of 83.6. It is the largest increase in consumer morale since May 2013, as households welcomed the third disbursement of relief checks and improved vaccination progress.

Furthermore, after a modest increase in February, The Conference Board Consumer Confidence Index® “surged” in March to its highest reading in a year. The Index now stands at 109.7, up from 90.4 in February.

A rise in consumer confidence is expected to carry through the Easter season, with consumers planning to spend an average of $179.70—the highest figure on record, according to results of the annual survey released by the National Retail Federation (NRF) and Prosper Insights & Analytics.

“With new stimulus funds from the President’s American Rescue Plan, positive trends in vaccinations and growing consumer confidence, there is a lot of momentum heading into the Spring and holiday events like Easter,” said Matthew Shay, NRF President and CEO. “Many have figured out how to celebrate holidays safely with family and that is reflected in consumer spending this Easter.”

A total of 79% of Americans celebrated the holiday and spent a collective $21.6 billion, down slightly from last year’s pre-pandemic forecast of $21.7 billion, but an impressive number nonetheless.

As reported last month, economists are optimistic that as Americans get past the worst of the pandemic, they will be eager to act upon pent-up demand. NRF forecasts put 2021 retail sales between $4.33 trillion and $4.4 trillion. Online sales, which are included in the total, are expected to grow between 18% and 23% ($1.14 trillion and $1.19 trillion). Read the full report here.

Professionals in the automotive aftermarket, powersports and RV industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Below are a few key data points explained in further detail throughout the report:

- The March Manufacturing PMI® registered 64.7%, an increase of 3.9 percentage points from the February reading of 60.8%, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

- The Conference Board revised its U.S. real GDP forecast, showing an increase of 3% (annualized rate) in Q1 2021 and 5.5% (year-over-year) in 2021.

- The Consumer Price Index for All Urban Consumers (CPI-U) increased .4% in February on a seasonally adjusted basis after rising .3% in January, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all items index increased 1.7% before seasonal adjustment.

- Global Light Vehicle (LV) sales fell to 80.7 mn units/year in February—down from an already poor 82.3 mn units/year a month prior. Sales posted a 12.4% year-over-year improvement; however, LMC Automotive reports the figure is distorted because annual comparision data runs paraellel to the pandemic spreading across Asia.

- The SAAR in March 2021 is estimated to be 16.5 million, above last year’s 11.4 million level and an increase from last month’s 15.7 million pace, reported Cox Automotive. In March, new light-vehicle sales are forecast to increase by 490,000 units, or nearly 50%, compared to March 2020. When compared to last month, sales are expected to rise nearly 300,000 units, or 25.4%.

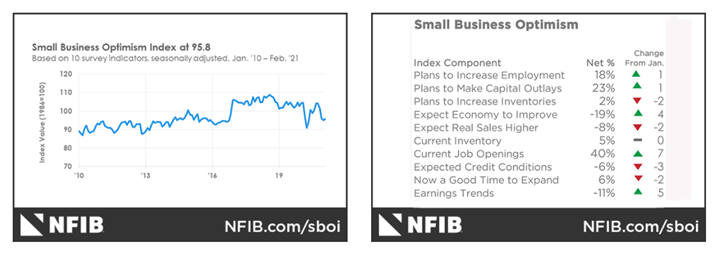

- The NFIB Small Business Optimism Index rose to 95.8 in February, a slight bump from January but still below the 47-year average reading of 98.

“Small business owners worked hard in February to overcome unexpected weather conditions along with the ongoing COVID-19 pandemic,” said Bill Dunkelberg, NFIB chief economist. “Capital spending has been strong, but not on Main Street. The economic recovery remains uneven for small businesses, especially those still managing state and local regulations and restrictions. Congress and the Biden administration must keep small businesses a priority as they plan future policy legislation.”

Readers are encouraged to study the most current Small Business Optimism Index.

Important Takeaways, Courtesy of NFIB

- Five of the 10 Index components improved, four declined and one was unchanged.

- Forty percent of owners reported job openings that could not be filled, an increase of seven points from January. Additionally, 33% have openings for skilled workers (up 5 points) and 16% have openings for unskilled labor (up 4 points).

- Owners expecting better business conditions over the next six months increased four points to a net negative 19%, a poor reading.

- Earnings trends over the past three months improved five points to a net negative 11% reporting higher earnings compared to the January reading.

The monthly Key Performance Indicator Report is your comprehensive source for industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.

KPI — April 2021: State of Business: Automotive Industry

Key Performance Indicators Report — April 2021