KPI – December 2023: State of the Economy

KPI – December 2023: State of Business

KPI – December 2023: Consumer Trends

KPI – December 2023: State of Manufacturing

KPI – December 2023: Recent Vehicle Recalls

Consumer confidence and sentiment stayed low in November, with political tension, inflation, interest rates, labor challenges and war top of mind for small businesses and consumers.

The Conference Board Consumer Confidence Index increased to 102.0 (1985=100) in November, up from a downwardly revised 99.1 in October. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – ticked down to 138.2 (1985=100), compared to 138.6 a month prior.

Meanwhile, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – rose to 77.8 (1985=100), up from its downwardly revised reading of 72.7 in October.

The Expectations index remains below 80 – a level which historically signals a recession within the next year. Consumer fears of an impending recession are elevated, consistent with the short and shallow economic contraction anticipated during the first half of 2024.

Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at 61.3, a 3.9% month-over-month decrease.

“Younger and middle-aged consumers exhibited strong declines in economic attitudes this month, while sentiment of those age 55 and older improved from October,” affirms Joanne Hsu, director of the University of Michigan’s Surveys of Consumers.

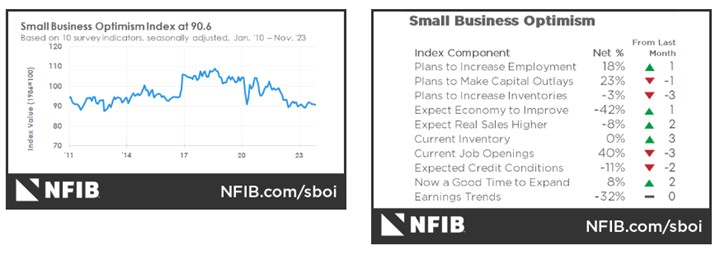

Small businesses continue to feel the burn – economically. According to the current NFIB Small Business Optimism Index, 22% of owners said inflation is the single most important problem in operating their business – unchanged from October, but a significant 10 points lower than this time last year. As a result, 25% reported raising average selling prices – down five points month-over-month but still elevated.

Overall, 54% of owners reported hiring or trying to hire in October, with 93% of owners reporting “few or no qualified applicants” for the positions they were trying to fill. Approximately 33% have openings for skilled workers and 14% have openings for unskilled labor. The difficulty in filling open positions is particularly acute in the construction, manufacturing and transportation sectors.

“Job openings on Main Street remain elevated as the economy saw a strong third quarter,” says Bill Dunkelberg, chief economist at NFIB. “However, even with the growing economy, small business owners have not seen a strong wave of workers to fill their open positions. Inflation also continues to be an issue among small businesses.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Here are a few key data points explained in further detail throughout the report:

TOP TAKEAWAYS:

Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 46.7% in November, unchanged month-over-month.

In November, The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1% on a seasonally adjusted basis, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.1% before seasonal adjustment.

NFIB’s Small Business Optimism Index decreased 0.1 point in November to 90.6, which marks the 23rd consecutive month below the 50-year average of 98.

Total new vehicle sales for November 2023, including retail and non-retail transactions, are projected to reach 1,236,000 units – a 10.2% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

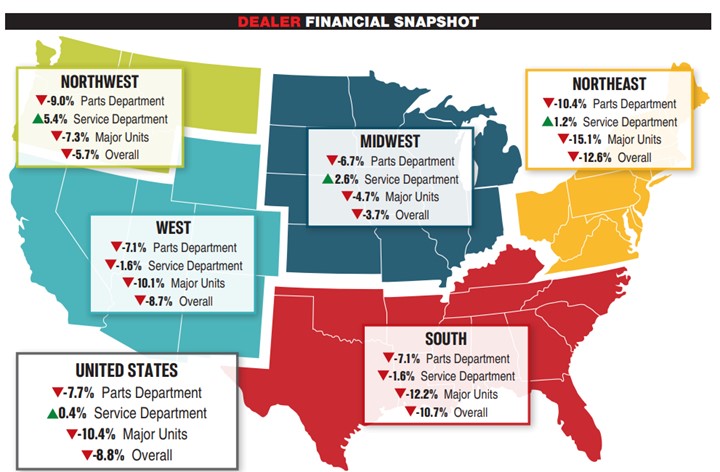

Powersports Business says dealers across the country reported an overall revenue decline of 8.8% in October, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 10.4% in major units and 7.7% in the parts department.