KPI — September 2021: The Brief

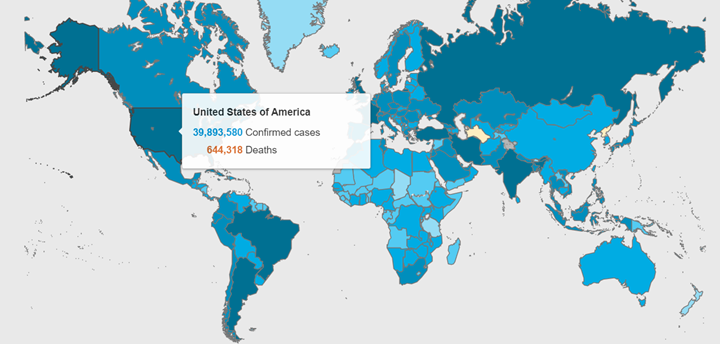

More than 221.6 million COVID-19 cases and 4.5 million deaths have been confirmed across 235+ countries, areas or territories. Vaccination efforts remain a top priority, with an ultimate goal of reaching herd immunity. Nearly 5.4 billion doses have been administered globally, with 176.6 million Americans, or 53.2% of the total U.S. population, now fully vaccinated.

“Vaccination is the key to further economic recovery, reopening and rebuilding,” according to Jack Kleinhenz, chief economist at the National Retail Federation (NRF). “With the outlook for the global economy continuing to hinge on public health, vaccine numbers are extremely important not just for the U.S., but also the whole world,” he continued. “The latest Blue Chip Economic Indicators report says the biggest threat to global stability is an uneven rollout of vaccines and the emergence of additional variants, while the biggest impetus for growth is faster-than-expected global vaccination.”

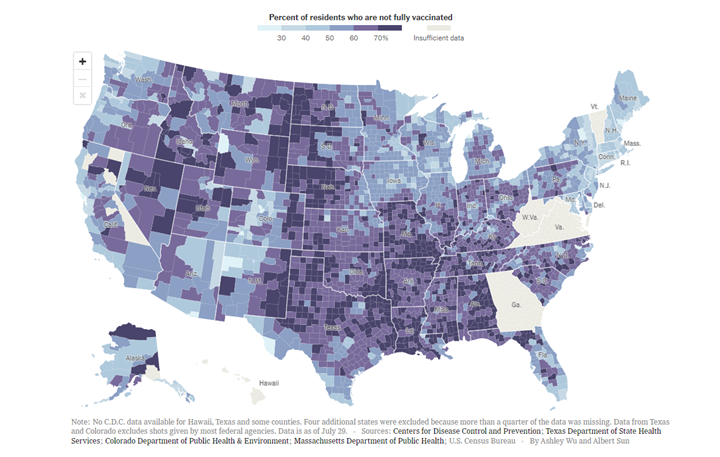

As COVID-19 cases rise across the U.S., the focus turns to approximately 93 million people who are eligible for vaccination but have declined.

The debate rages on, with at least a quarter of Americans opposed to vaccination. Some top reasons include rapid vaccine development – thus calling into question the lack of long-term studies – side effects, efficacy and natural immunity after infection, according to Pew Research and the most recent Gallup poll.

A steady 53% of U.S. adults say they are worried about people choosing not to get vaccinated, including 25% who are very worried. It is now the public’s greatest worry about the virus by a wide margin, surpassing concerns about lack of social distancing in their area (27%), availability of local hospital resources and supplies (11%) and availability of coronavirus tests in their area (5%). – Gallup

Moreover, increased pressure for “mandatory vaccination” is of growing concern among those opposed to inoculation, as well as those who are on the fence about the decision. Overall, Americans remain sharply divided over vaccine mandates, a topic sure to unfold even more in the coming months.

COVID-19 Cases by Country

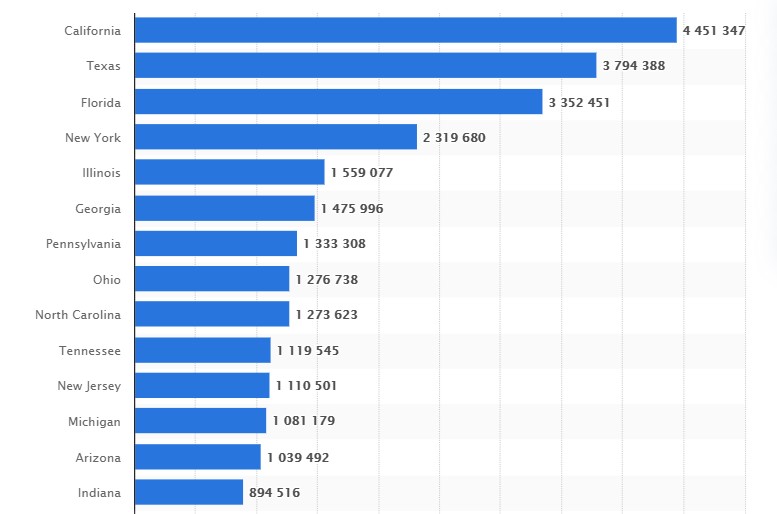

COVID-19 Cases by State

As of Sept. 6, 2021, the state with the highest number of COVID-19 cases was California. Over 39 million cases have been reported across the U.S., with California, Texas, Florida and New York reporting the highest numbers.

COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

Vaccination rates are not the only numbers at a crossroads, as consumer sentiment and confidence plummet.

The Conference Board Consumer Confidence Index® declined in August, following a decrease in July (a downward revision). The Index now stands at 113.8 (1985=100), significantly down from 125.1 in July.

Meanwhile, The Consumer Sentiment Index – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – fell to 70.3 in August, a decline of 13.4% from July and the least favorable economic prospect in more than a decade, according to the University of Michigan Survey of Consumers. In fact, The Sentiment Index has only recorded larger losses in six other monthly surveys since 1978.

On the upside, “While there has been a pickup in COVID-19 cases across the U.S. tied to the delta variant, there is no evidence that the variant is impacting consumer behavior so far,” said Kleinhenz. “Increased infection rates and renewed mask mandates might have an impact, but at this point, consumer activity during the third quarter is continuing to resemble pre-pandemic behavior as the reopening of stores and the economy progresses.”

Within the aftermarket, industry experts forecast online sales of auto parts and accessories to hit $19 billion by 2022. Buy Online Pick-Up In-Store shopping channels are expected to post double-digit growth rates through 2024 – presenting a whole new revenue stream to automotive shops that seize the opportunity.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Below are a few key data points explained in further detail throughout the report:

- The August Manufacturing PMI® registered 59.9%, an increase of .4 percentage points from the July reading of 59.5%. Though the index continues to underperform, the data indicates expansion in the overall economy for the 15th month in a row after contraction in April 2020, according to supply executives in the latest Manufacturing ISM® Report On Business®.

- The Consumer Price Index for All Urban Consumers (CPI-U) increased .5% in July on a seasonally adjusted basis after rising .9% in June, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all items index increased 5.4% before seasonal adjustment. The August report will be released on Sept. 14 and can be viewed here.

- Global Light Vehicle (LV) sales registered 82 mn units/year in July, advancing the downward trend in projections during recent months, according to LMC Automotive.

- Total new vehicle sales in August 2021, including retail and non-retail transactions, are projected to reach 1,094,500 units – a 13.7% year-over-year decrease and a 25.3% drop from August 2019, according to D. Power.

- RV wholesale shipments are projected to hit at an all-time high in 2021 and continue trending upward through 2022, according to the Fall issue of RV RoadSigns – a quarterly forecast prepared by ITR Economics for the RV Industry Association (RVIA).

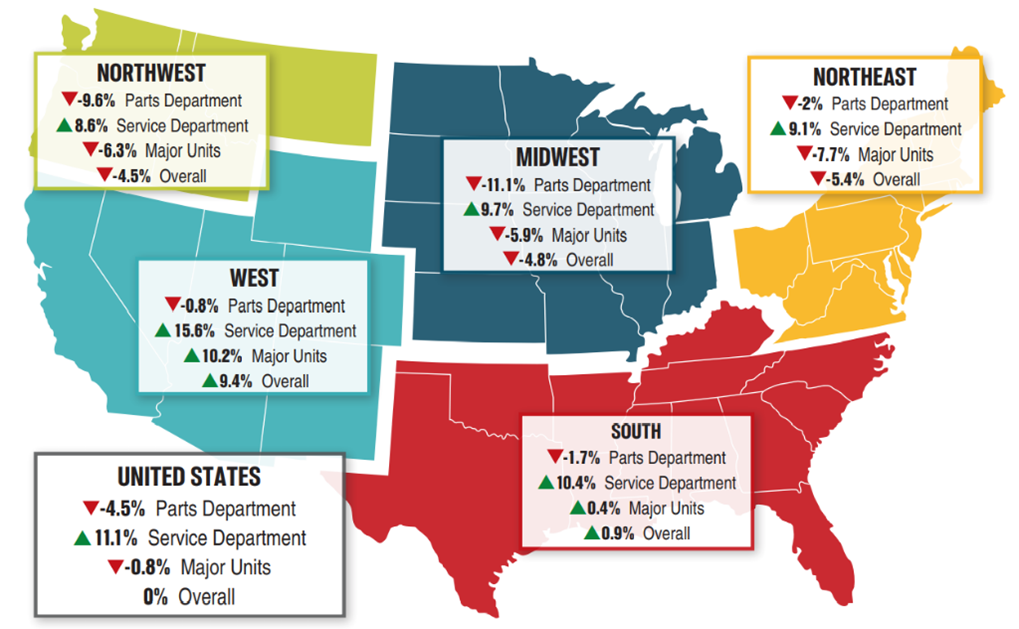

Recently, Powersports Business announced the Major Unit sales market correction continued as the summer progressed, with revenue from new and pre-owned Major Units declining just .8% in the June 2021 period vs. June 2020, according to composite data from more than 1,650 dealerships in the U.S. that use the CDK Lightspeed DMS. Dealerships in the Northeast saw a 7.7% revenue decline in Major Unit sales on average during the period, while the Northwest followed with a 6.9% average decrease, and the Midwest saw a 5.9% decline. However, sales averages were buoyed by increases in the West (10.2%) and a more modest South (.4%). Parts sales dipped into the red during the same period by 4.5% on average year-over-year, led by the Midwest at an 11.1% decline. The national average for Service revenue remained strong and saw a 11.1% overall increase, led by the West (15.6%) and South (10.4%).

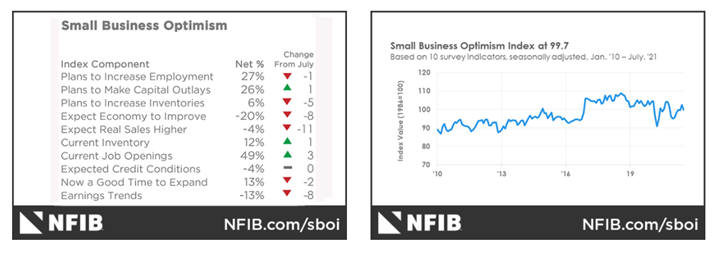

The NFIB Small Business Optimism Index declined in July to 99.7, a decrease of 2.8 points – reversing June’s 2.9-point gain. As noted in the NFIB monthly jobs report, 49% of owners reported job openings that could not be filled, a 48-year record high.

The next report is scheduled to be released on Sept 14th, which can be viewed here. Below are details from July reporting.

“Small business owners are losing confidence in the strength of the economy and expect a slowdown in job creation,” said Bill Dunkelberg, NFIB chief economist. “As owners look for qualified workers, they are also reporting that supply chain disruptions are having an impact on their businesses. Ultimately, owners could sell more if they could acquire more supplies and inventories from their supply chains.”

Important takeaways, courtesy of NFIB:

- Sales expectations over the next three months decreased 11 points to a net negative 4% of owners.

- The percent of owners reporting inventory increases declined seven points to a net negative 6%. A net 12% of owners view current inventory stocks as “too low” in July, up one point from June and a 48-year record high reading. A net 6% of owners plan inventory investment in the coming months, down five points from June and also a historically high reading.

- Owners expecting better business conditions over the next six months decreased eight points to a net negative 20%.

- Earnings trends over the past three months decreased eight points to a net negative 13%.

The monthly Key Performance Indicator Report is your comprehensive source for industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.

KPI — September 2021: State of Business: Automotive Industry

Key Performance Indicators Report — September 2021