Report: Work Truck Solutions Releases Q1 2025 Commercial Vehicle Market Analysis

Tariff uncertainty & looming trade war add pressure to recently recovered supply chains…

Work Truck Solutions has released its Q1 2025 Commercial Vehicle Market Analysis, highlighting ongoing market adjustments as new inventory stabilizes amid uncertainty surrounding emissions standards and international trade.

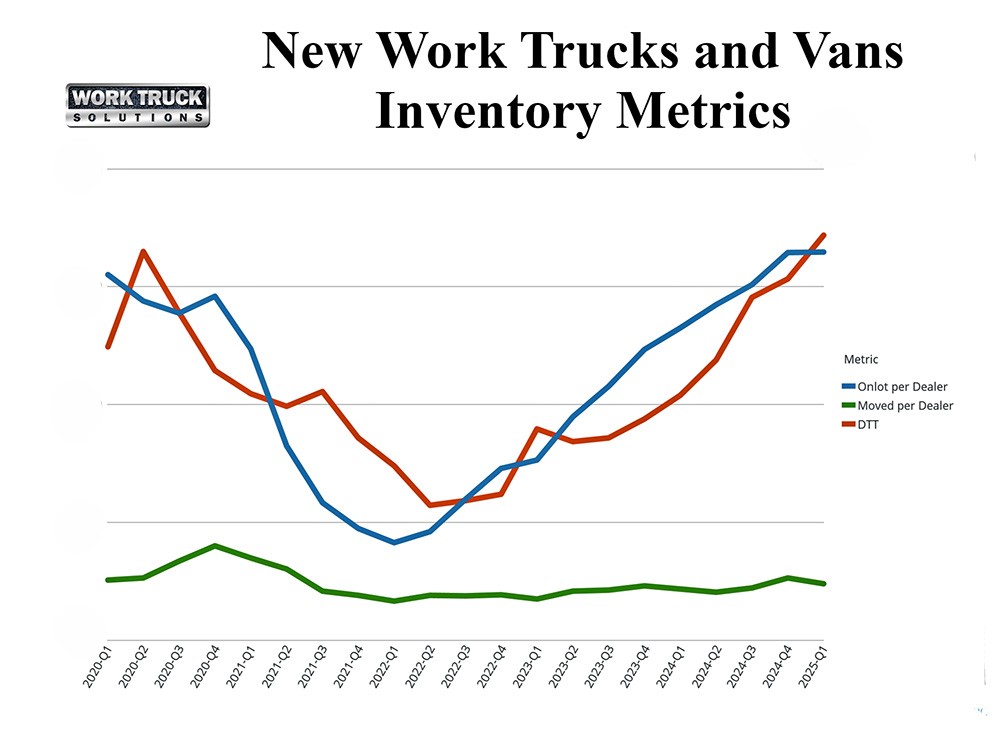

New Work Truck and Van Market

New commercial vehicle inventory remained largely stable, with the average number of trucks on-lot per dealer showing no change quarter over quarter, following a 24.1% year-over-year (YoY) increase. Despite this, movement, or sales, per dealer declined by 11.1% compared to the previous quarter, though it remains up by 9.1% YoY.

New work truck and van prices softened almost imperceptibly, declining 0.7% quarter-over-quarter (QoQ), but edging up 0.4% compared to the same period last year. Meanwhile, Days to Turn (DTT) continued rising, increasing by 12.4% from the previous quarter and 65.4% YoY, reinforcing the trend of slower vehicle movement.

When comparing the current environment to the early stages of COVID, there are similarities. At the beginning of the pandemic, business owners did not immediately react with aggressive purchasing when faced with a looming inventory shortage; it took several months for demand to truly accelerate.

Now, with a potential trade war threatening the automotive supply chain, it’s creating a similar pattern of cautious buying behavior. However, as concerns over tariff impacts continue, it’s likely that businesses will be proactive and pull purchases forward that were planned for later in the year, noted the report.

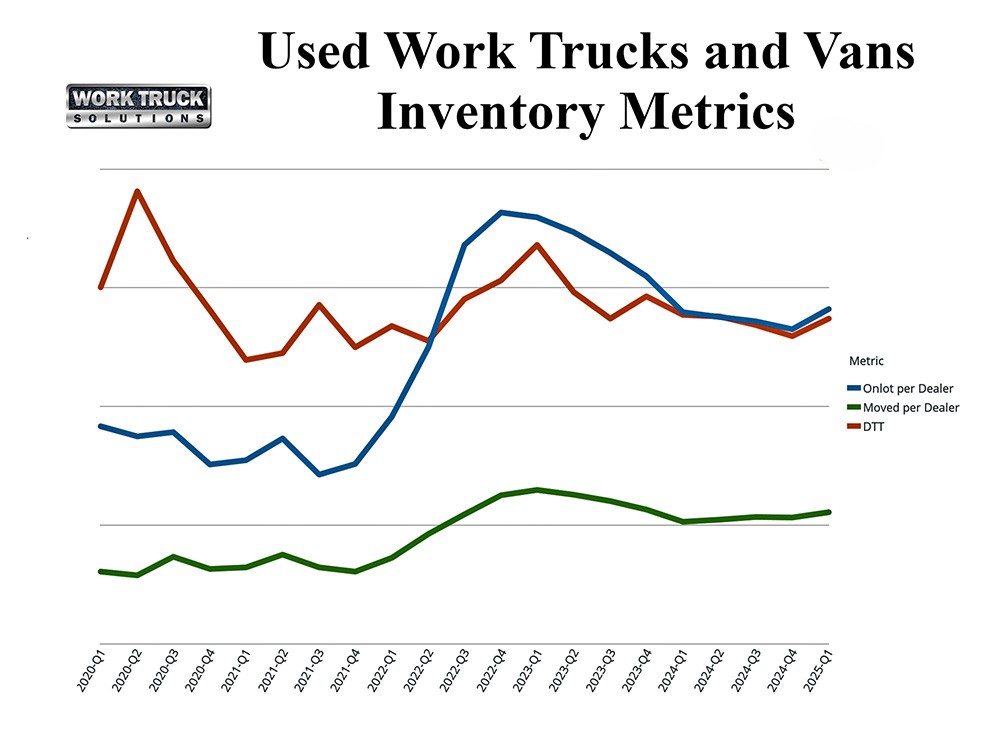

Used Work Truck and Van Market

The used work and van truck market continues to adjust, with inventory levels showing modest quarter-over-quarter growth (up 3.7%) while flat year-over-year. While the number of used work trucks sold per dealer remained unchanged from the previous quarter, year-over-year sales increased by 10.0%.

Used commercial vehicle prices remained unchanged QoQ, with a slight year-over-year decline of 6.3%. The price trend aligned with the modest increase in mileage of used vehicles, up 1.6% quarter-over-quarter and 5.2% YoY. Meanwhile, DTT saw an uptick of 5.8% from Q4 2024, but decreased by 1.8% year-over-year, suggesting continued demand for used vehicles despite elevated new truck inventory.

BEV Market Insights

The battery electric vehicle (BEV) work vehicle segment experienced notable price shifts, with new BEV final prices increasing by 11.4% quarter-over-quarter and 6.1% year-over-year. In contrast, used BEV truck prices declined by 9.2% quarter-over-quarter and 17.08% year-over-year, reflecting shifting demand dynamics in the commercial EV sector.

Industry Perspective

“The commercial vehicle market continues to rebalance, with new commercial vehicle inventory holding steady over the last two quarters and pricing showing minor fluctuations,” said Aaron Johnson, CEO of Work Truck Solutions. “However, ongoing trade tensions may well introduce new supply chain challenges, similar to those seen during the pandemic. Dealers who successfully navigated inventory shortages in 2020 by adopting digital merchandising strategies are in a position to thrive again. The ability to showcase available vehicles efficiently, connect with buyers online, and optimize inventory visibility has proven to be a timeless advantage—one that will continue to serve the industry through any market disruption.”

Johnson further noted that external factors, including interest rate changes, economic forecasts, and ongoing shifts in government policy surrounding low-emission vehicles, are impacting purchasing behavior. “Business owners and fleet operators are being very strategic about their approach to low-emission vehicles. Many are seeking out tools to help them with these evaluations, weighing use cases and business needs, such as those associated with delivery vehicles, against costs and ROI,” he added.

As the market progresses through 2025, Work Truck Solutions says that it will continue to provide deep analysis and expert insights into commercial vehicle trends, helping industry professionals navigate an evolving landscape.