Report: SUVs & Trucks Set New Sales Record in 2024

Big vehicles accounted for 75% of light vehicle sales in the U.S. last year...

In 2024, the European new car market saw minimal growth; however, in contrast, the U.S. saw encouraging progress. According to JATO Dynamics data, the industry sold 16.09 million units, up by 3.3% compared to the previous year. The market had not seen sales at this level since 2019—the year before the onset of the COVID-19 pandemic.

Total registrations surpassed 2021 figures by 1 million units and exceeded 2020 levels by approximately 1.5 million. However, sales have yet to recover to the levels seen in 2019—the year prior to the onset of the pandemic—when the market sold nearly one million more units than last year.

Two key factors have contributed to the positive results in the U.S. car market: strong economic recovery in the latter half of last year and a slowdown in new vehicle price increases.

ICEs Secure Lowest Market Share in Decades

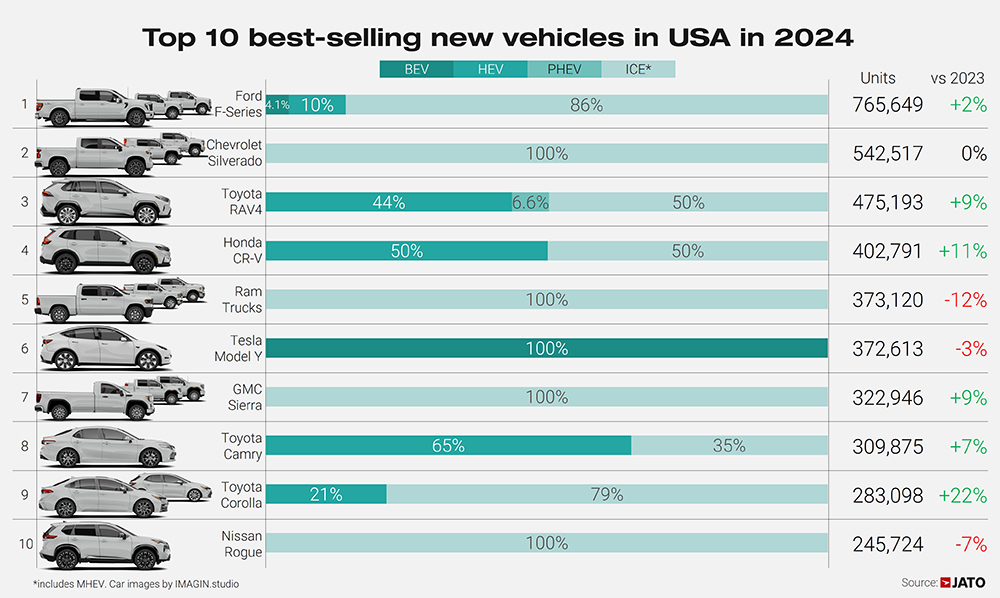

The U.S. market has traditionally favored petrol vehicles. However, last year, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) emerged as the primary drivers of growth. In 2024, internal combustion engine vehicles (ICEs), including mild hybrids, fell below the 80% market share threshold—a notable shift in the world’s second-largest new vehicle market. ICE sales totaled 12.05 million units, down by 0.6% compared to 2023. In contrast, total sales of BEVs and PHEVs increased by 12% and 39%, respectively.

Due to an expansion in the number of models available that meet the needs of consumers, the market is seeing a shift away from traditional combustion powertrains. But, despite record sales in the electrified segment, the U.S. continues to trail China and Europe in overall EV adoption rates.

Americans Favor SUVs and Trucks

This was not the only market share record achieved in 2024. Sales of SUVs and pickup trucks reached new highs, accounting for 75% of total vehicle registrations. A decade ago, these two segments made up just half of the market. Today, they represent three out of every four new vehicles sold in America.

The SUV market was again the main source of growth for most of carmakers—a total of 9.17 million units were sold last year, a year-on-year increase of 5%. General Motors led with a 15.6% share of the market, followed by Toyota (13.3%), Hyundai-Kia (12.6%), Ford (9.6%) and Honda (9.4%)—the fastest-growing SUV brand last year, thanks mainly to strong results from the Honda CR-V, HR-V and Pilot.

While the truck market saw a more muted increase in volume (+4%), it remained an important component in the sales mix for companies like Ford (43%), GM (36%) and Stellantis (31%). Meanwhile, the arrival of the Tesla Cybertruck made less of an impact than many would have expected, with General Motors leading in the group’s ranking and the Ford F-Series leading in the model ranking.

Honda and Chevrolet Trax on the Ascent

The strong performance of the U.S. market last year did not benefit all manufacturers equally. Honda, the Japanese carmaker, recorded the largest market share increase, rising by 0.45 percentage points to 8.8%. However, this remained well below the 9.7% share it achieved in 2021, its highest in the past decade.

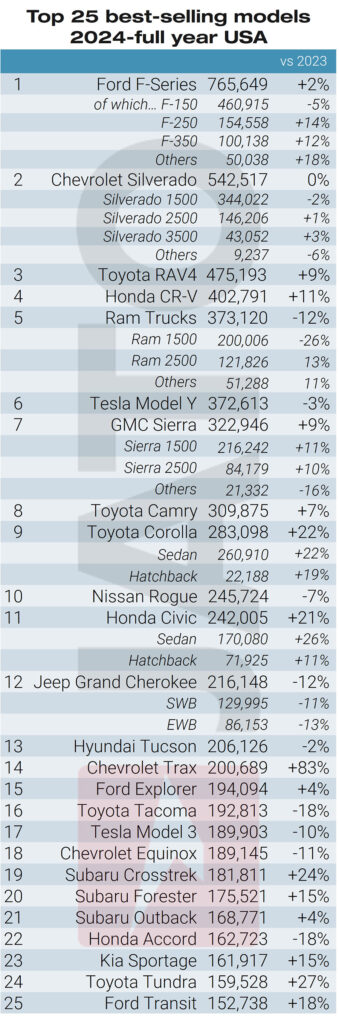

Among individual models, the Chevrolet Trax, a compact SUV, saw the biggest market share gain. It ranked as the 15th best-selling vehicle in the U.S. in 2024, with 200,700 units sold.

The Ford F-Series (the family composed of the F-150, F-250, F-350 and F-450) led the market with more than 765,600 units, up by 2% compared to 2023. Growth was driven by the F-250 (+14%), while the F-150 recorded a sales decrease of 5%. Sales of the electric version of the F-Series increased by 21% but accounted for just 4% of sales across the entire F-Series range.

The Silverado Series (composed of the Silverado 1500, 2500, 3500 and 4500) held the second position in the ranking, followed by the Toyota RAV4, the 3rd best-seller in 2023. Despite its age and the upcoming arrival of the new generation, sales of the Japanese SUV increased by 9%. The Ram pickup truck range, consisting of the 1500, 2500, 3500 and 4500, saw the steepest annual decline among the top 10, losing its 4th position secured in 2023 to the Honda CR-V. In contrast, the Toyota Corolla, which includes the hatchback and sedan versions, recorded the highest increase.