S&P Global Mobility Projects February 2025 US Auto Sales Mildly Improved

Even with an expected rebound from slow January sales, new vehicle sales still face uncertainty…

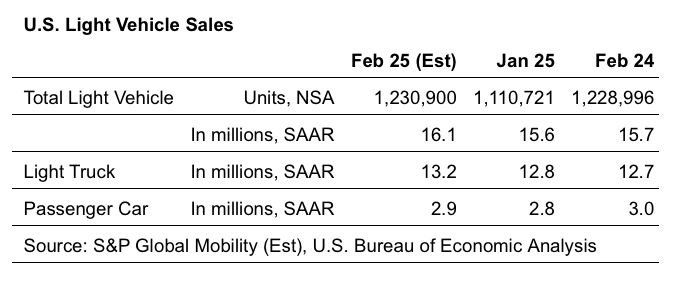

With volume for the month projected at 1.23 million units, February 2025 U.S. auto sales are estimated to translate to an estimated sales pace of 16.1 million units (seasonally adjusted annual rate: SAAR), according to a press release from S&P Global Mobility. This would be a step up from the 15.6-million-unit pace of January 2025 and reflective of the volatile nature of the current auto demand environment.

“We expect that auto sales in February should recover mildly from the January 2025 result, but sustained momentum seems tough to come by, given the swirling economic and policy conditions facing auto consumers and automakers alike,” said Chris Hopson, principal analyst at S&P Global Mobility. “While pricing, inventory and incentive trends are seemingly moving in the right direction, respectively, to promote new vehicle sales growth, unsettled buying conditions will likely continue to push against any consistent upshift for demand levels.”

The S&P Global Mobility U.S. auto outlook for 2025 reflects sustained but more moderate growth levels for light vehicle sales. Vehicle pricing levels are expected to decline but remain high, and interest rates are expected to shift further downward, but inflation levels are anticipated to remain sticky. New vehicle inventory should also progress, but careful management is expected as well. Combined with an uneasy consumer, S&P Global Mobility projects this will translate to mild growth prospects for auto sales. It also projects a calendar-year 2025 light vehicle sales volume of 16.2 million units, a growth of approximately 1% from the 2024 tally.

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer-term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. February BEV share is expected to reach 8.9%, similar to the January reading, as automakers, dealers and consumers continue to digest potential changes to BEV incentives as the new year is underway.