Report: Recall Masters Unveils 2024 Automotive Recall Report

Report reveals opportunities to reengage customers & increase revenue through warranty & customer-pay repairs…

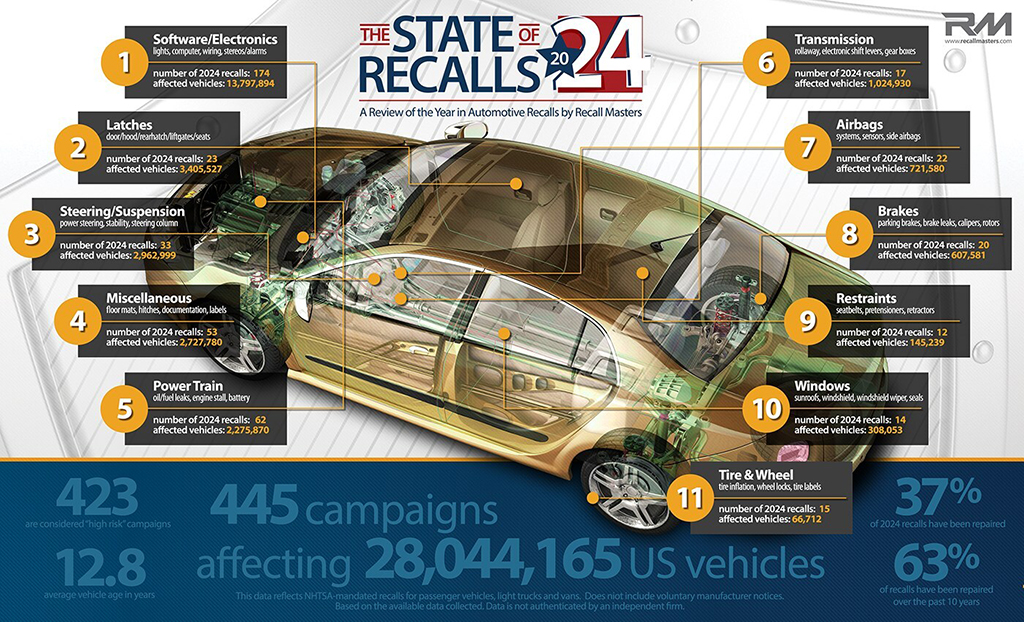

Automotive recall management and retention solutions company Recall Masters has released its annual State of Recalls report with comprehensive data about U.S. automotive recall activity in 2024. The research identifies 445 NHTSA-mandated recall campaigns together with 238 voluntary manufacturer recall notices affecting more than 28 million passenger vehicles, light trucks and vans. The report features detailed data by OEM, system category and campaign risk level.

While the industry is working hard to keep drivers safe, challenges around compliance, software-related failures, and under-the-radar voluntary recalls continue to grow, according to the report.

Key Findings From the State of Recalls Report

Here are the top five key findings from Recall Masters:

- Recall volume remains elevated: A total of 505 recall campaigns in 2024 were all classified as “high-risk.” This includes both federal recalls and voluntary notices, many of which are not published in the NHTSA database and are often overlooked by dealerships.

- Repair rates drop off after three years: The data shows that once a recall campaign hits the three-year mark, the chances of getting those vehicles repaired drop significantly. Older cars tend to fall out of sight for dealerships, and owners may stop paying attention to recall notices. But for service departments, those same vehicles could represent missed revenue and a chance to reengage customers.

- Recalls by system defect: In 2024, 174 campaigns affecting 13.8 million vehicles were linked to software and electronic system failures. As vehicles become more like electronic appliances than machines, software errors and failing electronics dominate. For dealerships with mobile units and skilled technicians capable of performing inspections and software updates, this presents a valuable opportunity to earn warranty revenue.

- Voluntary recalls pose hidden risks: Approximately 34.5% of voluntary campaigns are indeed “high-risk,” posing real dangers to consumers and legal exposure for dealerships, especially when off-brand vehicles are sold with unresolved issues. While not publicly disclosed through NHTSA until an investigation is completed, these recalls can still result in litigation. Recall Master’s claims that its MarketSMART platform can help dealerships uncover and address these blind spots.

- Older vehicles are hardest to reach but most profitable: The average recalled vehicle is now 12.8 years old. While these vehicles are less likely to return for service, when they do, they often bring significant customer-pay repair opportunities.

“Behind every missed recall is not just a safety risk—it’s a lost opportunity for dealers to engage, build trust, and deliver service that protects customers and boosts their bottom line,” said Christopher Miller, founder and chairman of Recall Masters. “We’re committed to giving dealerships the tools they need to close the gap and protect both consumers and their businesses.”