Ford To Reinvest in Trucks, Hybrids, Affordable EVs & Battery Storage

The company plans to leverage its U.S. manufacturing footprint to add a broad range of trucks & vans to its lineup & launch a battery energy storage business…

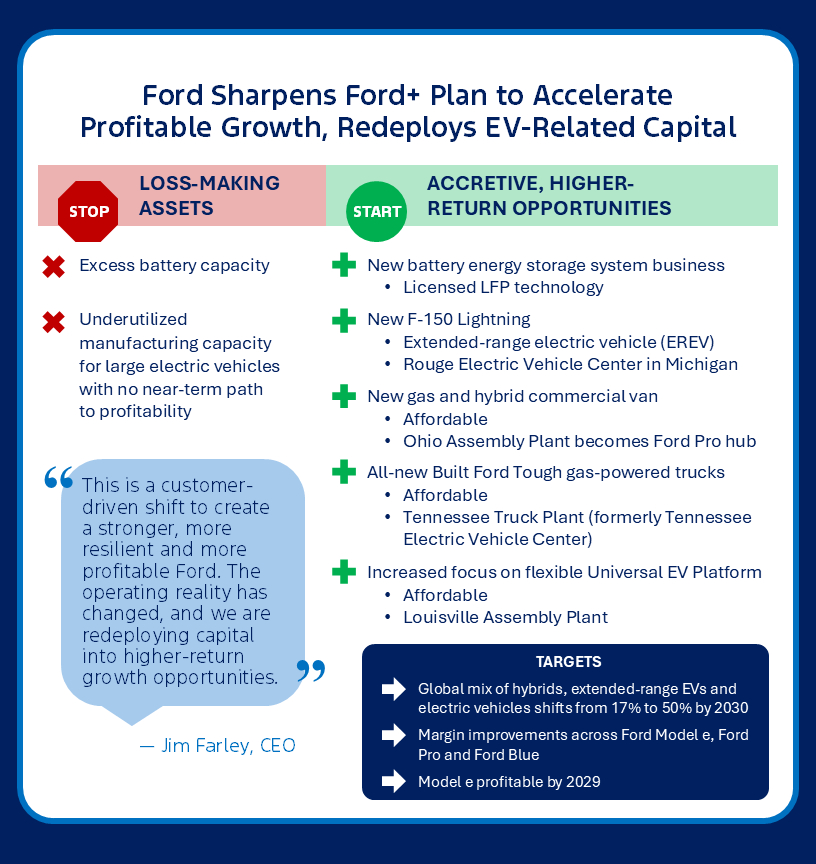

Ford Motor Company announced a series of actions to sharpen its Ford+ plan, executing a redeployment of capital to meet customer demand and drive profitable growth, company officials stated in a press release.

The company says that it is shifting to higher-return opportunities, including leveraging its U.S. manufacturing footprint to add trucks and vans to its lineup and launch a new, high-growth battery energy storage business. As part of these actions, Ford no longer plans to produce select larger electric vehicles where the business case has eroded due to lower-than-expected demand, high costs and regulatory changes, noted the release.

Ford plans to expand powertrain choice, including a range of hybrids and extended-range electric propulsion, while focusing its pure electric vehicle development on its Universal EV Platform for smaller, affordable models.

“This is a customer-driven shift to create a stronger, more resilient and more profitable Ford,” said Ford president and CEO Jim Farley. “The operating reality has changed, and we are redeploying capital into higher-return growth opportunities: Ford Pro, our market-leading trucks and vans, hybrids and high-margin opportunities like our new battery energy storage business.”

These actions provide a path to profitability in Model e by 2029, targeting annual improvements beginning in 2026, the company said. The actions will also improve profits in Ford Blue and Ford Pro over time, with early signs of benefits in 2026. As a result, Ford expects to record about $19.5 billion in special items, the majority in the fourth quarter of 2025, with the remainder in 2026 and 2027. As part of these special items, the company expects approximately $5.5 billion in cash effects, with the majority paid in 2026 and the remainder in 2027.

To support these actions, Ford and its subsidiaries plan to hire thousands of people across America, reinforcing the company’s leadership as the top employer of U.S. hourly autoworkers, Ford officials stated.

The evolved strategy is built on four key pillars.

1. Expanding Customer Choice With Gas, Hybrids & Low-Cost Electric Vehicle Platform

By 2030, Ford expects approximately 50% of its global volume will be hybrids, extended-range EVs and fully electric vehicles, up from 17% in 2025.

Ford will concentrate its North American electric vehicle development on its new, low-cost, flexible Universal EV Platform. Ford says this next-generation architecture is engineered to underpin a high-volume family of smaller, highly efficient and affordable electric vehicles designed to be accessible to millions of customers.

The first vehicle from the Universal EV Platform will be the fully connected midsize pickup truck assembled at the Louisville Assembly Plant starting in 2027.

Ford plans to expand hybrids with a range of executions based on customer needs and duty cycle—economical, performance hybrids and hybrids with exportable power. Ford is enhancing its strategy for larger trucks and SUVs to better align with customer demand for capability, towing and range, which includes adding extended-range electric options to its lineup.

As part of this plan, Ford’s next-generation F-150 Lightning will shift to an extended-range electric vehicle (EREV) architecture and be assembled at the Rouge Electric Vehicle Center in Dearborn, Michigan. Production of the current generation F-150 Lightning has concluded as Ford redeploys employees to the Dearborn Truck Plant to support a third crew for F-150 gas and hybrid truck production as a result of the Novelis fires.

“The F-150 Lightning is a groundbreaking product that demonstrated an electric pickup can still be a great F-Series,” said Doug Field, Ford’s chief EV, digital and design officer. “Our next-generation Lightning EREV is every bit as revolutionary. It keeps everything customers love—100% electric power delivery, sub-5-second acceleration—and adds an estimated 700+ mile range and tows like a locomotive. It will be an incredibly versatile tool delivered in a capital-efficient way.”

The company no longer intends to produce a previously planned new electric commercial van for Europe, but will continue to maintain its full lineup of electrified vans for that market. Ford also plans to replace a planned electric commercial van for North America with a new, affordable commercial van with gas and hybrid models to meet the needs of commercial customers. This new van will be manufactured at Ford’s Ohio Assembly Plant.

These moves complement the company’s plan to launch five new affordable vehicles by the end of the decade, four of which will be assembled in the U.S. The company also plans to expand gas, hybrid and extended-range electric options across its portfolio, with nearly every vehicle featuring a hybrid or multi-energy powertrain choice by the end of the decade.

Recently, Ford announced a series of changes to its business in Europe, including new leadership to drive the strategic direction, and a European product offensive that will bring a new generation of multi-energy vehicles to customers in Europe. Ford also announced a strategic partnership with Renault to collaborate in the development of electric vehicles in both the commercial and passenger segments.

2. Expanding Ford’s Truck & Van Leadership With New U.S. Production

This strategy reinforces Ford’s commitment to American manufacturing by repurposing its facilities in Tennessee and Ohio to expand its truck and van lineup leadership, the company said.

- Tennessee Truck Plant: On the BlueOval City campus, the Tennessee Electric Vehicle Center is renamed Tennessee Truck Plant. The facility will produce all-new Built Ford Tough truck models with production starting in 2029. These new affordable gas-powered trucks will broaden Ford’s truck family, replacing the previously planned next-generation electric truck.

- Ohio Assembly Plant: The plant will become a central hub for Ford Pro, assembling the new gas- and hybrid-powered commercial van starting in 2029, alongside Super Duty chassis cabs.

3. Launching a Battery Energy Storage System Business

Ford is also launching a new business, including sales and service, to capture the demand for battery energy storage from data centers and infrastructure to support the electric grid. Ford plans to repurpose existing U.S. battery manufacturing capacity in Glendale, Kentucky, to serve the rapidly growing battery energy storage systems market. This initiative will leverage currently underutilized electric vehicle battery capacity to create a new, diversified and profitable revenue stream for Ford, according to officials. The company also plans to invest roughly $2 billion in the next two years to scale the business.

The Kentucky site will be converted to manufacture 5 MWh+ advanced battery energy storage systems. Ford plans to produce LFP prismatic cells, battery energy storage system modules and 20-foot DC container systems at this facility. These systems are at the heart of the energy storage solution market for data centers, utilities and large-scale industrial and commercial customers.

Leveraging more than a century of manufacturing expertise and licensed advanced battery technology, Ford plans to bring initial capacity online within 18 months, positioning the company to capture share in the growing U.S. battery energy storage systems market. Ford currently plans to deploy at least 20 GWh annually by late 2027.

Last week, Ford, SK On, SK Battery America and BlueOval SK entered into a joint venture disposition agreement. Under this mutual agreement, a Ford subsidiary will independently own and operate the Kentucky battery plants. SK On will fully own and operate the Tennessee battery plant.

Separately, Ford will utilize BlueOval Battery Park Michigan in Marshall, Michigan, to produce smaller Amp-hour cells for use in residential energy storage solutions. This plant remains on track to begin manufacturing LFP prismatic battery cells in 2026 to power Ford’s upcoming midsize electric truck, the first model on the new Universal EV Platform.

4. Building a Stronger, More Sustainable Future

Ford says these actions are consistent with its goal of becoming carbon neutral across its vehicles, manufacturing facilities and supply chain no later than 2050.

The company will continue its investments in cleaner manufacturing, sustainable supply chains and technologies that reduce emissions across its entire ecosystem.

Updated 2025 Guidance

Company raises 2025 adjusted EBIT guidance to about $7 billion, given continued underlying business strength, including cost improvement. Reaffirms adjusted free cash flow guidance range, trending towards the high end of $2 billion to $3 billion.

Ford plans to report its fourth-quarter and full-year 2025 financial results on Tuesday, Feb. 10, 2026.