Cloud Theory Releases 2024 ‘On The Horizon’ Report

New vehicle inventories dropped for the first time in eleven months...

Cloud Theory announces new vehicle inventory took a step back from its ongoing recovery, dropping from 2.64M in December to 2.53M in January. This interrupts an 11-month run of growth, during which counts grew by more than 1 million.

Inventory also declined in January 2023 amid its long-term revival, pointing to a seasonal dip rather than a shift in the long-term market trajectory, officials stated.

“January always represents a bit of an inventory and sales respite after MYCOs and end-of-year deals run their course, and this is true for 2024,” says Rick Wainschel, VP of data science & analytics at Cloud Theory. “The dynamics leading to a more supply-oriented marketplace are still in place, however, which push OEMs to focus on building demand in order to compete.”

With model year changeovers and end-of-year deals in the rearview mirror, new vehicle movement also dipped back into the stable range near 1 million per month. February forecasts point to a perpetuation of that level over the next month.

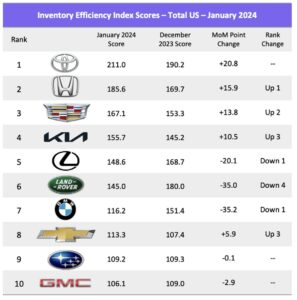

Cloud Theory’s proprietary Inventory Efficiency Index reflects the post-holiday decline for luxury OEMs, with Lexus, Land Rover and BMW dropping substantially in score and at least one rank.

On the other hand, Cadillac bucked the trend and moved back into third place.

“After the luxury OEMs played their hands in December, January is shaping up to be a return to a typical pattern in terms of inventory efficiency, with Toyota, Honda and Kia at the top of the rankings once again,” said Ron Boe, chief revenue officer at Cloud Theory. “Cadillac is an exception to the luxury trend, however, and strong showings by Chevrolet and GMC point to a good start to the year for GM.”

To see more trends and forecasts on inventory, download the February 2024 On the Horizon report here.