This article originally appeared in the January 2023 issue of THE SHOP magazine.

What does the future hold for the restyling industry? A panel of experts at the 2022 SEMA Show debated the big questions and came away optimistic that the market is ready to handle whatever comes next.

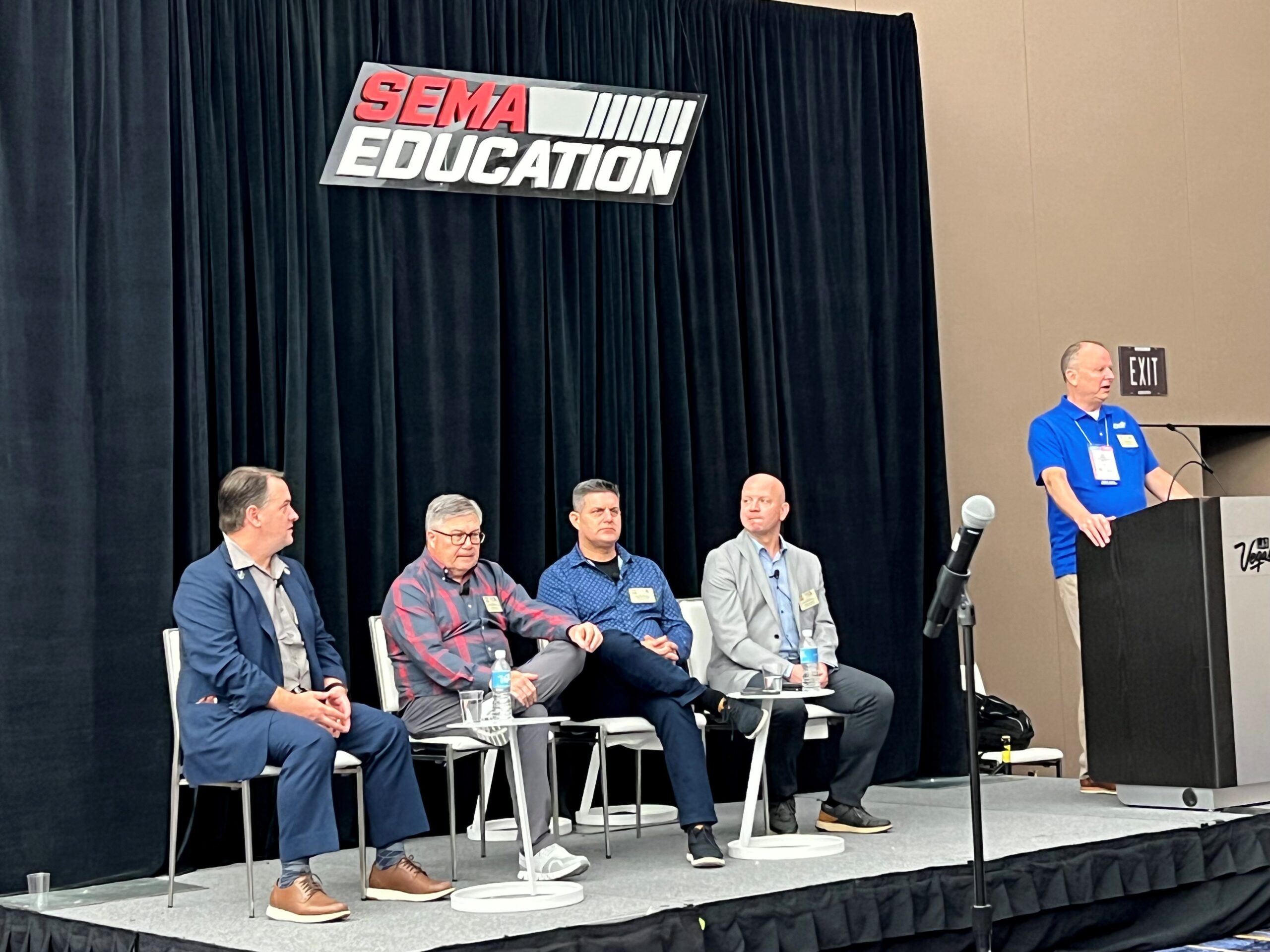

Here are the questions and a summary of the responses from the “Forecasting the Future of the Restyling Industry” panel, which included Ron Leslie, vice president of sales for Katzkin; Kevin Gillis, general manager at Integrity Customs; Josh Poulson, principal of Auto Additions; and Steve Gilmore, design chief of vehicle personalization at Ford Motor Co., and was moderated by Rod Bennett, general manager of Chrome Enhancements.

According to SEMA’s Fall 2022 State of the Industry report, the specialty equipment industry continues to experience growth and strong demand, but is starting to see sales level off from the record highs of the last two years. Ongoing product supply chain issues, rising product prices and economic uncertainty present challenges for the aftermarket industry moving forward.

Question: Based on your personal experience in the industry, what short- and long-term impacts do you believe product supply chain issues, rising product prices and inflation will have on our industry?

The experts agree that supply chains for the OEs are going to continue to be a problem for years to come. And it’s not just the chip shortage—many products are affected by supply chains and even more by rising prices.

So, yes, there will continue to be constraints on new car inventory and with inflation and rising prices will come tighter margins.

In response, now is the time for restyling shops to raise their prices if they haven’t already. Customers expect it and, despite any pushback you might initially receive, it really is the only way to survive. Everyone understands it.

According to SEMA’s Fall 2022 State of the Industry Report, new vehicle sales have slowed in 2022 due to ongoing supply issues, high prices and rising interest rates. The average price of a new gas-powered vehicle skyrocketed to a record $48,301 as of August 2022, a 10.8% increase from a year ago. The average new EV price is even higher at $66,000. According to a recent SEMA survey, 79% of consumers think it is a bad time to buy a car.

Question: In your opinion, what impact will the ongoing vehicle chip supply issues, lack of vehicle inventory, high prices and rising interest rates have on the restyling market?

Challenges usually always open up an opportunity of some kind. With the pricing of cars being so high, many restylers are looking to products and services that provide “protection” to those high-dollar investments.

That includes things like security products, paint protection film, ceramic coatings or anything else that brings value to a consumer to help protect their vehicles.

Meanwhile, an opportunity for lower-end trim level models to be more popular will also help restylers. Four years ago, people were buying loaded trucks and enjoying discounts and rebates. Now, the payments are almost double what they were back then for the same truck models.

This means many new buyers will drop down in trim level to something they can afford and will then opt to add a few of the accessories that they love and are accustomed to like leather, remote starts or heated seats.

Again, this can be an opportunity for restylers to help dealerships get customers what they want.

According to SEMA’s Future Trends report, America is aging. The number of Americans aged 65 or older is expected to grow by nearly 30 million in the next 30 years. Conversely, the number of Americans under age 35 is expected to only grow by 6 million.

Question: According to the same SEMA report, nearly 70% of specialty equipment sales came from accessorizers under the age of 40. How do you feel the aging of our country will impact the future of the restyling industry?

The experts agree that arguments stating that young people don’t want to drive or get their license and thus won’t care about their car or accessorizing their vehicles is false. Many young drivers are doing what drivers have always done—they want their vehicles to be personalized.

As for the older generation continuing to get older, the opportunity to protect their investments remains. Older consumers also have the funds to get exactly what they want in a vehicle later in life, and there are many aftermarket comfort and convenience items that are attractive to more mature drivers.

Thus, sales should continue to be strong for the next few years as these customers buy and upgrade their vehicles.

SEMA’s Future Trends Report published in January 2022 predicts the specialty equipment industry will grow from $50.55 billion in 2022 to $66.57 billion in 2030.

Question: Where do you feel this $16-plus billion increase will come from and what should restylers be focused on to participate in the predicted future growth revenue?

Obviously, pricing will go up, which will account for some of the growth, but many of the core restyling products will continue to be strong for many years to come.

Restylers will also see growth in many non-traditional restyling products that have come to the market like PPF, wrap film and ceramic coatings. Truck accessories will continue to remain strong as well.

According to a Sept. 21, 2022, Automotive News article, Bloomberg puts the U.S. on track to hit more than half of U.S. car sales being EV by 2030. However, according to a SEMA Future Trends Report, SEMA projects that alternative power will make up 45% of new vehicles sold by 2035—of which 26% will be fully electric.

Question: Which prediction would you deem to be more accurate, if either, and what impact will the growing EV market have on the restyling industry?

No one can really know what the percentage of EVs will be. With that said, the infrastructure is not where it needs to be in the U.S. and may continue to restrain people from fully embracing EVs the way some predict.

Regardless, the great position restylers are in is that whether a vehicle is ICE or EV, it can still be restyled with many of our products and services. As EVs become more abundant, so will products for these vehicles.

Also, today’s EVs have just a few trim levels, which allows for aftermarket products to fill the gaps.

According to an Automotive News article dated Sept. 12, 2022, advanced driver-assistance systems, referred to as ADAS, are poised to radically change and disrupt the automotive industry for both OEMs and consumers.

Question: How do you feel ADAS and its associated government regulations will impact the future of the restyling industry?

The more we learn and understand ADAS and how it works in vehicles, the less scary it is.

I compare it to when tire pressure monitoring systems (TPMS) came out and the industry thought we would never be able to sell wheels and tires again. But our knowledge grew and now we know where that wheel and tire market stands.

The same could also be said about airbag sensors in seats—when these became prevalent, we wondered if we’d ever be able to add leather interiors again.

We have learned a lot about ADAS already, and the new SEMA Garage in Detroit has a complete ADAS testing facility.

Also, government regulations have been slow to react to setting complete standards. All of this being the case, it should be business as usual—with a bit of caution—as we move forward with improved safety systems.