- KPI – September 2025: The Brief

- KPI – September 2025: State of Business – Automotive Industry

- KPI – September 2025: State of the Economy

- KPI – September 2025: Consumer Trends

- KPI – September 2025: Recent Vehicle Recalls

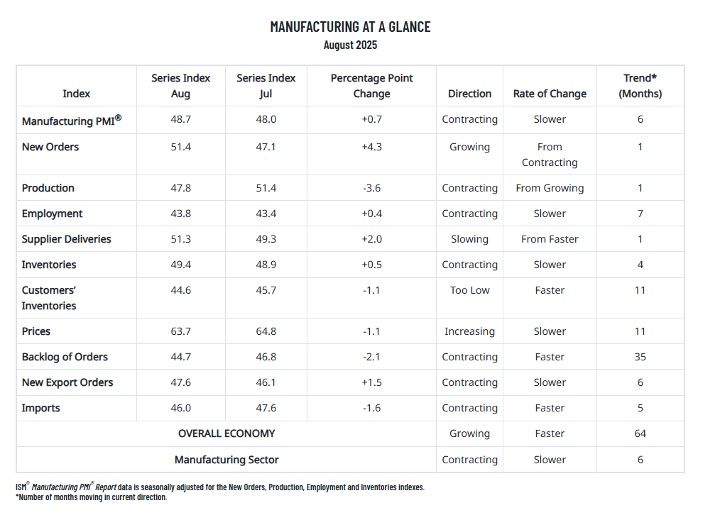

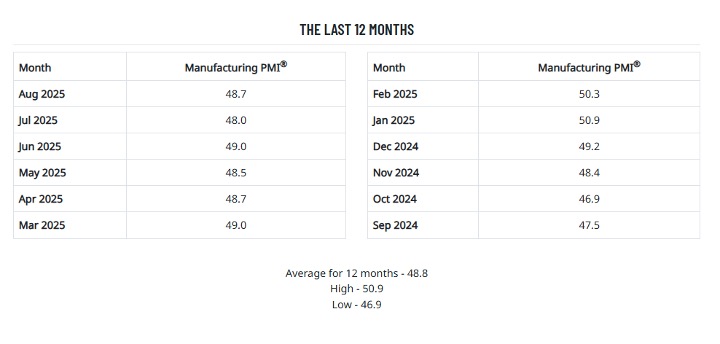

Economic activity in the manufacturing sector contracted for the sixth consecutive month, following a two-month expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest ISM Manufacturing PMI Report. The Manufacturing PMI registered 48.7% in August, a 0.7% increase compared to the 48% recorded a month prior.

“In August, U.S. manufacturing activity contracted at a slightly slower rate, with new orders growth the biggest factor in the 0.7-percentage point gain of the Manufacturing PMI. However, since production contracted at a rate nearly equal to the expansion in new orders, the Manufacturing PMI increase was nominal,” says Susan Spence, MBA, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Data shows 69% of the sector’s gross domestic product (GDP) contracted in August, down from 79% in July. Approximately 4% of GDP is strongly contracting (registering a composite PMI of 45% or lower), down from 31% a month prior.

“The share of sector GDP with a PMI at or below 45% is a good metric to gauge overall manufacturing weakness,” she explains.

Important Takeaways, Courtesy of the Manufacturing ISM Report On Business:

- Two of the four demand indicators improved, with the New Orders and New Export Orders indexes showing gains, while the Customers’ Inventories and Backlog of Orders indexes contracted at slightly faster rates. A “too low” status for the Customers’ Inventories Index is usually considered positive for future production.

- Regarding output, the Production Index returned to contraction, and the Employment Index edged up slightly, as panelists indicated that managing headcounts is still the norm at their companies, as opposed to hiring.

- Inputs—defined as supplier deliveries, inventories, prices and imports—declined further into contraction territory (on net). The Inventories Index improved slightly but remains in contraction territory, while the Supplier Deliveries Index indicated slower deliveries and prices continued to increase, though at a slower rate. The Imports Index moved further into contraction.

What Respondents Are Saying:

- “A 50% tariff on imports from Brazil, combined with the U.S. Department of Agriculture’s elimination of the specialty sugar quota, means certified organic cane sugar—and everything made with it—is about to get significantly more expensive.” [Food, Beverage & Tobacco Products]

- “Orders across most product lines have decreased. Financial expectations for the rest of 2025 have been reduced. Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy.” [Chemical Products]

- “Tariffs continue to be unstable, with suppliers adding surcharges ranging between 2.6% to 50%.” [Petroleum & Coal Products]

- “Tariffs continue to wreak havoc on planning/scheduling activities. New product development costs continue to increase as unexpected tariff increases are announced. For example, there are 50% duties on imports from India and increases to all countries—up from the original 10%. Our materials/supplies are now rising in price, so our sell pricing is again being reviewed to ensure we keep a sustainable margin. Plans to bring production back into the U.S. are impacted by higher material costs, making it more difficult to justify the return.” [Computer & Electronic Products]

- “The construction industry, especially home building, is still at a lower level. With new construction at a low level, our new sales are impacted. We are mainly now relying on replacement business. Cost of goods sold is higher due to tariff-impacted goods.” [Machinery]

- “Domestic sales remain flat but are down 4% from plan by unit volume [tariff pricing]. Export demand is falling as customers do not accept tariff impacts, which likely will require some production transfers out of the U.S. Supplier deliveries remain consistent with ocean shipping costs dropping significantly. Tariff costs have the biggest financial impact, but also costs of copper and steel products.” [Fabricated Metal Products]

- “The trucking industry continues to contract. Our backlog continues to shrink as customers continue to hold off on buying new equipment. This current environment is much worse than the Great Recession of 2008-09. There is absolutely no activity in the transportation equipment industry. This is 100% attributable to current tariff policy and the uncertainty it has created. We are also in stagflation: Prices are up due to material tariffs, but volume is way off.” [Transportation Equipment]

- “Very tentative domestic market, with home building and remodeling not very active at all. Inflation, among other factors, is starting to impact consumer buying power, leading to negative signs for our order files. International markets are upended due to the unpredictability of on-again, off-again tariff activity.” [Wood Products]

- “We’ve implemented our second price increase. Made in the USA has become even more difficult due to tariffs on many components. Total price increases so far: 24%. That will only offset tariffs. No influence on margin percentage, which will actually drop. In two rounds of layoffs, we have let go of about 15% of our U.S. workforce. These are high-paying and high-skilled roles: engineers, marketing, design teams, finance, IT and operations. The administration wants manufacturing jobs in the U.S., but we are losing higher-skilled and higher-paying roles. With no stability in trade and economics, capital expenditures spending and hiring are frozen. It’s survival.” [Electrical Equipment, Appliances & Components]

- “There is still uncertainty in the construction market. Large expansions or investment are hampered by the unknown of costing and the economy. The markets we operate in can be strong short term, but there is an underlying feeling that has you questioning for how long.” [Nonmetallic Mineral Products]