- KPI – October 2025: The Brief

- KPI – October 2025: State of Business – Automotive Industry

- KPI – October 2025: State of the Economy

- KPI – October 2025: Consumer Trends

- KPI – October 2025: Recent Vehicle Recalls

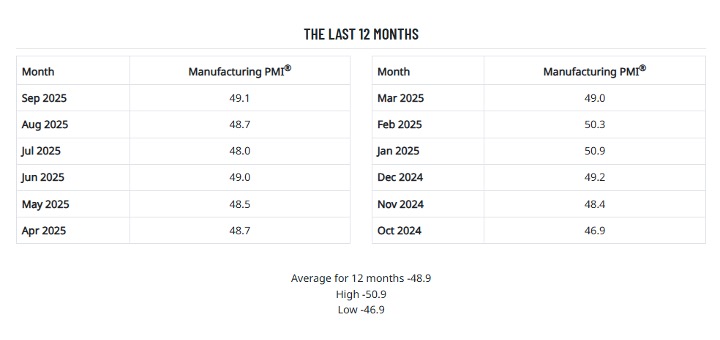

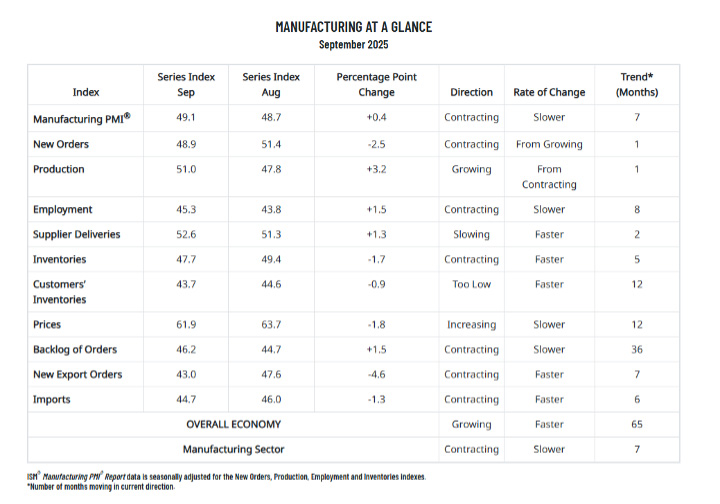

Economic activity in the manufacturing sector contracted in September for the seventh consecutive month, following a two-month expansion preceded by 26 straight months of contraction, say the nation’s supply executives in the latest ISM Manufacturing PMI Report. The Manufacturing PMI registered 49.1% in September, a 0.4% increase compared to the reading of 48.7% recorded in August.

“In September, U.S. manufacturing activity contracted at a slightly slower rate, with production growth the biggest factor in the 0.4-percentage point gain of the Manufacturing PMI,” says Susan Spence, MBA, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

“However, the combined drops in the New Orders and Inventories indexes (4.2 percentage points) exceeded the increase in the Production Index (3.2), rendering the Manufacturing PMI improvement negligible. Last month’s increase in new orders (an index gain of 4.3 percentage points from July to August) seems to have flowed through to production but does not appear to be sustainable given the subsequent drop in new orders in September,” she continues.

Data shows 67% of the sector’s gross domestic product (GDP) contracted in September, down from 69% in August. Approximately 28% of GDP is strongly contracting (registering a composite PMI of 45% or lower), up from 4% in August.

“The share of sector GDP with a PMI at or below 45% is a good metric to gauge overall manufacturing weakness. Of the six largest manufacturing industries, only one (Petroleum & Coal Products) expanded in September, compared to two in August,” Spence says.

Important Takeaways, Courtesy of the Manufacturing ISM Report On Business:

- One of the four demand indicators improved, with the Backlog of Orders Index showing a gain of 1.5% (which could be due to August’s increase in new orders), while the New Orders, New Export Orders and Customers’ Inventories indexes contracted at faster rates. A “too low” status for the Customers’ Inventories Index is usually considered positive for future production.

- Regarding output, the Production and Employment indexes improved, though 64% of panelists’ comments still indicated that managing head count is still the norm at their companies, as opposed to hiring.

- Inputs – defined as supplier deliveries, inventories, prices and imports – moved further into contraction territory on net. The Supplier Deliveries Index indicated slower deliveries, the Inventories Index worsened and the Prices Index continued to increase, albeit at a slower rate. The Imports Index inched further into contraction.

What Respondents Are Saying:

- “Business continues to be severely depressed. Profits are down and extreme taxes (tariffs) are being shouldered by all companies in our space. We have increased price pressures both to our inputs and customer outputs as companies are starting to pass on tariffs via surcharges, raising prices up to 20%. The addition of the derivative steel and aluminum tariffs in the middle of the month — with no announcement — was devastating. Interest-rate lowering or the ‘One Big Beautiful Bill’ will not impact our business, as all capital projects are on hold until there is some level of certainty and customers start to place orders for new equipment again. We believe we are in a stagflation period where prices are up but orders are down due to tariff policy, and again, customers are not willing to pay the higher prices, so they are just not buying. Continuing to find ways to reduce overhead, which means letting go of experienced workers.” [Transportation Equipment]

- “The tariffs are still causing issues with imported goods into the U.S. In addition to the cost concerns, product is being held up at borders due to documentation issues. The inflation issues continue; low volumes are a constant concern. The European region is not improving as we had expected, causing further concern for long-term business viability.” [Chemical Products]

- “Ongoing macroeconomic conditions highlighted by interest-rate management and tariffs continue to impact customer purchasing decisions, resulting in subdued production rates and growing cost concerns on direct material and operations.” [Machinery]

- “Lead times have slightly normalized, but tariffs continue to drive additional spend.” [Petroleum & Coal Products]

- “Customer orders are depressed for heavy machinery because tariffs are so impactful to high-end capital equipment. Revenue expectations are flat for the rest of 2025, with no outlook to improve in 2026.” [Electrical Equipment, Appliances & Components]

- “Current business conditions remain volatile, with geopolitical tensions, weather disruptions and shifting trade policies driving uncertainty in agricultural commodities. Oils remain sensitive to biofuel demand and global production. Inflation and evolving consumer trends add further complexity. To manage this, we are emphasizing supplier diversification, long-term contracts and formula-based pricing to balance cost stability with flexibility.” [Food, Beverage & Tobacco Products]

- “The semiconductor industry is being impacted by high tariff prices on parts from Korea, China and Europe. Our industry is at a low point right now as we race to get new nanotechnology in the U.S.” [Computer & Electronic Products]

- “Business is slowing down. Order books are softening as customers push orders out. Seems to be stemming from concerns about the direction of the U.S. economy.” [Plastics & Rubber Products]

- “Tariffs still affecting vast amounts of increases in hardware, Al (artificial intelligence) and stainless steel. MRO (maintenance, repair and operating) products have continually increased, and the slowdown in agriculture has had stark impacts on bottom lines for raw materials.” [Fabricated Metal Products]

- “Steel tariffs are killing us.” [Miscellaneous Manufacturing]