- KPI – October 2025: The Brief

- KPI – October 2025: State of Manufacturing

- KPI – October 2025: State of Business – Automotive Industry

- KPI – October 2025: State of the Economy

- KPI – October 2025: Recent Vehicle Recalls

Below is a synopsis of consumer confidence, sentiment, demand and income/spending trends.

Sentiment

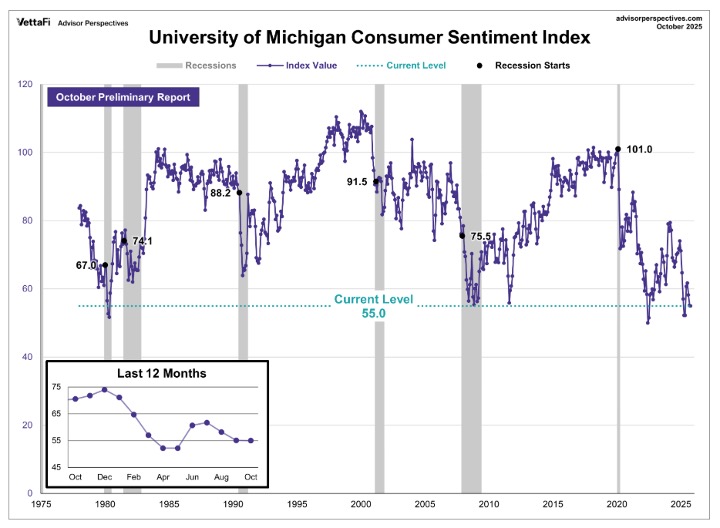

The University of Michigan Survey of Consumers—a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions—registered 55.1 in September and posted a preliminary reading of 55.0 in October. Overall, consumer sentiment is relatively unchanged year-over-year.

Caption: To put today’s report in historical context, consumer sentiment is currently 34.7% below its average reading of 84.3 (arithmetic mean) and 33.8% below its geometric mean of 83.1, based on data dating back to 1978. The current index level is at the 1st percentile of the 574 monthly data points in this series.

Data shows improvements in current personal finances and year-ahead business conditions were offset by declines in expectations for future personal finances, as well as current buying conditions for durables. Compared to last month, consumers perceive very few changes in the economic outlook.

“Pocketbook issues like high prices and weakening job prospects remain at the forefront of consumers’ minds. At this time, consumers do not expect meaningful improvement in these factors. Meanwhile, interviews reveal little evidence that the ongoing federal government shutdown has moved consumers’ views of the economy thus far,” says Joanne Hsu, director of Surveys of Consumers.

Key Takeaways, Courtesy of Survey of Consumers:

- Year-ahead inflation expectations ebbed from 4.7% last month to a still-high 4.6% this month.

- Long-run inflation expectations held steady at 3.7%.

- Inflation expectations for both time horizons are approximately midway between readings from a year ago and highs during April and May, when major tariff changes were initially announced.

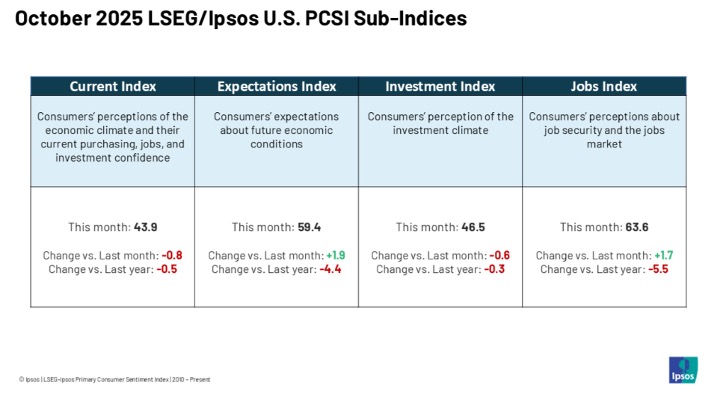

Caption: The LSEG/Ipsos Primary Consumer Sentiment Index for October 2025 is at 52.9. Fielded from September 19–25, 2025*, the Index is up 0.5 points from last month.

Confidence

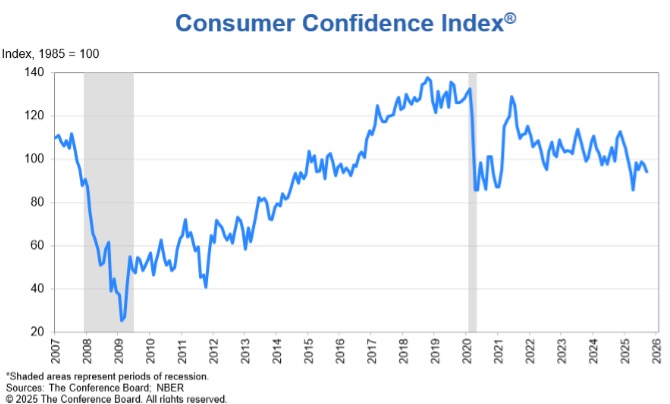

The Conference Board Consumer Confidence Index declined by 3.6 points—down from 97.8 in August to 94.2 (1985=100) in September. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell by seven points to 125.4. Meanwhile, the Expectations Index—based on consumers’ short-term outlook for income, business and labor market conditions—decreased by 1.3 points to 73.4. Since February 2025, expectations have registered below the threshold of 80, which historically signals a recession ahead.

“Consumer confidence weakened in September, declining to the lowest level since April 2025,” according to Stephanie Guichard, senior economist of global indicators at The Conference Board. “The present situation component registered its largest drop in a year. Consumers’ assessment of business conditions was much less positive than in recent months, while their appraisal of current job availability fell for the ninth straight month to reach a new multiyear low. This is consistent with the decline in job openings. Expectations also weakened in September, but to a lesser extent. Consumers were a bit more pessimistic about future job availability and future business conditions, but optimism about future income increased, mitigating the overall decline in the Expectations Index.”

Confidence increased among consumers under 35 years old but declined for consumers over 35. Index data by income group was mixed, with no clear pattern emerging. Overall, confidence remained above its April low for all consumer cohorts besides households making between $25K and $35K and those making above $200K. According to partisan affiliation, confidence improved slightly among both Republicans and Democrats but dropped substantially among Independents.

Key Takeaways, Courtesy of The Conference Board:

- Consumers’ outlook on stock prices improved slightly. The share of consumers expecting stock prices to increase over the next 12 months remains unchanged since August and July, at 48.9%. Meanwhile, 27.6% of consumers expected stock prices to decrease over the next 12 months, down from 30.2% in August.

- The share of consumers expecting interest rates to rise inched down to 51.9% compared to 52.1% a month prior. In addition, 25.6% consumers expected interest rates to decline, up from 23.6% in August.

- Consumers’ views of their Family’s Current and Future Financial Situation both weakened in September. Views of the current financial situation recorded the largest one-month drop since July 2022.

- The share of consumers thinking that a recession is very likely over the next 12 months rose slightly in September, its highest level since May. In addition, more consumers thought the economy was already in recession.

- Purchasing plans for cars weakened in September, with buying intentions for both used and new cars declining. Meanwhile, purchasing plans for homes jumped to a four-month high, but big-ticket buys were little changed overall. As it relates to the latter, data shows “a lot of variation” across different types of appliances: TVs and dryers saw the largest increase, while refrigerators posted the largest decline. Electronics purchase intentions were “mostly up,” with smartphones leading the uptick. Consumers’ intentions to purchase more services ahead deteriorated, especially travel-related. Vacation intentions fell again, hitting the lowest level since April; intentions to travel abroad drove the decline.

“Consumers’ write-in responses showed that references to prices and inflation rose in September, regaining its top position as the main topic influencing consumers’ views of the economy. References to tariffs declined this month, but remained elevated and continued to be associated with concerns about higher prices,” Guichard says.

Nonetheless, data shows consumers’ average 12-month inflation expectations inched down from 6.1% in August to 5.8% in September. This remains notably above 5%, the level at the end of 2024.

Consumer Income & Spending

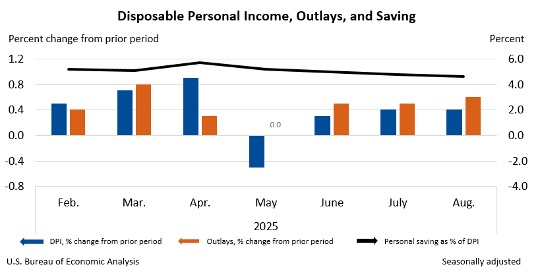

According to the U.S. Bureau of Economic Analysis (BEA), personal income increased $95.7 billion (0.4% at a monthly rate) in August. Disposable personal income (DPI)—personal income less personal current taxes—increased $86.1 billion (0.4%), and personal consumption expenditures (PCE) increased $129.2 billion (0.6%).

Personal outlays—the sum of PCE, personal interest payments and personal current transfer payments—increased $132.9 billion. Personal saving was $1.06 trillion and the personal saving rate—personal saving as a percentage of disposable personal income—registered 4.6%.

Important Takeaways, Courtesy of BEA:

- In August, the $129.2 billion increase in current-dollar PCE reflected increases of $77.2 billion in spending on services and $52 billion in spending on goods.

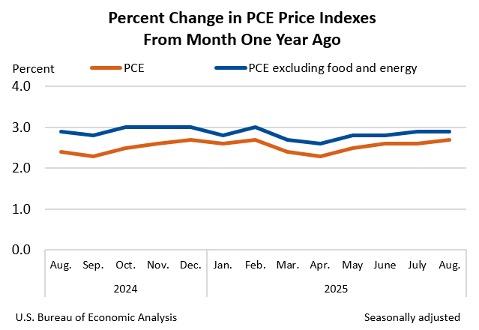

- Compared to the preceding month, the PCE price index increased 0.3%. Excluding food and energy, the PCE price index increased 0.2%.

- In August, the PCE price index increased 2.7% year-over-year. Excluding food and energy, the PCE price index increased 2.9% from one year ago.