KPI — October 2023: State of the Economy

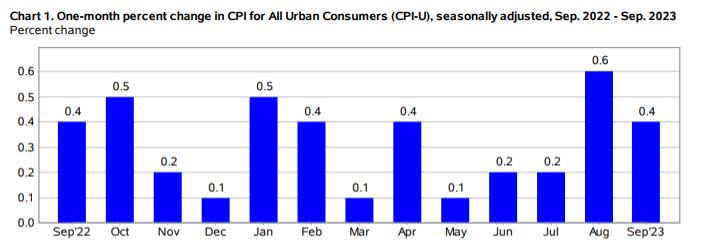

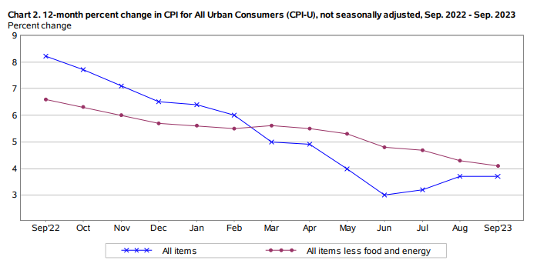

The Consumer Price Index for All Urban Consumers (CPI-U) increased another 0.4% in September on a seasonally adjusted basis after rising 0.6% in August, notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.7% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- The index for shelter was the largest contributor to the monthly all-items increase, accounting for more than half of the incline. A jump in the gasoline index also contributed to the all-items hike. While the major energy component indexes were mixed, energy rose 1.5% month-over-month. The food index increased 0.2%, as it did in the previous two months. The index for food at home increased 0.1%, while the index for food away from home rose 0.4%.

- In September, indexes on the rise include rent, owners’ equivalent rent, lodging away from home, motor vehicle insurance, recreation, personal care and new vehicles. The indexes for used cars and trucks and apparel were among those that decreased month-over-month.

- The all-items index increased 3.7% year-over-year, while the all items less food and energy index rose 4.1%. The energy index decreased 0.5%, but food jumped 3.7% year-over-year.

Employment

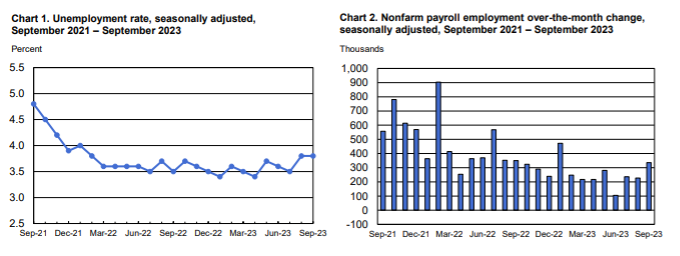

Total nonfarm payroll employment rose by 336,000 in September – outpacing Dow Jones estimates of 170,000.

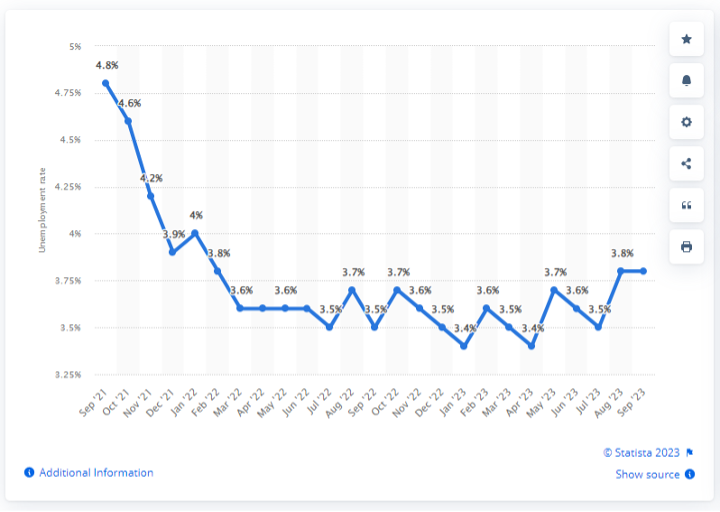

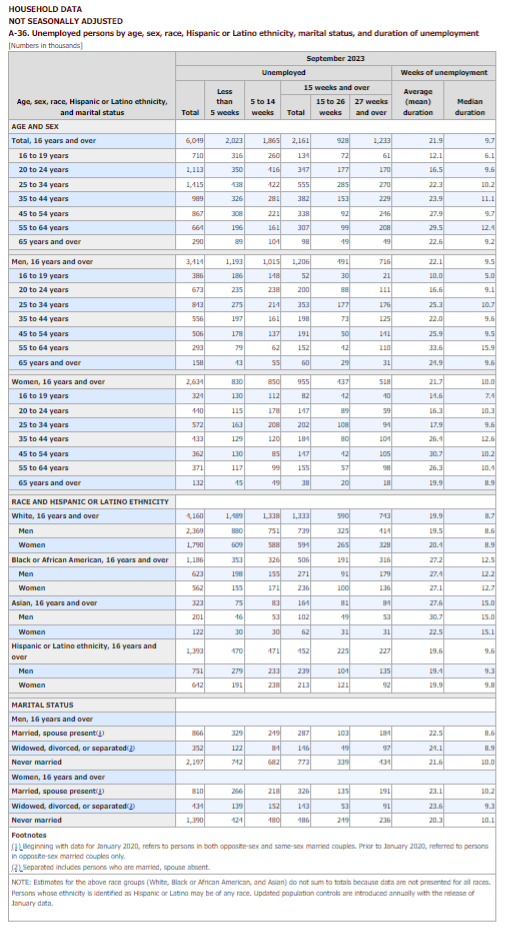

In addition, the unemployment rate and number of unemployed persons were relatively flat at 3.8% and 6.4 million, respectively, according to the U.S. Bureau of Labor Statistics. The labor force participation rate and the long-term unemployed (those jobless for 27 weeks or more) also were essentially unchanged at 62.8% and 19.1%, respectively. Data shows that wage increases were softer than expected, with average hourly earnings up 0.2% for the month and 4.2% year-over-year, compared to respective estimates for 0.3% and 4.3%.

“Slowdown? What slowdown? The U.S. labor market continues to exhibit amazing strength, with the number of new jobs created last month nearly twice as large as expected,” says George Mateyo, chief investment officer at Key Private Bank.

While the September jobs report outperformed expectations, CNBC reports that investors continue to be on edge – stating a resilient economy could force the Federal Reserve to keep interest rates high or perhaps even hike as inflation remains persistently elevated.

Traders in the fed funds futures market increased the odds of a rate increase before the end of the year to approximately 43%, according to the CME Group’s tracker.

“Clearly it’s moving up expectations that the Fed is not done,” says Liz Ann Sonders, chief investment strategist at Charles Schwab. “All else equal, it probably moves the start point for rate cuts, which has been a moving target, to later in 2024.”

The seasonally-adjusted national unemployment rate is measured on a monthly basis in the U.S. In September 2023, the national unemployment rate was at 3.8%. Seasonal adjustment is a statistical method of removing the seasonal component of a time series that is used when analyzing non-seasonal trends.

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.8%, teenagers – 11.6%, Asian – 2.8%, White – 3.4%, Hispanic – 4.6% and Black – 5.7%.

Last month, unemployment rates among the major worker groups: adult women – 3.2%, adult men – 3.7%, teenagers – 12.2%, Asian – 3.1%, White – 3.4%, Hispanic – 4.9% and Black – 5.3%.

By Industry

In September, job gains occurred in leisure and hospitality, government, health care, social assistance, as well as professional, scientific and technical services. For context, approximately 75,000 of the total nonfarm payroll increase is attributed to government employment, which is nearly 30% higher than the average monthly gain.

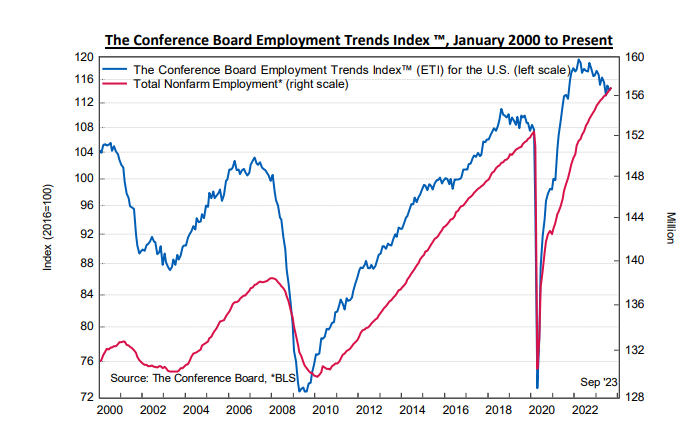

“The Employment Trends Index™ has been on a slow downward trend since it peaked in March 2022, but remains well above pre-pandemic levels. This suggests the U.S. economy will continue adding jobs through the remainder of 2023 and into next year, even if the rate of growth slows,” says Selcuk Eren, senior economist at The Conference Board.

He confirms the number of employees working in temporary help services – an important early indicator for hiring in other industries – has declined steadily in the past year. In addition, the number of consumers who noted jobs were “hard to get” in The Conference Board Consumer Confidence Survey® increased.

“Looking ahead, we expect the Fed’s rate hikes to gradually slow job growth, with job losses likely to start in Q2 2024. Our latest U.S. forecast sees the unemployment rate rising to 4.2% by the second half of 2024, corresponding to around 700,000 job losses. However, we expect the recession to be short-lived and jobs to quickly recover by the end of next year,” Eren says.

The Conference Board Employment Trends Index™ (ETI) increased in September to 114.66, from an upwardly revised 114.16 in August. The ETI is a leading composite index for employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Leisure and hospitality added 96,000 jobs in September, above the average monthly gain of 61,000 during the past 12 months. Employment in food services and drinking places jumped by 61,000 and returned to its pre-pandemic February 2020 level. Accommodation employment continued to trend up month-over-month (+16,000) but remains below its February 2020 level by 10.3%.

- Health care added 41,000 jobs, compared with the average monthly gain of 53,000 during the past 12 months. Employment continued to trend up in ambulatory health care services (+24,000), hospitals (+8,000) and nursing and residential care facilities (+8,000).

- Employment in transportation and warehousing changed little (+9,000). Truck transportation added 9,000 jobs, following a decline of 25,000 in August that largely reflected a business closure. Air transportation added 5,000 jobs. Employment in transportation and warehousing has shown little net change this year.

- Employment showed little change month-over-month in other major industries, including mining, quarrying and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; financial activities; and other services.

Click here to review more employment details.

KPI — October 2023: State of Manufacturing

Key Performance Indicators Report — October 2023