KPI — October 2023: State of Business

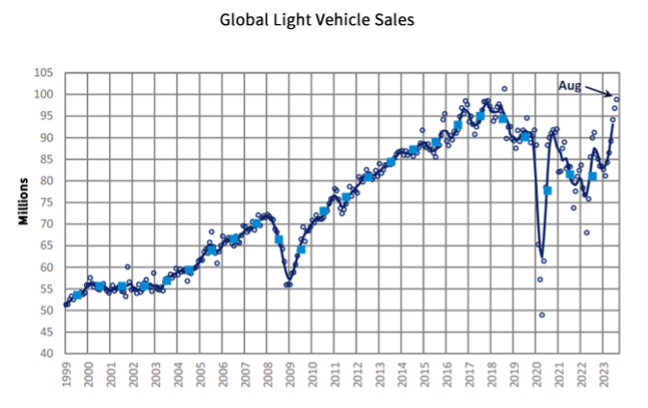

GlobalData reports the global light vehicle (LV) selling rate rose for the sixth consecutive month in August – reaching 99.7 million units, the highest monthly SAAR since August 2018. Global year-over-year growth increased 10.5% from relative strength in demand. Europe led growth, with volume up 23%, while North America posted a strong performance at 17%. Growth across Asia was stable, most notably in Japan (17%), South Korea (15%) and China (7%).

According to GlobalData, September is expected to have a selling rate of 90 million units, making it the fourth consecutive month above the 90-million threshold. Volume is forecasted to be up nearly 5% as growth moderates from a strong base last year.

“As we edge toward the end of 2023, the global automotive market has consistently outperformed expectations monthly – leading to another increase to the forecast from 86.8 million units to 87.9 million units, an increase of 8% from 2022,” says Jeff Schuster, group head and executive vice president of automotive at GlobalData.

“The wildcards to the finish of 2023 are the U.S. market, which may be influenced by the ongoing UAW strike, and China, with a price war that is attracting more consumers into the new-vehicle market but is negatively affecting OEM margins,” he continues.

The lift in 2023 forecast is projected to spill into 2024, with the outlook increased to 91.6 million units from 90.2 million.

U.S. New Vehicle Sales

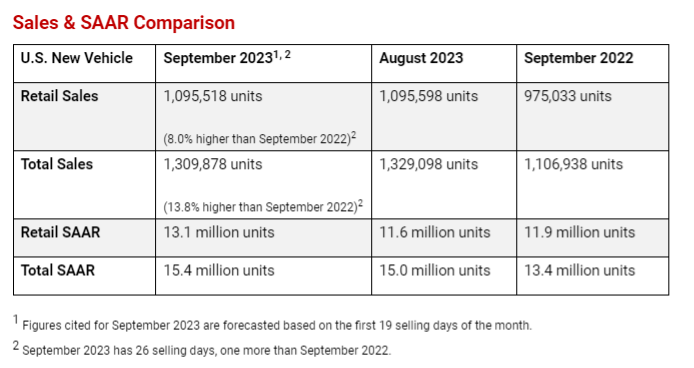

Total new-vehicle sales for September 2023, including retail and non-retail transactions, are projected to reach 1,309,900 units – a 13.8% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

“September finishes out the quarter relatively strong with double-digit, year-over-year sales growth for a sixth consecutive month. Year-to-date total sales through September will be slightly more than 11.6 million units – an increase of 14.5% from a year ago – but still below pre-pandemic levels when sales were north of 12.7 million units,” says Thomas King, president of the data and analytics division at J.D. Power. “The UAW work stoppage, which has affected only a limited number of models, had a negligible effect on September sales. However, depending on the duration and scope of the stoppage, there could be disruption to sales results in October and beyond.”

Fleet sales remain elevated, as manufacturers leverage higher vehicle production to allocate more vehicles to those customers. Fleet sales are projected to increase 56.3% year-over-year.

Important Takeaways, Courtesy of J.D. Power:

- Retail buyers are on pace to spend $46.8 billion on new vehicles, up $4.5 billion year-over-year.

- Truck/SUVs are projected to account for 79% of new vehicle retail sales in September.

- The average new vehicle retail transaction price is expected to reach $45,516.

- Average incentive spending per unit on trucks/SUVs is expected to be $1,921, up $889 from a year ago.

- Average interest rates for new-vehicle loans are estimated to increase to 7.3%, 162 basis points higher than a year ago.

- The total retailer profit per unit – which includes grosses, finance and insurance income – is expected to reach $3,300 in September. While this is 28.6% lower than a year ago, it is nearly triple the amount in September 2019.

- Fleet sales are expected to total 214,360 units in September, up 56.3% year-over-year on a selling day adjusted basis. Fleet volume is expected to account for 16.4% of total light-vehicle sales, up from 11.9% a year ago.

“In September, the main focus will be on any potential work stoppages that could hinder production. A disruption in production could create more asymmetry in the market and potentially extend the overall tight supply situation currently in place. This would give support to new-vehicle pricing, but also keep used-vehicle values high. Thereby trade-in values could remain elevated longer, continuing to help consumers offset higher interest rates and pricing,” King says.

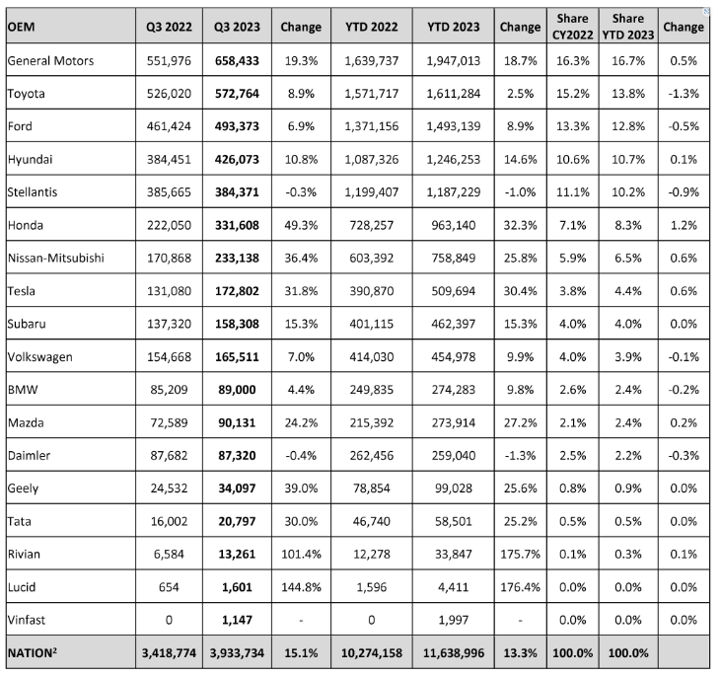

Review comprehensive Q3 2023 new vehicle sales data and analysis here, courtesy of Cox Automotive.

U.S. Used Market

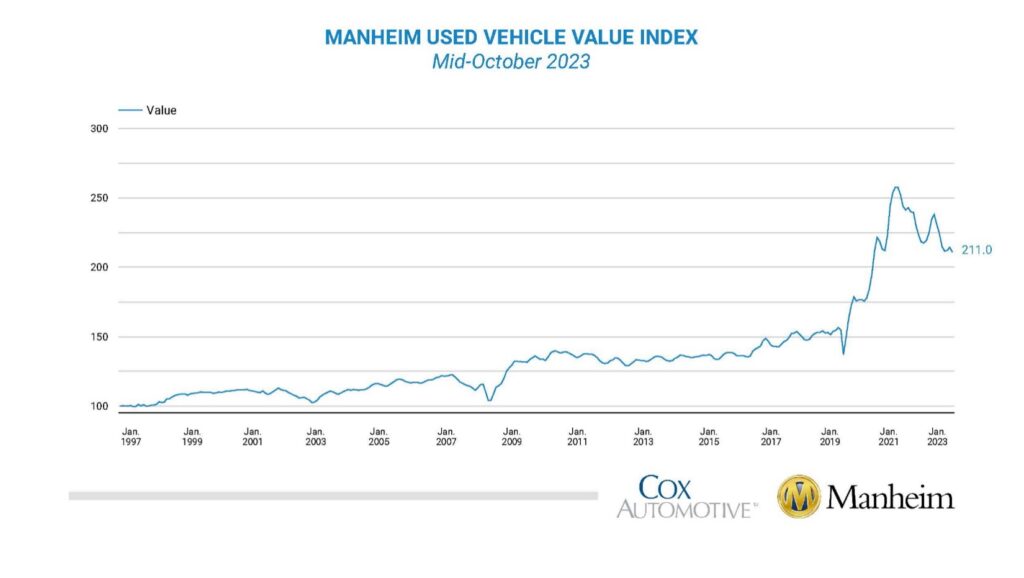

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) decreased 1.6% month-over-month during the first 15 days of October. The mid-month Manheim Used Vehicle Value Index declined to 211.0, down 3.3% from the full month of October 2022. The seasonal adjustment minimized the decrease. The non-adjusted price change in the first half of October dropped 2.2% compared to September, while the unadjusted price was down 5.5% year-over-year.

According to Manheim, nearly all major market segments saw seasonally adjusted prices that were lower year-over-year during the first half of October, while pickups gained 0.4%. SUVs dipped 2.9%, less than the industry’s year-over-year decline of 3.3%. Compact cars, luxury cars, midsize cars and vans all declined more than the industry, at 9.3%, 6.3%, 5.9% and 4.5%, respectively. The major segments posted negative price performance compared to September with varying results. Compact cars (1.4%) and pickups (1.1%) declined less than did the industry. Luxury remained flat, while vans, SUVs and midsize cars edged down 2.3%, 1.9% and 1.8%, respectively.

Overall, used-vehicle prices declined slightly from a year ago but remain close to all-time highs. J.D. Power says the current average trade-in equity is approximately $9,082, down $327 from a year ago. For context, trade-in equity this month is still double the pre-pandemic level, helping owners offset some of the pricing and interest rate increases.

“As demonstrated by consumer expenditures in September, demand remains robust and the industry continues to struggle with adequate supply, thereby reinforcing support for new-vehicle pricing and overall profitability,” King says. “At the same time, the relatively high values of used vehicles serve to keep trade-in values elevated, providing consumers with a means to mitigate the effects of higher interest rates and pricing.”

KPI — October 2023: Recent Vehicle Recalls

Key Performance Indicators Report — October 2023