KPI — October 2022: State of Business

LMC Automotive reports Global Light Vehicle (LV) sales improved to 94 million units per year in August, the strongest gains of the year thus far but still down 3.8% year-over-year. The increase in China and other parts of Asia stabilized the global market and offset expected losses in North America, Europe, Japan and Brazil in 2022, according to Jeff Schuster, president of Americas operations and global vehicle forecasts at LMC Automotive.

September 2022 data is expected to swell 15% year-over-year. For context, international markets incurred significant chip shortages and supply chain disruptions this time last year. As such, the overall selling rate is projected to peak around 84.3 million units.

“Given the constraints of a year ago, growth across the world is expected to be more synchronized, with main markets expected to increase in the 10-15% range. Asian markets are expected to outperform the rest of the world, with India’s volume projected to nearly double from the 2021 volume,” says Schuster. “As the likelihood of a global recession increases, the expected 5% growth to 85 million units is at risk.”

Read “Global Demand Braces for Impact”

The September Manufacturing PMI® registered 50.9, 1.9 percentage points lower than the 52.8% recorded in August, according to supply executives in the latest Manufacturing ISM® Report On Business®.

“The U.S. manufacturing sector continues to expand, but at the lowest rate since the pandemic recovery began,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “Following four straight months of panelists’ companies reporting softening new orders rates, the September index reading reflects companies adjusting to potential future lower demand.”

According to Business Survey Committee respondents’ comments, companies slowed hiring activity. In addition, month-over-month supplier delivery performance was the best since December 2019. Prices growth slowed notably (with the index at 60% or lower) for the third consecutive month. Plus, lead times continue to ease for capital equipment and production materials.

Markedly absent from panelists’ comments was any large-scale mentioning of layoffs which, Fiore notes, likely indicates companies are confident of near-term demand so primary goals are managing medium-term head counts and supply chain inventories.

Important takeaways, courtesy of the Manufacturing ISM® Report On Business®:

- Demand eased, with the (1) New Orders Index returning to contraction, (2) New Export Orders Index in contraction for a second consecutive month, (3) Customers’ Inventories Index remaining at a somewhat low level and (4) Backlog of Orders Index approaching contraction.

- Consumption (measured by the Production and Employment indexes) declined during the period, with a combined negative 5.3-percentage point impact on the Manufacturing PMI® calculation.

- The Employment Index returned to contraction after one month of expansion while the Production Index increased by 0.2 percentage point, staying in growth territory but at a modest level. *Many Business Survey Committee panelists’ companies are now managing head counts through hiring freezes and attrition to lower levels, with medium- and long-term demand more uncertain.

- Inputs – defined as supplier deliveries, inventories, prices and imports – accommodated growth. The Supplier Deliveries Index reached an appropriate tension level while the Inventories Index increased as panelists’ companies continued to manage the total supply chain inventory.

- The Prices Index decreased for a sixth straight month and sits not far from contraction territory.

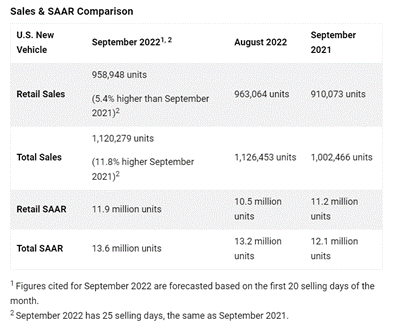

U.S. New Vehicle Sales

Total new vehicle sales for September 2022, including retail and non-retail transactions, are projected to reach 1,120,279 units – an 11.8% year-over-year increase. The seasonally adjusted annualized rate (SAAR) for total new vehicle sales is expected to hit 13.6 million units, up 1.5 million units compared to 2021, according to a joint forecast from J.D. Power and LMC Automotive.

“Traditionally, September is a high-volume sales month as manufacturers implement promotions for Labor Day to clear out old model-year vehicles and start sales of the new model-year products. This September, while holiday promotions were nearly nonexistent, modest improvements in vehicle production allowed manufacturers to tap pent-up consumer demand,” says Thomas King, president of the data and analytics division at J.D. Power.

“The result is a retail sales pace that shows a modest increase from a year ago but still falls below its potential due to tight vehicle availability,” he adds.

Important Takeaways, Courtesy of J.D. Power:

- Buyers are on pace to spend $43.7 billion on new vehicles, up $4.7 billion year-over-year.

- Truck/SUVs are on pace to account for 77.9% of new vehicle retail sales.

- The average new vehicle retail transaction price in September is expected to reach $45,622, a 6.3% year-over-year increase. The previous high for any month was $46,173, set in July 2022.

- Average incentive spending per unit in September is expected to reach $936, down from $1,792 in September 2021. Spending as a percentage of the average MSRP is expected to fall to 2%, down two percentage points from last year.

- Average interest rates for new vehicle loans are expected to increase to 5.71%, 169 basis points higher than a year ago. The average monthly finance payment is on pace to be $711, up $56 from last year.

- Total retailer profit per unit – inclusive of grosses and finance and insurance income – is on pace to be a flat $4,726. Total aggregate retailer profits from new vehicle sales is expected to be up 5.3% year-over-year, reaching $4.5 billion (the best September on record).

- Fleet sales are estimated to total 161,300 units, up 75% year-over-year on a selling day adjusted basis. Fleet volume is expected to account for 14% of total light-vehicle sales, up 5% from a year ago.

“In October, production constraints are expected to continue. These constraints may result in a somewhat lumpy fourth quarter as partially built vehicles in storage are completed and released in batches to the retail channel,” King says. “Higher interest rates will continue to put pressure on transaction prices and retailer profits. However, with 54% of vehicles still transacting above MSRP, there is still room for price compression without material damage to industry health.”

U.S. Used Market

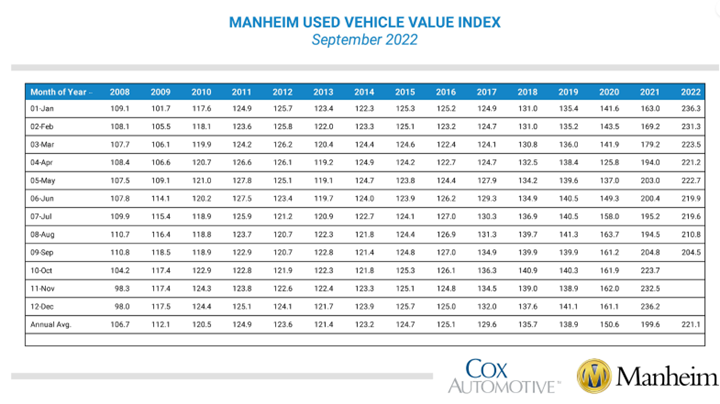

Wholesale used-vehicle prices (on a mix, mileage and seasonally adjusted basis) decreased 3% in September. The Manheim Used Vehicle Value Index declined to 204.5 and is now down 0.1% year-over-year.

In September, Manheim Market Report (MMR) values posted larger-than-normal declines which were consistent month-over-month – culminating in a 2.5% total decline in the Three-Year-Old Index over the last four weeks.

According to Manheim, only three of eight major market segments recorded seasonally adjusted prices which were higher year-over-year in September. Compact cars posted the largest increase at 5.9%, followed by vans and pickups, both of which increased 0.8%. The remaining five segments’ prices were well below the industry, with midsize cars only minimally lower. Compared to August, all eight major segments’ performances were down. Full-size cars dipped more than 14%. Pickups and compact cars declined the least, at 1.4% and 2.6%, respectively. The remaining five segments (vans, SUVs, midsize, luxury and sports cars) declined between 3.1% and 5.2%.

KPI — October 2022: Recent Vehicle Recalls

Key Performance Indicators Report — October 2022