- KPI – November 2025: The Brief

- KPI – November 2025: Recent Vehicle Recalls

- KPI – November 2025: State of Business – Automotive Industry

- KPI – November 2025: State of Manufacturing

- KPI – November 2025: Consumer Trends

Employment

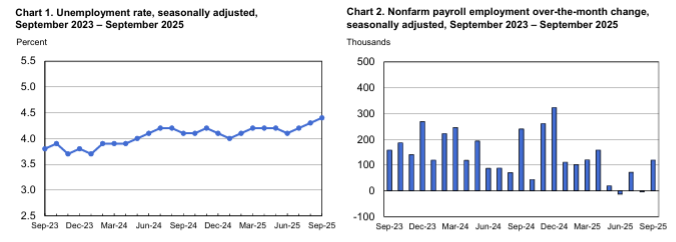

Total nonfarm payroll employment increased by 119,000 in September – above the Dow Jones estimate of 50,000. Employment continued to trend up in health care, food services and drinking places, as well as social assistance. Job losses occurred in federal government as well as transportation and warehousing.

According to the U.S. Bureau of Labor Statistics, the unemployment rate and number of unemployed persons edged up to 4.4% and 7.6 million, respectively. In addition, the labor force participation and long-term unemployed (those jobless for 27 weeks or more) rates registered 62.4% and 24.9%, respectively.

“September’s jobs report shows the labor market still had resilience before the shutdown by beating payroll expectations, but the picture remains muddy with August jobs revised to a job loss and the unemployment rate increasing,” says Daniel Zhao, chief economist at Glassdoor. “These numbers are a snapshot from two months ago and they don’t reflect where we stand now in November.”

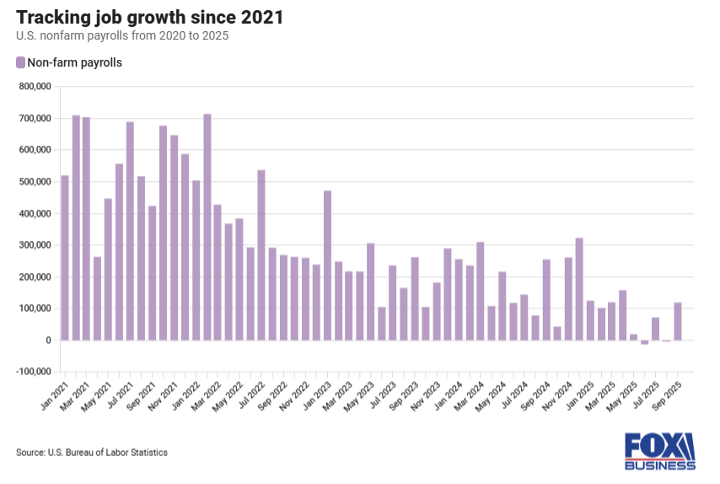

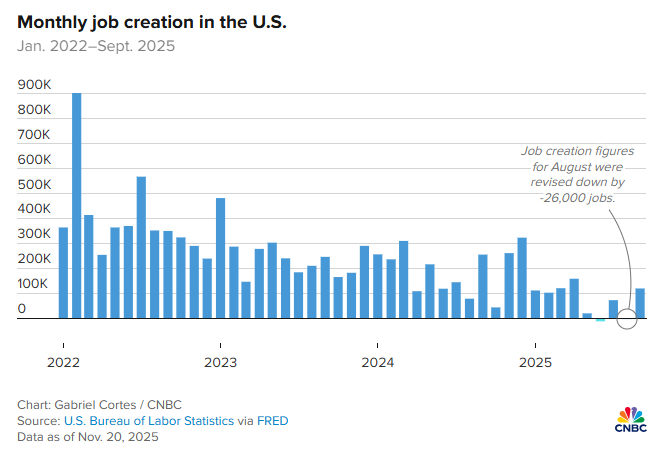

Caption: According to Fox Business reports, job gains during the prior two months were both revised in the September report. Job creation in July was revised down by 7,000, from a gain of 79,000 to 72,000. Likewise, job creation for August was revised down by 26,000, from a gain of 22,000 to a loss of 4,000.

Caption: According to Fox Business reports, job gains during the prior two months were both revised in the September report. Job creation in July was revised down by 7,000, from a gain of 79,000 to 72,000. Likewise, job creation for August was revised down by 26,000, from a gain of 22,000 to a loss of 4,000.

Average hourly earnings increased 0.2% for the month and 3.8% from a year ago compared to forecasts of 0.3% and 3.7%, respectively. Meanwhile, data shows stock market futures added to gains following the report, while Treasury yields were mostly lower.

“Despite the fact that today’s jobs report is very backward-looking, it’s making markets move,” says Seema Shah, chief global strategist at Principal Asset Management. “Equities like the fact that payrolls were stronger than expected, suggesting the economy is still on a firm footing, while the bond market likes the rise in unemployment and slowdown in wage growth, which may keep the case for a December Fed cut just about alive.”

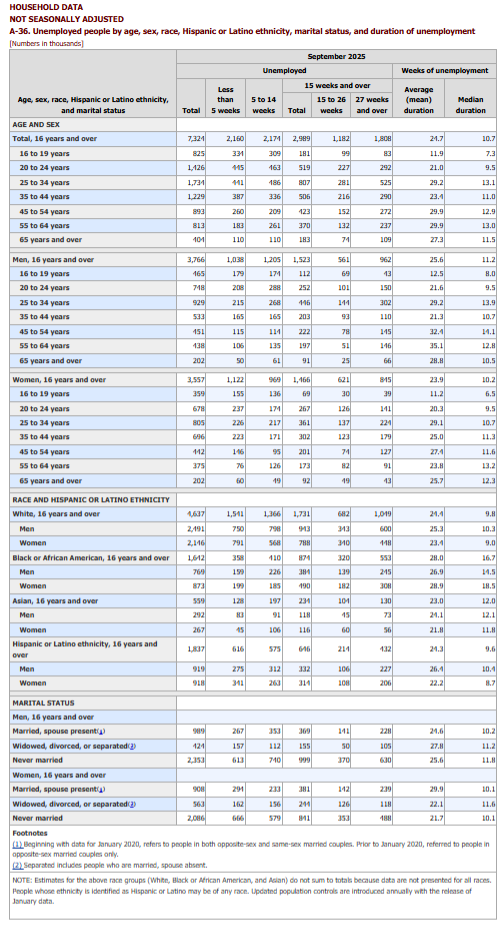

By Demographic

This month, unemployment rates among the major worker groups: adult women – 4.2%; adult men – 4%; teenagers – 13.2%; Asians – 4.4%; Whites – 3.8%; Hispanics – 5.5%; and Blacks – 7.5%.

Image Source: A-36. Unemployed persons by age, sex, race, Hispanic or Latino ethnicity, marital status, and duration of unemployment (bls.gov).

Image Source: A-36. Unemployed persons by age, sex, race, Hispanic or Latino ethnicity, marital status, and duration of unemployment (bls.gov).

By Industry

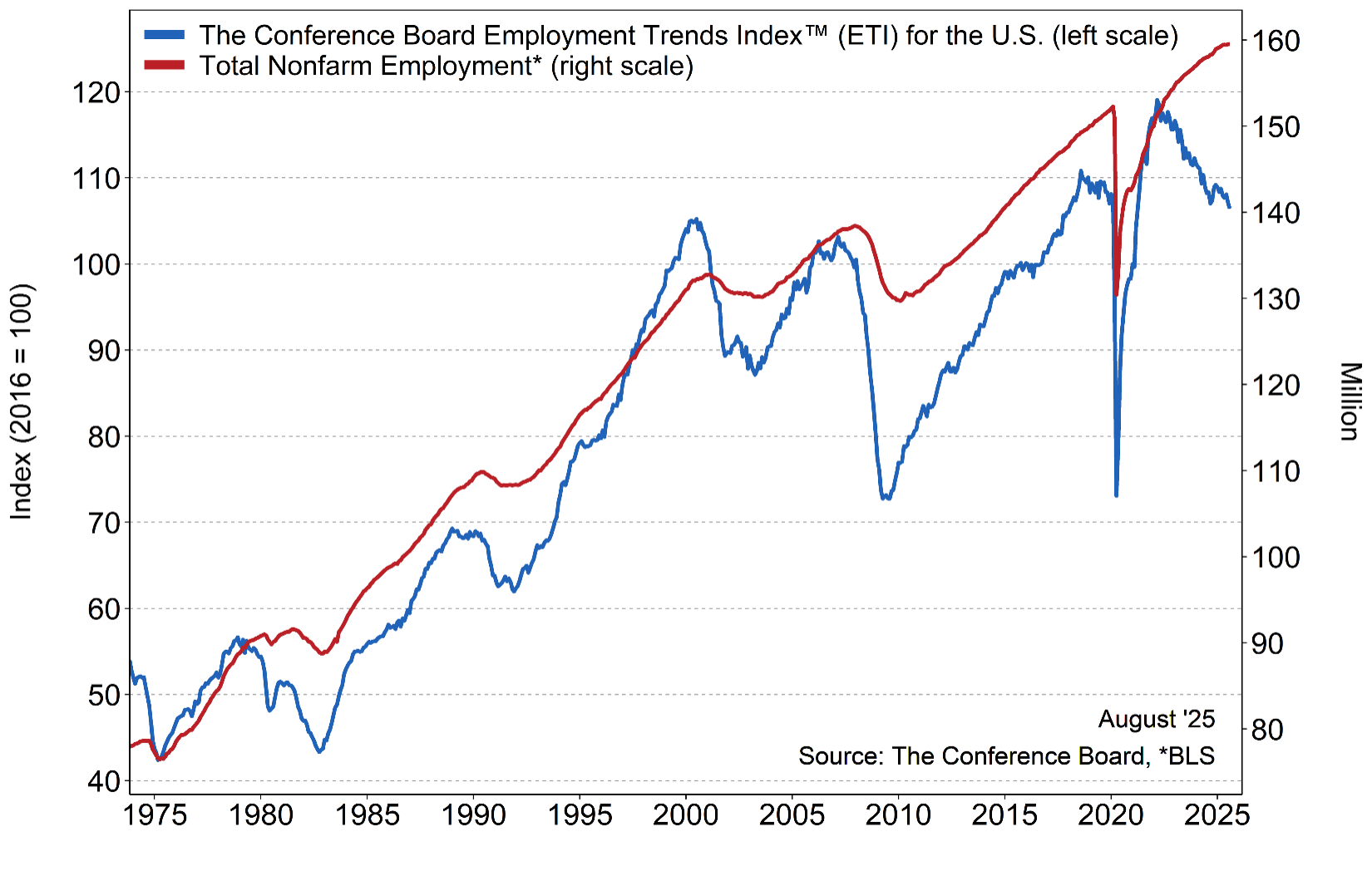

The Conference Board Employment Trends Index (ETI) declined from a revised 107.13 in July to 106.41 in August. According to industry experts, the decrease in the Employment Trends Index was a result of negative contributions from six of its eight components: the Percentage of Respondents Who Say They Find Jobs Hard to Get, the Percentage of Firms with Positions Not Able to Fill Right Now, the Number of Employees Hired by the Temporary-Help Industry, Initial Claims for Unemployment Insurance, Real Manufacturing and Trade Sales and Industrial Production. The two components that contributed positively were Job Openings and the Ratio of Involuntarily Part-time to All Part-time Workers.

“The ETI slid further in August, reaching its lowest level since early 2021,” says Mitchell Barnes, economist at The Conference Board. “The ETI peaked two or three years ago and has been falling ever since, where the decline likely captured normalization of the distorted post-pandemic labor market, not weakness. However, the degree of weakness among August’s components is disconcerting.”

Caption: The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months. Due to the U.S. federal government shutdown, all further data releases for The Conference Board Employment Trends Index™ (ETI) may be delayed. The Conference Board will resume publication once updated U.S. federal government data are released.

Caption: The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months. Due to the U.S. federal government shutdown, all further data releases for The Conference Board Employment Trends Index™ (ETI) may be delayed. The Conference Board will resume publication once updated U.S. federal government data are released.

For example, the share of consumers who report “jobs are hard to get” – an ETI component from the Consumer Confidence Survey – rose from 18.9% in July to 20% in August, the highest reading since early 2021. In addition, the share of small firms that report jobs are “not able to be filled right now” fell to 32% in August, down from 33% in July and 36% in June. JOLTS job openings fell by 176,000 in July after falling by 355,000 in June – more than offsetting increases in April and May. Employment in the temporary-help industry also declined by 9,800 in August.

According to Barnes, layoffs and unemployment remain low as companies navigate uncertainty, but tariff pressures are expected to intensify – raising inflation and reducing consumption, which could restrain activity and dampen future hiring.

Key Takeaways, Courtesy of ETI:

- Initial claims for unemployment insurance (an ETI component) ticked up slightly in August.

- The share of involuntary part-time workers was near 17%, below the high of 18% reached in February.

- Measures of industrial activity contributed the largest negative drag on the ETI since January: Industrial Production fell between June and July, while Real Manufacturing and Trade Sales growth slowed to 3.1% year-over-year in June, from a recent high of 4.6% in March. That slowdown corroborates negative manufacturing survey data, including from the Institute for Supply Chain Management, which reported seven consecutive months of manufacturing employment contraction through August.

“While the labor market remained resilient over much of this year, six of eight ETI components were negative in both July and August for the first time since November 2024. This potentially marks a turning point, where business activity is slowing more materially to reflect softer business confidence levels,” he says.

Click here to view more detailed information by industry.