KPI – November 2025: State of Business – Automotive Industry

Sponsored by Holley Performance Brands

- KPI – November 2025: The Brief

- KPI – November 2025: State of Manufacturing

- KPI – November 2025: Consumer Trends

- KPI – November 2025: State of the Economy

- KPI – November 2025: Recent Vehicle Recalls

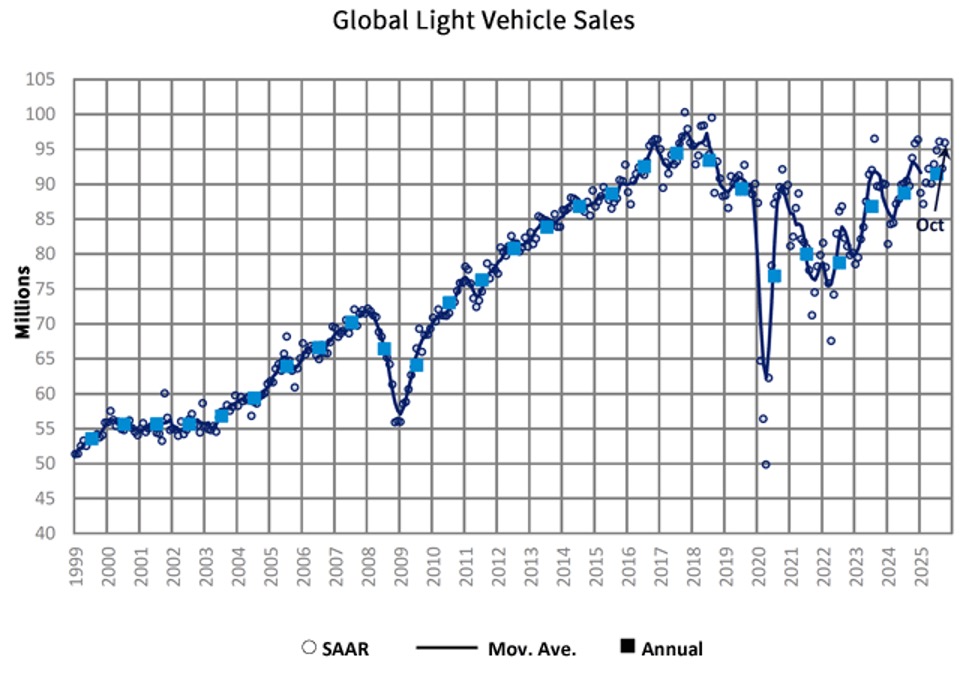

Global Light Vehicle Sales

In October, the Global Light Vehicle (LV) selling rate posted its second strongest month of the year at 96 million units per year. The market grew 3% year-over-year, as sales reached 8.2 million units globally. Approximately 75 million vehicles have been sold year-to-date—up 5% from the same period in 2024.

Key markets recorded mixed results. In the U.S., sales declined notably due to the expiration of EV tax credits. Meanwhile, sales in Western Europe continued to advance thanks to new incentives supporting electrification and minor improvements in consumer confidence. In China, sales posted “a record result” for the month, as consumers rushed to purchase vehicles before the NEV tax discount decreases next year.

“November sales are expected to decrease 3.9% year-over-year. In part, this is a reflection of a relatively strong month in November 2024. However, tariff effects and economic uncertainty are expected to play a part in subduing demand in Europe and North America, while China could see a slight slowdown as subsidies ease. The global selling rate is expected to reach 92.7 million units in November, down from a rate of 95.8 million units in November 2024,” explains David Oakley, manager of Americas vehicle sales forecasts at GlobalData.

Overall, he says global trade stabilized slightly over the past month, noting “some progress” in resolving the Nexperia chip crisis.

“Despite uncertainty remaining over the health of the global economy, we see total 2025 sales at 91.4 million units, up by around 200,000 from our forecast a month ago and representing growth of 3% year over year,” he continues.

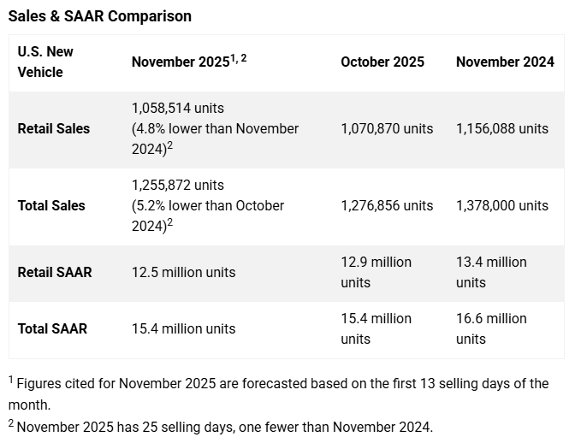

U.S. New Vehicle Market

Total new-vehicle sales for November 2025, including retail and non-retail transactions, are projected to reach 1,255,900—a 5.2% decrease year-over-year, according to a joint forecast from J.D. Power and GlobalData.

“November’s results reflect another notable—yet anticipated—decline in the new vehicle sales pace, driven largely by the pull-ahead of electric vehicle (EV) purchases prior to the expiration of federal EV tax credits on September 30th. That expiration prompted many shoppers to accelerate buying decisions, resulting in a surge in EV sales that temporarily inflated the overall industry sales pace,” says Thomas King, president of the data and analytics division at J.D. Power.

Two months later, King says the industry continues to feel the effect of accelerated purchases. EVs are expected to account for just 6% of new vehicle retail sales in November, which is consistent with the month prior but well below the 12.9% recorded in September.

As a result, “Automakers are recalibrating pricing strategies following the expiration of EV tax credits, tariff dynamics and evolving fuel economy requirements, along with the transition to the new model year,” he says, noting these factors create some distortions in typical seasonal discount patterns.

For example, discounts on EVs are expected to average $11,869 in November, up $260 year-over-year but down $928 compared to October 2025. Discounts on non-EVs are estimated at $2,960, an increase of $161 from a year ago.

Key Takeaways, Courtesy of J.D. Power:

- Retail buyers are on pace to spend $46.8 billion on new vehicles, down $3.2 billion year-over-year.

- Internal combustion engine (ICE) vehicles are expected to account for 77.5% of new vehicle retail sales, an increase of 2.3% from a year ago. Plug-in hybrid vehicles (PHEV), electric vehicles (EVs) and hybrid electric vehicles (HEV) are estimated at 1.1%, 6% and 14.5% of new vehicle retail sales, respectively.

- Trucks/SUVs are on pace to account for 82.6% of new vehicle retail sales, up one percentage point year-over-year.

- Leasing is expected to account for 20.5% of sales this month, down 2.7% from a year ago.

- The average new vehicle retail transaction price in November is estimated at $46,029, up $722 year-over-year.

- Average monthly finance payments are on pace to hit $760, up $19 from a year ago. The average interest rate for new-vehicle loans is 6.05%, down 0.27% year-over-year.

- Total retailer profit per unit—which includes vehicle gross plus finance and insurance income—is expected to be $2,161, up $6 year-over-year but down $54 compared to last month.

- Fleet sales should total 197,358 units in November, down 7.5% year-over-year. Fleet volume is expected to account for 15.7% of total light-vehicle sales, down 0.4% from a year ago.

Looking ahead, “The industry enters the holiday sales season facing a mix of affordability challenges, evolving incentive strategies and lingering effects from the EV pull-ahead earlier this year. While interest rates have eased and used-vehicle values remain strong—providing some support for trade-in equity—the number of leases set to expire in December is projected to be more than 15% lower than the same period a year ago and 50% lower than in 2023, thus limiting the typical year-end boost,” King says.

“Automakers are expected to maintain disciplined pricing and restrained incentives, particularly in non-EV segments, as they balance profitability with the need to stimulate demand. How aggressively manufacturers choose to adjust discounting and promotional activity during December will be critical in shaping the close of 2025,” he continues.

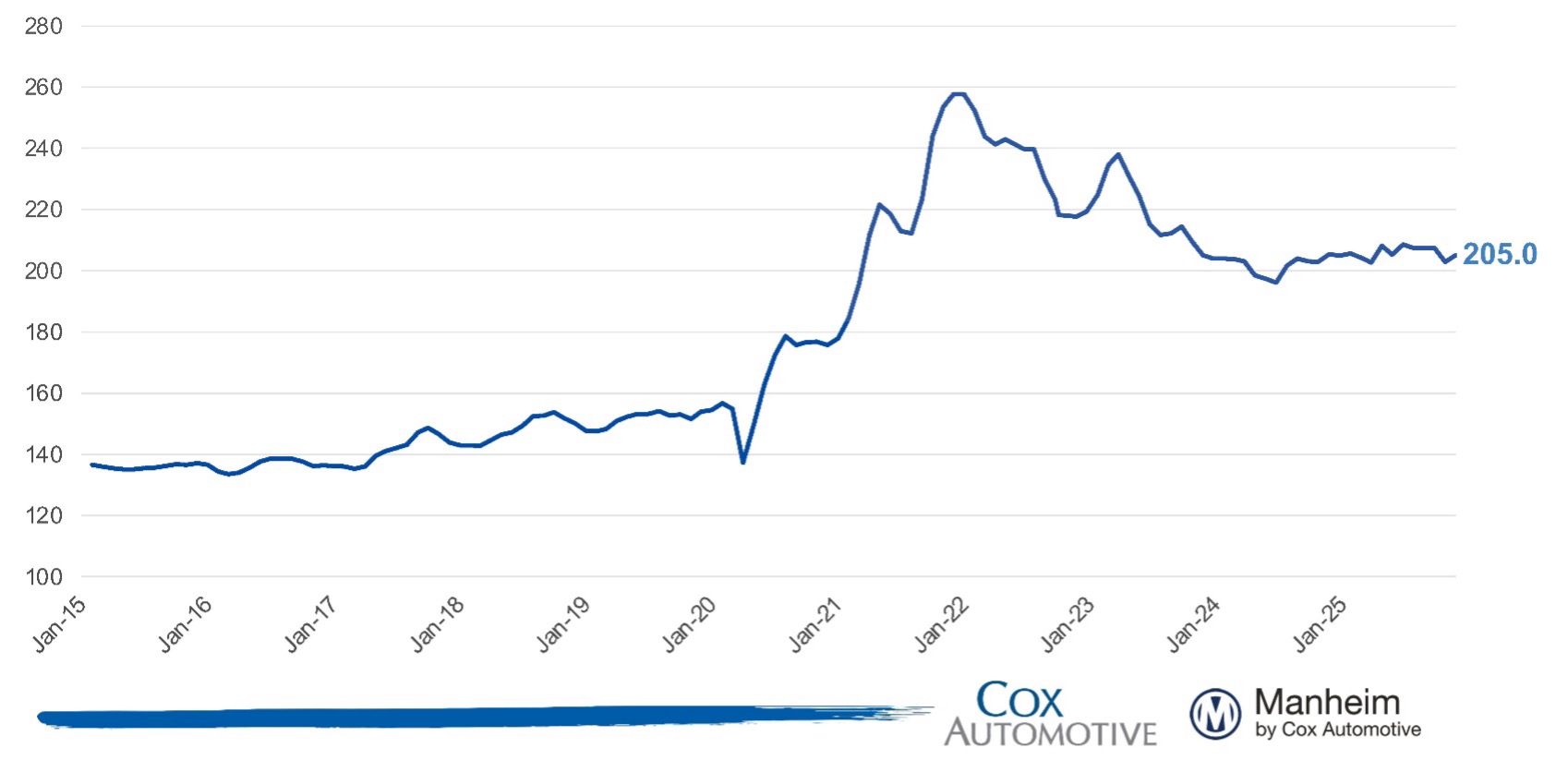

U.S. Used Market

The Manheim Used Vehicle Value Index (MUVVI) registered 205.0, reflecting a 1.1 % increase in wholesale used-vehicle prices (adjusted for mix, mileage and seasonality) during the first 15 days of November compared to October; however, the index posted a 0.2% decline year-over-year.

“Wholesale depreciation rates were elevated in October, burning off a bit of the higher valuation levels seen most of this year. In early November, we’ve observed more moderate trends, which was a glimmer of what we saw right at the last week of October. So far this month, our estimates for retail sales show a slightly higher pace of sales, a great piece of information given how little economic data is out there right now,” says Jeremy Robb, interim chief economist at Cox Automotive.

Additionally, new and used loan rates are down approximately 30 basis points from October levels, which helps consumers. Depreciation trends are known to level out in the last month of the year. With increased tax refunds expected in spring, Robb says the market is likely to see early demand from dealers.

Click here to view results by segment.