KPI — November 2022: State of the Economy

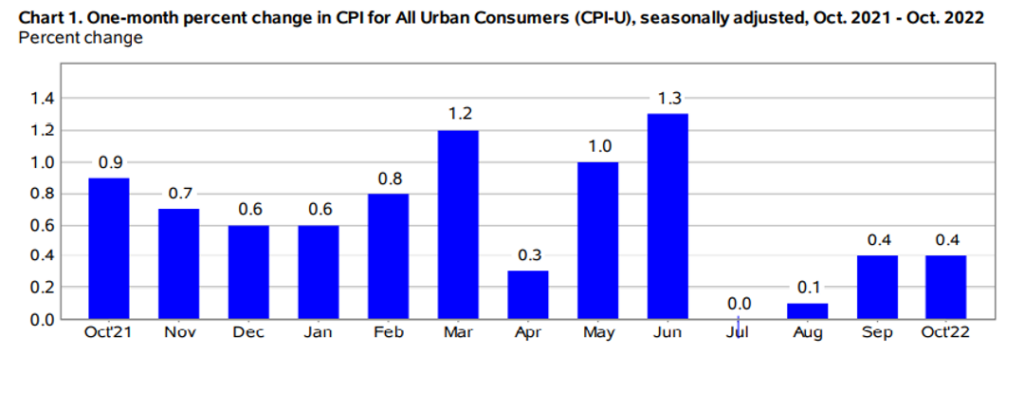

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in October on a seasonally-adjusted basis (the same increase as in September), notes the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 7.7% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- The indexes for shelter, motor vehicle insurance, recreation, new vehicles and personal care were among those to increase since last month. Declining indexes include used cars and trucks, medical care, apparel and airline fares indexes.

- The index for shelter contributed to over half of the monthly all-items increase, with the indexes for gasoline and food also on the rise. The energy index increased 1.8% month-over-month, as the gasoline index and the electricity index both rose. The food index increased another 0.6%, with the food-at-home index rising 0.4%.

- The all-items index increased 7.7% year-over-year – the smallest 12-month increase since the period ending January 2022. The all items less food and energy index rose 6.3% year-over-year, while the energy and food indexes increased 17.6% and 10.9%, respectively.

Employment

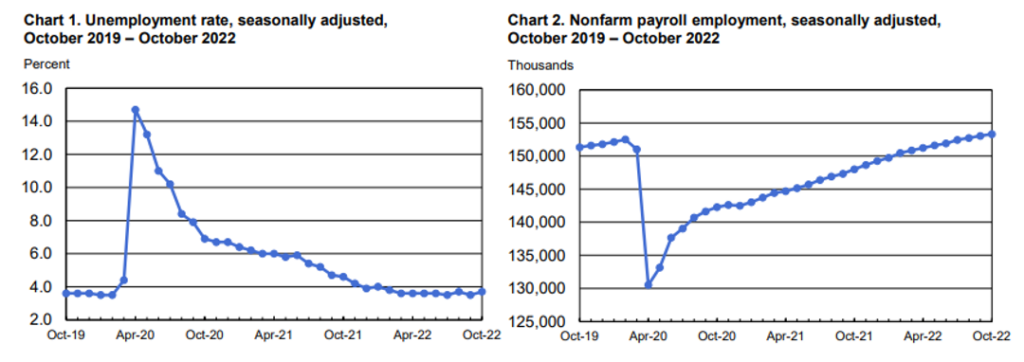

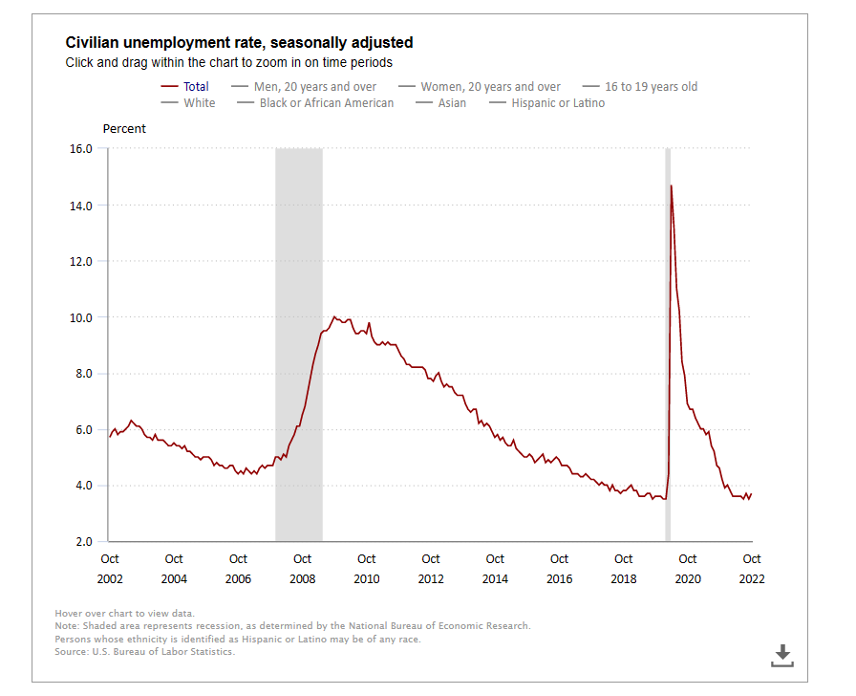

In September, the unemployment rate ticked up to 3.7% and the number of unemployed persons increased by 306,000 to 6.1 million, according to the U.S. Bureau of Labor Statistics. While the labor market currently remains strong, expert opinions about the overall economy range from a pending deep recession to a projected soft landing.

Stocks and Treasury yields improved following the nonfarm payrolls release. However, reports indicate a growing number of influential Wall Street executives and business titans are concerned about the challenging state of the U.S. economy.

“I think you have to expect that there’s more volatility on the horizon now,” Goldman Sachs CEO David Solomon told CNBC during a recent interview. While volatility does not automatically predict “a really difficult economic scenario” ahead, he says asset appreciation undoubtedly will be tougher in an environment where inflation is more embedded and growth is slower.

“Are we going to get rooted in that kind of a decade-long scenario? I don’t know,” he adds. “The policy decisions we make from here will have an impact.”

Amazon founder Jeff Bezos agrees with Solomon’s assessment, stating “the probabilities in this economy tell you batten down the hatches.”

JPMorgan Chase CEO Jamie Dimon concurs, emphasizing the U.S. is likely headed for a recession by mid-2023 as a result of steeper interest rates, runaway inflation, the war in Ukraine and the unknown effects of the Federal Reserve’s quantitative tightening policy.

The U.S. central bank headed down one of the fastest monetary tightening paths in decades in an effort to control consumer prices still running near a 40-year high. Thus far, the rate hikes have failed to tame suffocating inflation. With core prices rising, the Fed may continue “charting its aggressive course,” raising the odds that it will crush consumer demand and cause unemployment to rise, according to recent news reports.

Important Takeaways, Courtesy of the Bureau of Labor Statistics:

- The number of persons on temporary layoff was relatively unchanged at 847,000.

- Among the unemployed, the number of permanent job losers changed little at 1.2 million.

- The number of long-term unemployed (those jobless for 27 weeks or more) increased to 1.2 Million, accounting for 19.5% of all unemployed persons.

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.4%; adult men – 3.3%; teenagers – 11%; Asian – 2.9%; White – 3.2%; Hispanic – 4.2%; and Black – 5.9%.

Last month, unemployment rates among the major worker groups: adult women – 3.1%; adult men – 3.3%; teenagers – 11.4%; Asian – 2.5%; White – 3.1%; Hispanic – 3.8%; and Black – 5.8%.

*Unemployment rates increased across various categories, including adult women, Asian, White, Hispanic and Black.

By Industry

Total nonfarm payroll employment increased by 261,000 in October, compared to the Dow Jones estimate of 205,000. Notable job gains occurred in health care, manufacturing, as well as professional and technical services, but market experts warn of tough times ahead.

“Indeed, the labor market remains resilient with job gains still strong, but the Fed’s rapid monetary policy tightening is expected to have a more visibly-negative impact on the pace of hiring by early 2023,” says Frank Steemers, senior economist at The Conference Board. “Therefore, job growth will likely continue over the next months, albeit at a slowing pace. Until that happens, employers will have to deal with continued labor shortages. While there are signs these shortages have begun easing somewhat, hiring and retention difficulties are not over.”

Steemers points to a tight U.S. labor market, understaffing, limited recovery in labor force participation and an aging workforce as areas which suggest U.S. labor supply will remain a challenge for companies. As a result, he says employers may be more careful in laying off workers.

“Currently, we expect the U.S. economy to enter recession around year-end 2022, with the unemployment rate to rise to around 4.5% in 2023 – roughly one percentage point higher than today, but still quite low compared to past downturns.”

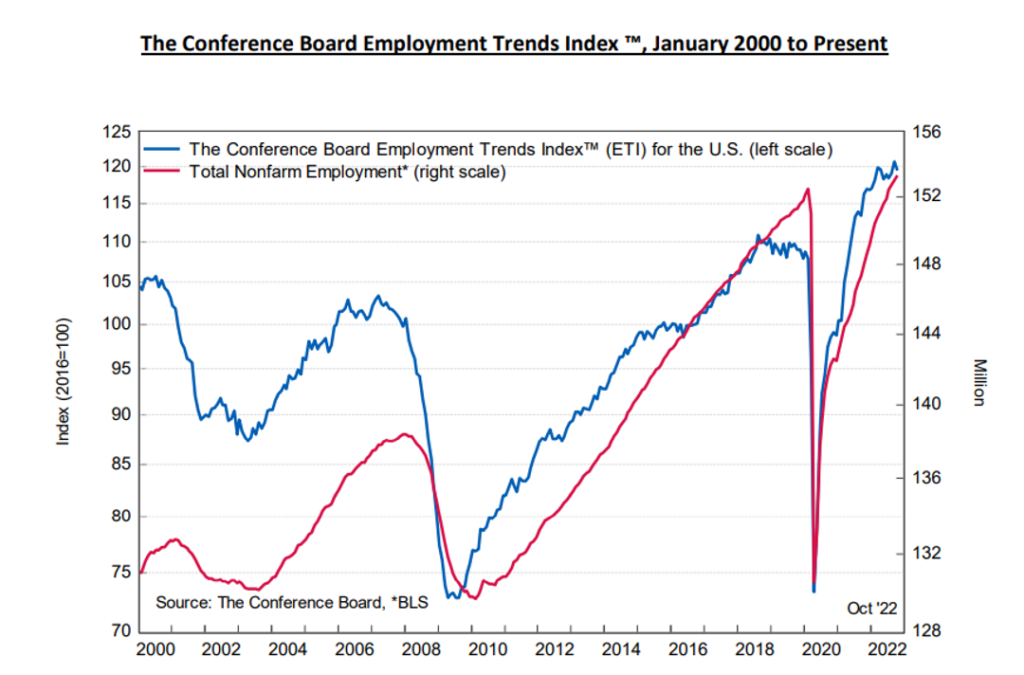

The Conference Board Employment Trends Index™ (ETI) declined in October to 119.57, down from an upwardly revised 120.73 in September 2022.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in health care rose by 53,000, with gains in ambulatory health care services (+31,000), nursing and residential care facilities (+11,000) and hospitals (+11,000). In 2022, health care employment increased by an average of 47,000 per month, compared with 9,000 per month in 2021.

- Professional and technical services added 43,000 jobs. Employment continued to trend up in management and technical consulting services (+7,000), architectural and engineering services (+7,000) and scientific research and development services (+5,000). Monthly job growth in professional and technical services averaged 41,000 thus far in 2022, compared with 53,000 per month in 2021.

- Manufacturing added 32,000 jobs, mostly in durable goods industries (+23,000). Employment increased by an average of 37,000 per month thus far this year, compared with 30,000 per month in 2021.

- Wholesale trade added 15,000 jobs. Employment in wholesale trade increased by an average of 17,000 per month thus far in 2022, compared with 13,000 per month in 2021.

Review all employment statistics here.

NFIB’s Small Business Optimism Index declined 0.8 points in October to 91.3, which is the 10th consecutive month below the 49-year average of 98. Approximately 46% of owners reported job openings that were hard to fill. Of those hiring or trying to hire, 90% of owners reported few or no qualified applicants for the positions they were trying to fill. Owners expecting better business conditions over the next six months deteriorated two points from September to a net negative 46%. The net percent of owners who expect real sales to be higher decreased three points from September to a net negative 13%.

KPI — November 2022: Consumer Trends

Key Performance Indicators Report — November 2022