KPI — May: The Brief

In recent months, global economies have fallen victim to an unprecedented public health crisis that has negatively impacted a variety of industries and supply chains. The U.S. alone reported a 20.5 million decrease in total nonfarm payroll employment during April, causing the unemployment rate to creep near 15%—the highest rate since the Great Depression.

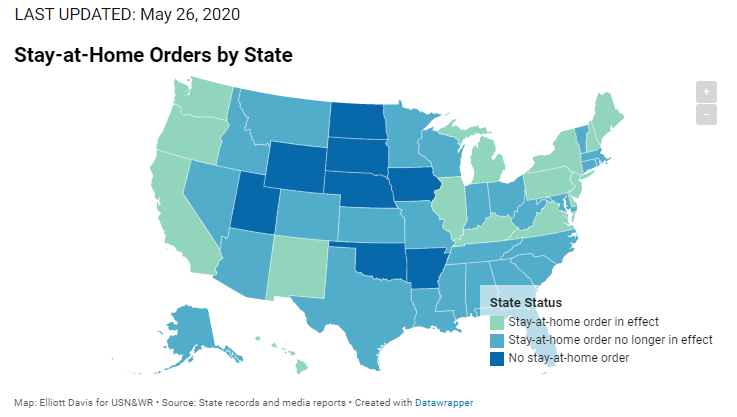

Americans remain skeptical but hopeful, as many governors begin to ease stay-at-home orders and implement safe, responsible protocols for reopening local economies crippled by the pandemic. Despite a jobless rate of more than 40 million Americans, The Conference Board Consumer Confidence Index® held steady in May, following a sharp decline in April.

“Following two months of rapid decline, the free-fall in Confidence stopped in May,” said Lynn Franco, senior director of economic indicators. “The severe and widespread impact of COVID-19 has been mostly reflected in the Present Situation Index, which has plummeted nearly 100 points since the onset of the pandemic. Short-term expectations moderately increased as the gradual re-opening of the economy helped improve consumers’ spirits. However, consumers remain concerned about their financial prospects. In addition, inflation expectations continue to climb, which could lead to a sense of diminished purchasing power and curtail spending. While the decline in confidence appears to have stopped for the moment, the uneven path to recovery and potential second wave are likely to keep a cloud of uncertainty hanging over consumers’ heads,” she continued.

Important takeaways, courtesy of the Conference Board:

• Consumers’ assessment of current conditions declined further in May. The percentage of consumers claiming business conditions are “good” decreased from 19.9% to 16.3%, while those claiming business conditions are “bad” increased from 45.3% to 52.1%. Consumers’ appraisal of the job market was mixed. The percentage of consumers saying jobs are “plentiful” decreased from 18.8% to 17.4%, however those claiming jobs are “hard to get” decreased from 34.5% to 27.8%.

• Consumers, however, were moderately more optimistic about the short-term outlook. Those expecting business conditions will improve over the next six months increased from 39.8% to 43.3%, while those expecting business conditions will worsen decreased, from 25.1% to 21.4%.

• Consumers’ outlook for the labor market was mixed. The proportion expecting more jobs in the months ahead declined from 41.2% to 39.3%; however, those anticipating fewer jobs in the months ahead also decreased, from 21.2% to 20.2%. Regarding their short-term income prospects, the percentage of consumers expecting an increase declined from 17.2% to 14%, but the proportion expecting a decrease declined from 18.4% to 15%.

While consumer confidence stabilized in May—a good sign indeed—it does not change the fact that tens of millions of Americans are feeling the burn right now.

In her recent article “4 Things to Know About Unemployment Benefits Under the CARES Act,” Gay Gilbert, administrator of the Office of Unemployment Insurance in the U.S. Department of Labor’s Employment and Training Administration, outlined important information about expanded unemployment insurance benefits under the Coronavirus Aid, Relief and Economic Security (CARES) Act. This legislation includes people who are not ordinarily eligible, such as self-employed, independent contractor and gig workers. Gilbert provided answers and supporting links to four frequently asked questions about how these benefits work.

All information below is credited to the author, Gay Gilbert, and the Office of Unemployment Insurance in the U.S. Department of Labor’s Employment and Training Administration.

How many weeks of regular unemployment insurance am I entitled to?

How many weeks you can receive benefits depends on state law. Find info on your state program here. It is important to file for benefits in the state where you last worked because doing so helps determine your eligibility for any additional federal benefits. However, before you can receive benefits, you must be found to be eligible based on the reasons you are unemployed. This analysis varies by state, so, again, it is important to file your claim in the state where you last worked.

Do I qualify for the additional $600 in federal benefits?

An additional $600 in Federal Pandemic Unemployment Compensation benefits are available to everyone receiving state unemployment benefits under the CARES Act. The funds are available for any weeks beginning after the date the state enters into an agreement through the week ending July 31. You don’t need to apply separately for these benefits – if you’re eligible, you will receive them through your state.

What happens after I exhaust my regular state benefits?

You may be eligible for additional benefits under the federal Pandemic Emergency Unemployment Compensation program, available through Dec. 31. Approval is based on your regular state claim: If you were eligible for benefits from your state, you are also eligible for this extension through the CARES Act. You need to apply for them.

Some states may be able to provide an additional 13 or 20 weeks of extended benefits, based on the unemployment rate in that state, that will kick in next. If you were eligible for regular unemployment benefits, you may also be eligible for your state’s extended benefits.

What if I don’t qualify for regular unemployment benefits, or if I have exhausted the federal benefits?

You may be eligible for federal Pandemic Unemployment Assistance (PUA) under the CARES Act available through Dec. 31. The amount you will receive is calculated by your state.

These benefits can last for a total of 39 weeks, which includes the number of weeks of regular benefits and extended benefits you’ve received from your state. For example: If you received 13 weeks of benefits from your state and the 13 additional weeks of federal Pandemic Emergency Unemployment Compensation, you may receive another 13 weeks under this program.

You may be covered if one of these reasons, among others, applies:

- You or someone in your home was diagnosed with COVID-19, or have symptoms and are waiting to be diagnosed

- You’re caring for a family member or someone in your home who has COVID-19

- You’re caring for a child whose school or childcare is closed because of COVID-19

- You’ve been quarantined by a government body or medical professional

- You’ve lost your job or cannot reach your job because of COVID-19

- You’ve become the main source of income for a household due to a death caused by COVID-19

- You’ve quit your job because of COVID-19

- Your workplace is closed because of COVID-19

- You were scheduled to start a new job but could not because of COVID-19

Self-employed workers, independent contractors, gig economy workers and those who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they meet one of the COVID-19 reasons above. States must first verify that these workers are not eligible for regular unemployment benefits.

Find more information about unemployment insurance generally here and more information about unemployment insurance relief during the COVID-19 outbreak here, including contact information for your state unemployment insurance office.

The monthly Key Performance Indicator Report is your comprehensive source for economic and industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.