- KPI – May 2025: The Brief

- KPI – May 2025: State of Manufacturing

- KPI – May 2025: State of Business – Automotive Industry

- KPI – May 2025: State of the Economy

- KPI – May 2025: Recent Vehicle Recalls

Below is a synopsis of consumer confidence, sentiment, demand and income/spending trends.

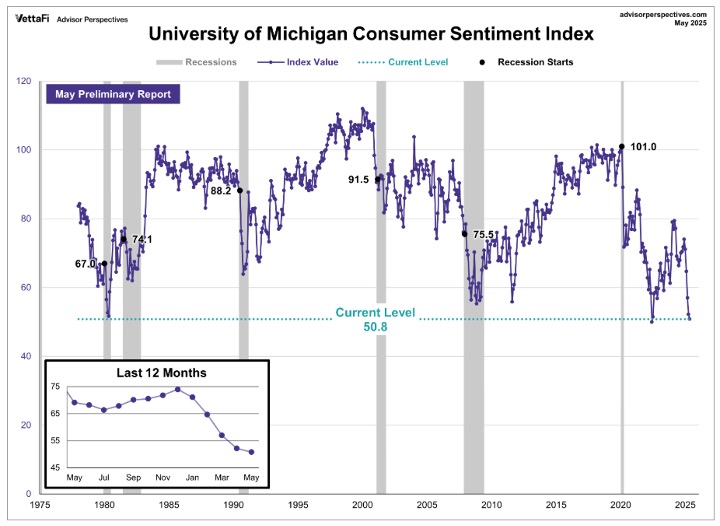

The University of Michigan Survey of Consumers—a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions—registered 52.2% in April and posted a preliminary reading of 50.8% in May.

A slight increase in sentiment was recorded among independent voters, but quickly offset by a 7% decline for Republicans. Overall, sentiment is down approximately 30% since January 2025.

While most index components were relatively unchanged, current assessments of personal finances sank nearly 10% due to weakening incomes. Tariffs were mentioned by nearly three-quarters of consumers, up from 60% a month prior.

Uncertainty regarding trade policy continues to dominate consumers’ thinking about the economy, according to the Survey of Consumers.

Data shows year-ahead inflation expectations jumped from 6.5% last month to 7.3% currently. Long-run inflation expectations rose from 4.4% in April to 4.6% in May, reflecting a particularly large monthly jump among Republicans. Looking ahead, the final figures for May will reveal if and how much a pause on Chinese tariffs impacted overall sentiment.

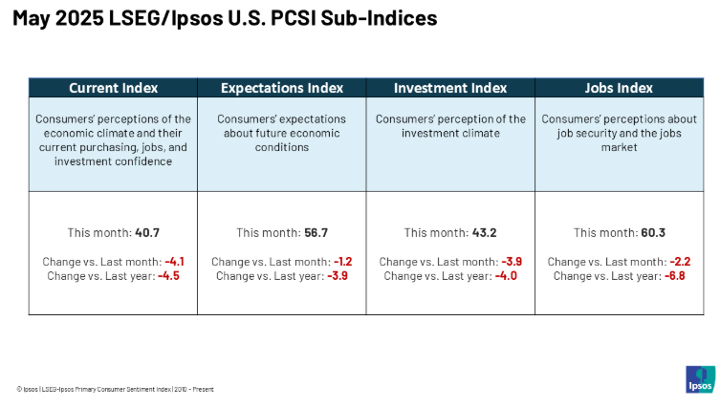

Caption: The LSEG/Ipsos Primary Consumer Sentiment Index for May 2025 is at 50.0. Fielded from April 25-May 2, 2025, the Index is down 2.9 points from last month, reflecting a similar decline as Survey of Consumers.

Unlike Survey of Consumers, the Conference Board Consumer Confidence Index took a turn in the right direction—increasing by 12.3 points to 98.0 (1985=100) in May. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—rose 4.8 points to 135.9. Meanwhile, the Expectations Index—based on consumers’ short-term outlook for income, business and labor market conditions—surged 17.4 points to 72.8.

“Consumer confidence improved in May after five consecutive months of decline. The rebound was already visible before the May 12 US-China trade deal but gained momentum afterwards,” says Stephanie Guichard, senior economist of global indicators at The Conference Board. “Consumers were less pessimistic about business conditions and job availability over the next six months and regained optimism about future income prospects. Consumers’ assessments of the present situation also improved.”

However, while consumers were more positive about current business conditions than last month, data shows their appraisal of current job availability weakened for the fifth consecutive month.

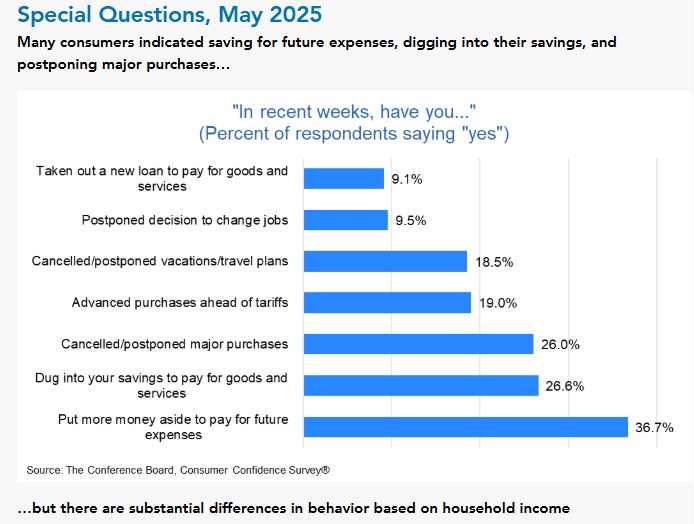

Key takeaways, courtesy of The Conference Board:

- Consumers’ outlook on stock prices improved, with 44% expecting stock prices to increase over the next 12 months (up from 37.6% in April) and 37.7% expecting stock prices to decline (down from 47.2% in April). This survey question showed major improvement after the recent trade deal.

- Compared to April, purchasing plans for homes, cars and vacation intentions increased notably, with some significant gains post trade deal. Plans to buy big-ticket items, including appliances and electronics, were up as well. Likewise, consumers plan to purchase more services in the months ahead. Dining out was a top contender, followed by streaming services. Plans to spend on movies, theater, live entertainment and sporting events increased the most month-over-month.

- Consumers’ views of their Family’s Current and Future Financial Situations improved. Likewise, the share of consumers expecting a recession over the next 12 months declined.

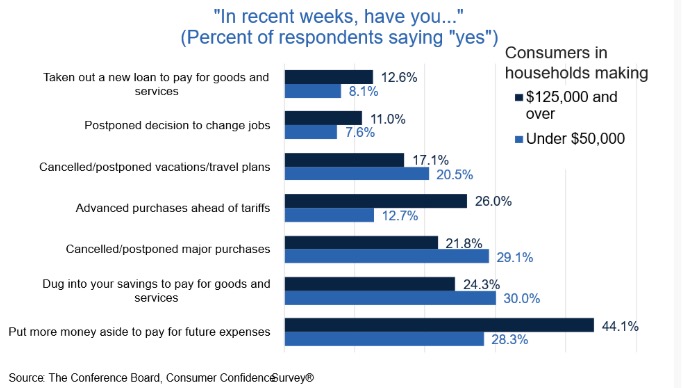

- Overall, consumers said they were more anxious about affordability than job security: Nearly half of consumers said they were concerned about not being able to buy the things they need or want, compared to less than a quarter worried about losing their jobs. See data charts below for more details.

Consumer Income & Spending

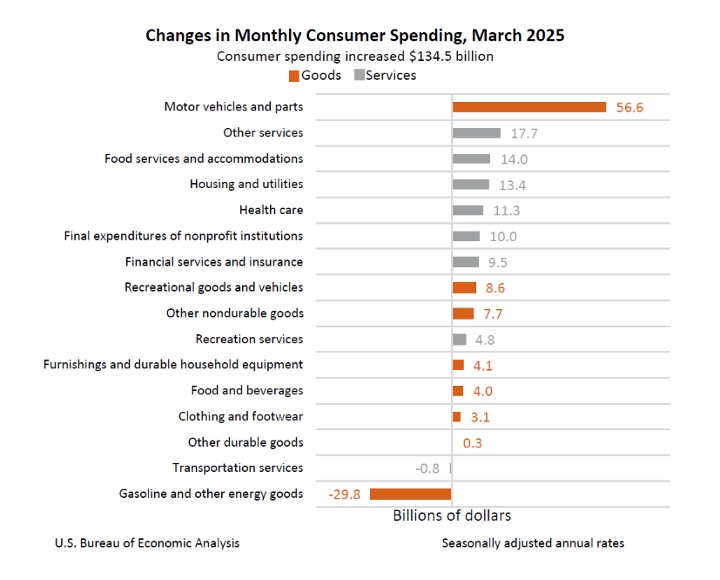

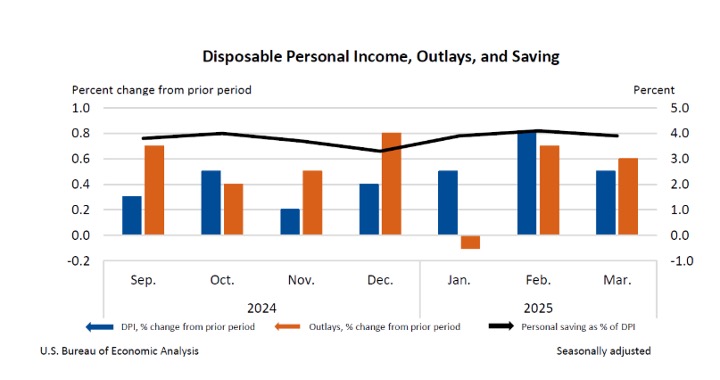

According to the U.S. Bureau of Economic Analysis (BEA), personal income increased $116.8 billion (0.5% at a monthly rate) during March 2025. Disposable personal income (DPI)—personal income less personal current taxes—increased $102.0 billion (0.5%), and personal consumption expenditures (PCE) increased $134.5 billion (0.7%).

Personal outlays—the sum of PCE, personal interest payments and personal current transfer payments—increased $136.6 billion. Personal saving was $872.3 billion, while the personal saving rate—personal saving as a percentage of disposable personal income—registered 3.9%.

Important takeaways, courtesy of BEA:

- In March, the $134.5 billion increase in current-dollar PCE reflected increases of $54.5 billion in spending for goods and $79.9 billion in spending for services.

- Compared to the preceding month, the PCE price index decreased less than 0.1%. Excluding food and energy, the PCE price index increased less than 0.1%.

- The PCE price index increased 2.3% year-over-year. Excluding food and energy, the PCE price index increased 2.6% from one year ago.