KPI – May 2024: Recent Vehicle Recalls

KPI – May 2024: State of Manufacturing

KPI – May 2024: State of Business – Automotive Industry

KPI – May 2024: State of the Economy

KPI – May 2024: Consumer Trends

Monthly consumer data shows a troubling trend in confidence and sentiment, as both indictors hit new lows. With stubborn inflation, high interest rates and the threat of tax hikes, businesses and consumers alike are pinching pennies and bracing themselves for greater impact.

The Conference Board Consumer Confidence Index® deteriorated for the third consecutive month, plummeting from a downwardly revised 103.1 in March to a dismal 97.0 (1985=100) in April – its lowest level since July 2022.

The Conference Board Consumer Confidence Index® deteriorated for the third consecutive month, plummeting from a downwardly revised 103.1 in March to a dismal 97.0 (1985=100) in April – its lowest level since July 2022.

Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at 77.2 in April, down from 79.4 in March. Of concern, May’s preliminary reading stands at 67.4, the lowest reading in approximately six months.

Consumers are expressing concern with a wide range of issues, from sticky inflation and high interest rates to decreased savings and less discretionary funds. They are not only stressed about economic uncertainty, volatile stocks and rumored tax rate hikes, but also political tensions, national security and global conflict. Experts predict consumer spending will cool further, and GDP growth will slow to under 1% over the Q2 to Q3 2024 period.

According to Fiserv, Inc. (NYSE: FI) – a leading global provider of payments and financial services technology – the latest Fiserv Small Business Index™ registered 145 in April, up four points from a month prior. Month-over-month sales increased by +2.2%, while year-over-year growth accelerated to +5.6%.

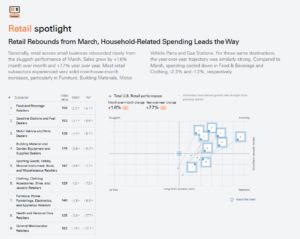

In April, data confirms consumers’ priorities shifted appreciably toward essential services and health care. Professional services experienced sales growth in the accounting/auditing, architectural/engineering/surveying and general business categories. Retail also performed well across small business, with an index value up two points month-over-month (148). On the contrary, areas that capture discretionary spending did not perform as well, such as restaurants, recreational activities, as well as some sectors within retail.

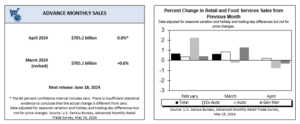

Caption: Advance estimates of U.S. retail and food services sales for April 2024 – adjusted for seasonal variation and holiday and trading-day differences but not for price changes – were $705.2 billion, virtually unchanged (±0.4%) from the previous month but up 3% (±0.5%) year-over-year. Total sales for the February 2024 through April 2024 period were up 3% (±0.5%) year-over-year. The February 2024 to March 2024 percent change was downwardly revised from +0.7% (±0.5%) to +0.6% (±0.1%).

Despite small business owners facing a slew of strong headwinds, including high prices and poor labor quality, the NFIB’s Small Business Optimism Index edged up by 1.2 points in April. At 89.7, this reading is the first increase of the year but marks the 28th consecutive month below the 50-year average of 98.

Twenty-two percent of small business owners pointed to inflation as the single most important challenge in operating their business. Overall, 56% reported hiring or trying to hire in April. Of those hiring or trying to hire, 91% of owners reported few or no qualified applicants for the positions they were trying to fill. Thirty-four percent have openings for skilled workers (up 3 points) and 18 percent have openings for unskilled labor (up 4 points). The difficulty in filling open positions is particularly acute in the transportation, construction, and wholesale sectors.

“Cost pressures remain the top issue for small business owners, including historically high levels of owners raising compensation to keep and attract employees,” says Bill Dunkelberg, NFIB chief economist. “Overall, small business owners remain historically very pessimistic as they continue to navigate these challenges. Owners are dealing with a rising level of uncertainty but will continue to do what they do best – serve their customers.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Top Takeaways:

- Economic activity in the manufacturing sector contracted in April after one month of expansion, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The Manufacturing PMI® registered 49.2%, down 1.1 percentage points from 50.3% in March.

- In April, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% on a seasonally-adjusted basis, after rising 0.4% in March, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.4% before seasonal adjustment.

- Total new-vehicle sales for April 2024, including retail and non-retail transactions, are projected to reach 1,304,600 units – a 0.9% year-over-year decrease on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

- RV wholesale shipments are expected to hit between 334,700-365,500 units in 2024, according to the Spring 2024 issue of RV RoadSigns – a quarterly forecast prepared by ITR Economics for the RV Industry Association. Most recently, RVIA reported 32,243 total RV shipments in March 2024, a 1.2% month-over-month increase.

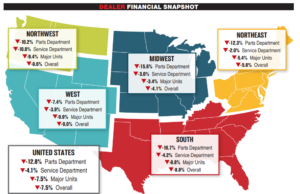

- Powersports Business says dealers across the country reported an overall combined revenue decline of 7.5% year-over-year in March, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 12.8% in parts, 7.5 in major units and 4.1% in service.