KPI — March 2022: State of Business — Automotive Industry

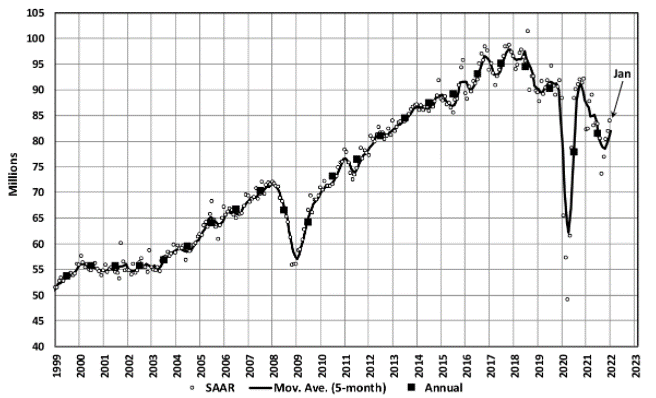

Global Light Vehicle (LV) sales crossed the finish line at 81.3 million units in 2021. Despite a 5% year-over-year increase, the global market remains down 10% compared to 2019.

The new year started on a positive note, with volume in China up 4.6%. Some markets across Europe also posted strong improvement, including Germany and the UK. While the selling rate improved to 84 million units per year at the start of 2022, February is expected to drop 1.8% year-over-year – pulling the forecast to 77.4 million units. The Russian invasion of Ukraine will negatively affect the close of the month and add another layer of substantial risk to the recovery in 2022, according to LMC Automotive.

“An already tight supply of vehicles and high prices across the globe will be under added pressure based on the severity and duration of the conflict in Ukraine. Rising oil and aluminum prices will likely affect consumers’ willingness and ability to purchase vehicles, even if inventory improves,” explains Jeff Schuster, president of Americas operations and global vehicle forecasts at LMC Automotive. “We have made significant downgrades to the Ukraine and Russia forecasts due to the escalating conflict between the two and the repercussions associated with sanctions against Russia. The decline in Europe has pulled the outlook for global light-vehicle sales down by 400,000 units to 85.8 million units. Volume still is expected to increase 5% from 2021, but short-term risk has been escalated beyond the pandemic,” he adds.

The February Manufacturing PMI® registered 58.6%, an increase of one percentage point from the January reading of 57.6%, according to supply executives in the latest Manufacturing ISM® Report On Business®.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment. The COVID-19 omicron variant remained an impact in February; however, there were signs of relief, with recovery expected in March. A higher-than-normal quits rate and early retirements continued,” says Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

Important takeaways, courtesy of the Manufacturing ISM® Report On Business®:

- Demand expanded, with the (1) New Orders Index increasing and remaining in strong growth territory, supported by stronger expansion of new export orders; (2) Customers’ Inventories Index remaining at a very low level; and (3) Backlog of Orders Index increasing to historically high levels.

- Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate, with a combined minus-0.9-percentage point change to the Manufacturing PMI® calculation.

- The Employment Index expanded for a sixth straight month. Panelists indicate their ability to hire continues to improve but to a lesser degree compared to January. Challenges with turnover (quits and retirements) and resulting backfilling continue to plague panelists’ efforts to adequately staff their organizations.

- Production expanded satisfactorily, despite staffing and supplier delivery headwinds.

- Inputs – expressed as supplier deliveries, inventories and imports – continued to constrain production expansion.

- The Supplier Deliveries Index again slowed at a slightly faster rate, while the Inventories and Imports indexes increased – both at slightly faster rates. In February, the Prices Index increased for the 21st consecutive month, at a slightly slower rate.

U.S. New Vehicle Sales

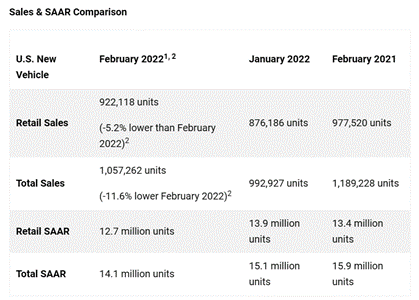

New vehicle retail sales are expected to decline year-over-year in February 2022, according to a joint forecast from J.D. Power and LMC Automotive.

Total new vehicle sales in February, including retail and non-retail transactions, are projected to reach 1,057,300 units – an 11.1% year-over-year decrease.

“With retail inventory on pace to finish a fourth consecutive month below 900,000 units and ninth consecutive month below one million units, the new-vehicle supply situation is not displaying signs of near-term improvement,” says Thomas King, president of the data and analytics division at J.D. Power. Therefore, sales in February are being determined by the number of vehicles delivered to dealerships rather than reflecting actual consumer demand.”

Important Takeaways, Courtesy of J.D. Power:

- Buyers are on track to spend $41 billion on new vehicles, up $4.3 billion from February 2021.

- Truck/SUVs are on pace to account for a record 78.8% of new vehicle retail sales in February.

- Average incentive spending per unit in February is expected to reach $1,246, down from $3,388 in February 2021.

- The average new vehicle retail transaction price in February is expected to reach $44,460. The previous high for any month, $45,283, was set in December 2021.

- Total retailer profit per unit – inclusive of grosses and finance and insurance income – should reach $5,023, an increase of $2,837 from a year ago and the fifth consecutive month above $5,000. The gains in per-unit profit are offsetting the drop in sales volume as the total aggregate retailer profit from new vehicle sales is projected to be up 117% from February 2021, reaching $4.6 billion.

- Fleet sales are expected to total 135,100 units in February, down 36.2% from February 2021 on a selling day adjusted basis. Fleet volume is expected to account for 13% of total light-vehicle sales, down from 18% a year ago.

“What we’re seeing in February – sales being constrained by available inventory – is expected to continue in March. The underlying question is which manufacturers will have the ability to produce enough vehicles to increase inventory levels. Ongoing supply chain disruptions, along with near-term announcements of production outages by several manufacturers, mean that the aggregate inventory situation is unlikely to change in March. For some manufacturers, the situation may deteriorate. This likely means that prices and per-unit profitability for retailers and manufacturers will likely remain healthy,” explains King.

Review more detailed February results, including an automaker breakdown, here.

U.S. Used Market

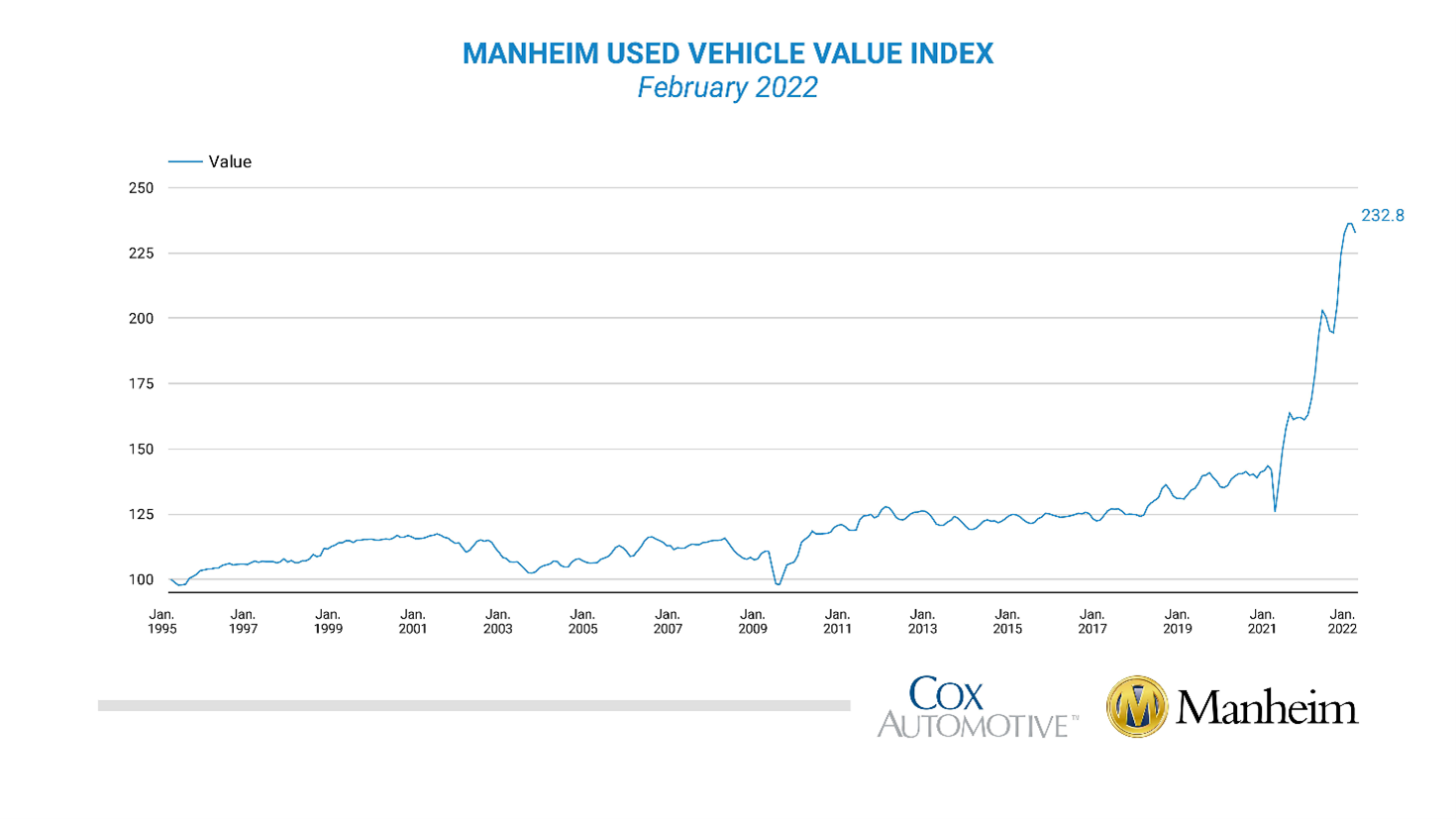

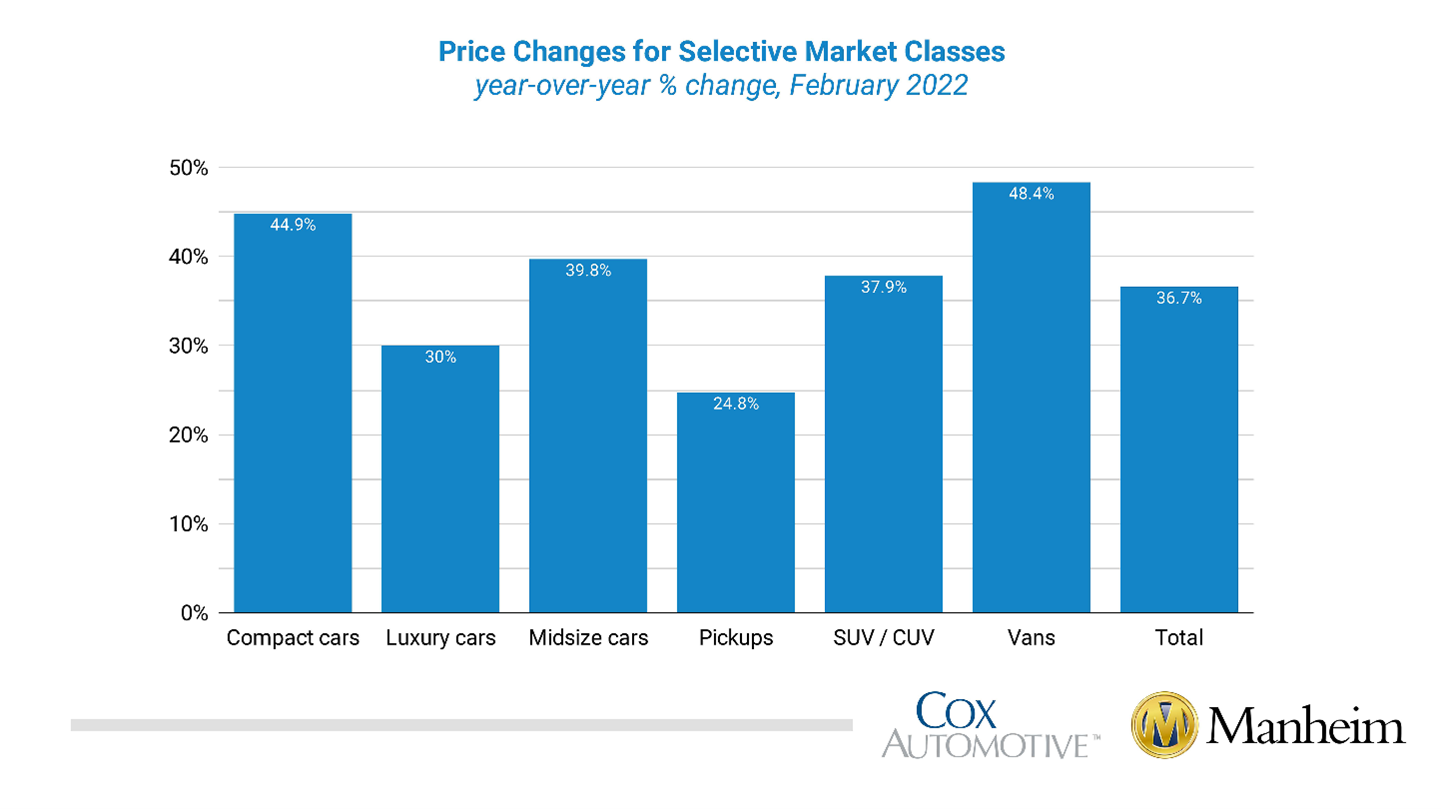

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) declined 2.1% month-over-month. The Manheim Used Vehicle Value Index declined to 231.3 – still a 36.7% year-over-year increase.

“Record new-vehicle prices are being supported by exceptionally strong used-vehicle prices, as new-vehicle buyers benefit from more equity on their trade-in vehicles. The average trade-in equity for February is trending towards $9,663, a 93% increase of $4,657 from a year ago,” adds King.

All major market segments saw seasonally adjusted prices that were higher year-over-year in February, according to Manheim. Vans posted the largest annual performance, followed by compact cars. Pickups, luxury cars and sports cars lagged the overall market. All major segments showed price declines month-over-month.

According to Manheim, total new light-vehicle sales were down 12% year-over-year, with the same number of selling days compared to February 2021. By volume, February new-vehicle sales were up 6% over January. The February SAAR came in at 14.1 million, an 11% decline from last year’s 15.9 million and down 6% from January’s 15 million pace.

KPI — March 2022: Recent Vehicle Recalls

Key Performance Indicators Report — March 2022