KPI – June 2025: State of Business – Automotive Industry

Sponsored by Holley Performance Brands

- KPI – June 2025: The Brief

- KPI – June 2025: State of Manufacturing

- KPI – June 2025: State of the Economy

- KPI – June 2025: Consumer Trends

- KPI – June 2025: Recent Vehicle Recalls

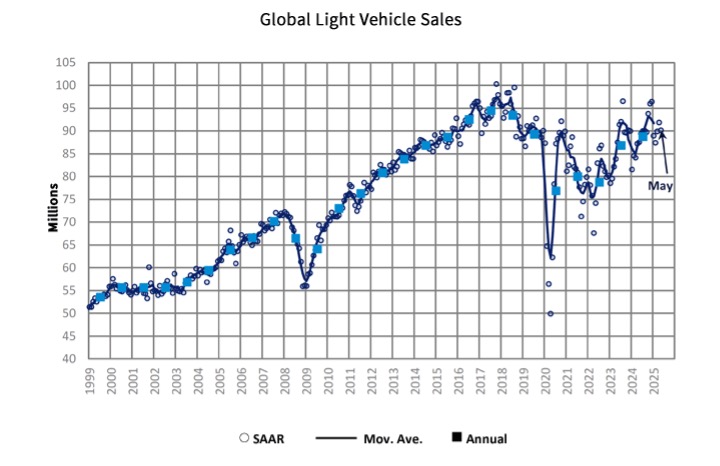

Global Light Vehicle Sales

In May, the Global Light Vehicle (LV) selling rate registered 90 million units per year, a decline compared to last month. The market grew 5% year-over-year, as sales reached 7.6 million units globally.

Like April, China posted positive light vehicle sales, while Western Europe declined “due to prevailing economic headwinds,” according to GlobalData. U.S. sales were up but showing signs of a slowdown, as the industry pulls back on incentives. Sales in Japan and Korea remain robust, while Argentina experienced another month of rapid year-over-year growth (+50%).

“With trade negotiations ongoing between the U.S. and various countries, there remains a great deal of uncertainty over what the result will be—and how quickly we will start to see deals being made. In the meantime, several regions are likely to see sales slow amid rising prices. Our 2025 global sales forecast stands at 89.7 million units, up 1.1% on 2024 volumes,” says David Oakley, manager of Americas vehicle sales forecasts at GlobalData.

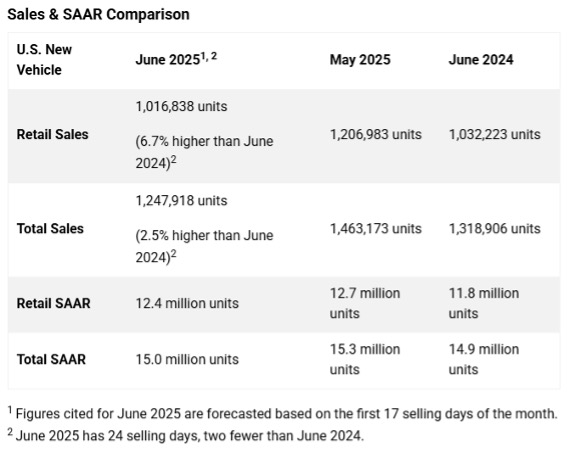

U.S. New Vehicle Market

Total new-vehicle sales for June 2025, including retail and non-retail transactions, are projected to reach 1,247,900—a 2.5% year-over-year increase, according to a joint forecast from J.D. Power and GlobalData.

“June sales are subdued, with the sales pace falling to its lowest level in the past 12 months. However, care needs to be taken when interpreting the results, as they are not fully indicative of the underlying demand for new vehicles,” according to Thomas King, president of the data and analytics division at J.D. Power.

He says there are three critical factors to keep in mind when evaluating the monthly results. First, year-over-year comparisons are impacted by last year’s dealer software outage, which limited many dealers’ ability to sell vehicles and reduced retail sales by approximately 85,000 vehicles. As such, year-over-year sales results appear considerably greater than they actually are.

“The second factor is payback from the tariff-related rush to showrooms in March and April of this year. In those months, approximately 173,000 extra vehicles were sold as buyers pulled purchases forward in anticipation of future tariff-driven price hikes. That pull-ahead effect has now become a payback effect, deflating June sales below the actual level of vehicle demand,” King says.

By and large, pre-tariff expectations were increased discounts during 2025, but they have fallen. Specifically, incentive spending expressed as a percentage of MSRP declined from 6.1% in January 2025 to 5% in June.

“This reflects the cost-pressure tariffs are creating for manufacturers, but it is also causing some shoppers looking for affordable vehicles to remain on the sidelines,” King explains.

Also noteworthy, he says there has not been a material increase in new vehicle MSRPs due to tariffs. While exceptions exist, MSRPs are generally stable. Changes in the average transaction price of new vehicles are driven by the combination of manufacturer discounts, retailer profitability and the mix of new vehicles being sold.

“Overall, vehicle prices are expected to rise, but significantly less than the tariffs would suggest—and some models may see no increase at all. Initial price changes are expected through July and August, particularly when new model-year vehicles are launched. It will likely be at year’s end before manufacturers’ new pricing and incentive strategies fully materialize,” King says.

Key Takeaways, Courtesy of J.D. Power:

- Retail buyers are on pace to spend $45 billion on new vehicles, up $1.9 billion year-over-year.

- Internal combustion engine (ICE) vehicles are projected to account for 75.8% of new vehicle retail sales, a decrease of 1.4 percentage points from a year ago. Plug-in hybrid vehicles (PHEV) are on pace to make up 1.8% of sales, down 0.3 percentage points year-over-year, while electric vehicles (EV) are expected to account for 8.7% of sales, down 1.6 percentage points.

- Trucks/SUVs are expected to account for 81.8% of new vehicle retail sales, up 1.7 percentage points year-over-year.

- Leasing is expected to account for 20.4% of sales this month, down 2.2 percentage points from a year ago.

- Fleet sales are estimated to total 231,081 units in June, down 12.7% year-over-year. Fleet volume is expected to account for 18.5% of total light-vehicle sales, down 3.2 percentage points from a year ago.

- The average new vehicle retail transaction price is expected to reach $46,233, up $1,400 year-over-year.

- Average incentive spending per unit is expected to hit $2,727, up $39 year-over-year. Spending as a percentage of the average MSRP is expected to decrease to 5.4%, down 0.1 percentage points year-over-year.

- Average monthly finance payments are on pace to be $748, up $22 from last year. The average interest rate for new-vehicle loans is expected to be 6.89%, down 0.08 percentage points year-over-year.

- Total retailer profit per unit, which includes vehicle gross plus finance and insurance income, is expected to be $2,380, up $45 year-over-year but down $32 month-over-month.

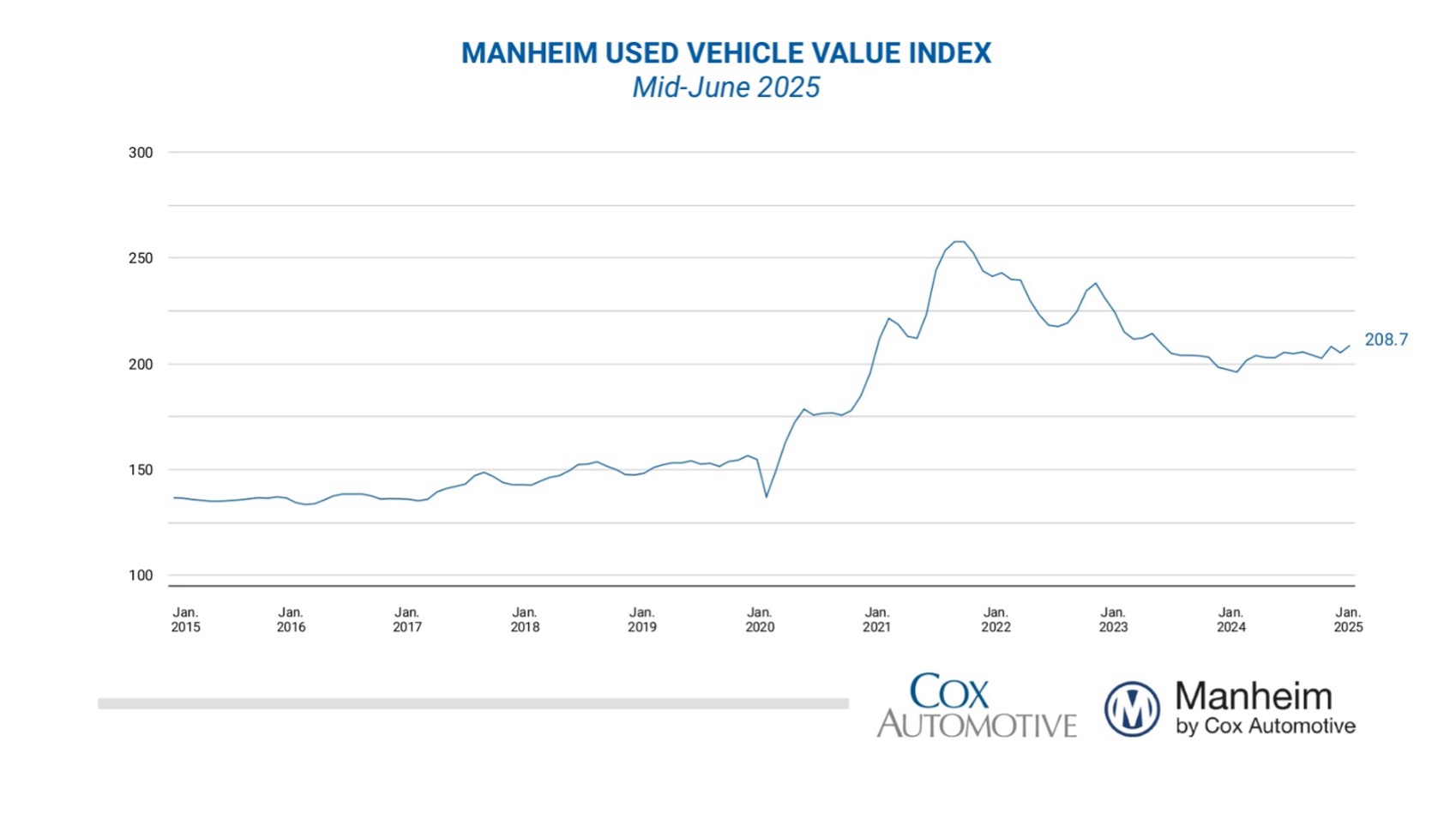

U.S. Used Market

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally-adjusted basis) increased in the first 15 days of June. The mid-month Manheim Used Vehicle Value Index rose 1.7% to 208.7, posting an increase of 6.5% from the full month of June 2024.

“While the wholesale market experienced some volatility in April and May, trends have started to calm down and are looking more normal early in June,” says Jeremy Robb, senior director of economic and industry insights at Cox Automotive. “In the first two weeks of June, we’ve seen fairly normal depreciation trends on a weekly basis, as used retail sales remain steady. With heightened activity in April and May, the seasonal adjustments to the index were a bit stronger. Now that they are starting to wane, this has caused the overall index to rise so far in June. Wholesale supply continues to be relatively tight, and we’ve seen healthy sales conversion in recent weeks, suggesting market demand will be steady as we move into summer.”

According to Manheim, all major market segments posted positive year-over-year results for seasonally-adjusted prices during the first half of June. Compared to the industry’s year-over-year increase of 6.5%, the luxury segment outperformed the market (+8.8%), with SUVs hovering at +6.4%. Trucks and compact cars were up 3.9% and 0.3%, respectively. Electric vehicles (EVs) experienced higher prices in recent months, with a notable 11.1% increase in early June compared to “somewhat depressed values” during the same period last year.

All segments were up month-over-month, with trucks, compact and midsize cars, SUVs and luxury vehicles up 2.1%, 1.5%, 1.3%, 1.5% and 1.2%, respectively. Against May values, EVs increased by 0.7% in the first half of June, while non-EVs showed stronger gains and were up 2.0% in the month.