KPI – June 2024: Recent Vehicle Recalls

KPI – June 2024: State of Manufacturing

KPI – June 2024: State of Business – Automotive Industry

KPI – June 2024: State of the Economy

KPI – June 2024: Consumer Trends

The Conference Board Consumer Confidence Index® rose slightly to 102.0 (1985=100) in May, compared to 97.5 in April. Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at a disappointing 69.1 in May. According to preliminary reports, sentiment dropped to a 7-month low in the beginning of June.

The Conference Board Consumer Confidence Index® rose slightly to 102.0 (1985=100) in May, compared to 97.5 in April. Similarly, the University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – finished at a disappointing 69.1 in May. According to preliminary reports, sentiment dropped to a 7-month low in the beginning of June.

From diminished excess savings and plateauing wage gains to low savings rates and less pent-up demand, experts predict consumer spending will cool further while GDP growth dips below 1% over the Q2 to Q3 2024 period.

“Additionally, the restart of student loan payments and uptick in subprime auto and millennial credit card delinquencies are emerging signs of stress for some consumers,” according to Ginger Chambless, head of research in Commercial Banking at J.P. Morgan.

Small businesses continue to fight for growth in a struggling economy. According to Fiserv, Inc. (NYSE: FI) – a leading global provider of payments and financial services technology – the latest Fiserv Small Business Index™ held at 145 in May. Retail spending was flat, while transactions increased slightly (+0.7%).

Small businesses continue to fight for growth in a struggling economy. According to Fiserv, Inc. (NYSE: FI) – a leading global provider of payments and financial services technology – the latest Fiserv Small Business Index™ held at 145 in May. Retail spending was flat, while transactions increased slightly (+0.7%).

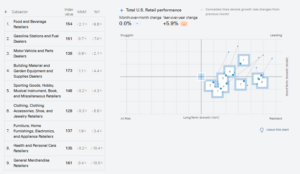

Data confirms Food & Beverage Retailers posted the largest spending expansion (+2.1% from April), while categories like Clothing, Sporting Goods and Health/Personal Care showed small gains month-over-month. Building Materials, General Merchandise, Auto Parts and Furniture also slipped in May – suggesting consumers continue to curb discretionary spending, according to Fiserv.

Leading subsectors based on sales volume within small business across the U.S., courtesy of Fiserv, Inc.

- The Food Services and Drinking Places index registered 129. Although spending increased slightly (+0.6%) from April, transaction activity decreased by -1.2% month-over-month. Instead, consumers devoted more trips to food and beverage retailers, including small business grocers. While the reduction in spend per transaction was less pronounced in May, Fiserv says consumers continue to seek the right balance in restaurant spending given its significant share of wallet.

- The Specialty Trade Contractors index registered 152. Sales grew slightly by +0.9%, while the pace of year-over-year growth slowed to +2.8% (compared to +4% in April). Seasonal demand delivered an uptick for small project contractors, swimming pool servicers and AC specialists.

- The Professional, Scientific and Technical Services index decreased slightly to 163. Despite a -0.7% decline from April, the category increased 13.5% year-over-year. According to Fiserv, this shift was expected considering the “acute demands” for April tax season services relaxed. Other areas driving demand include veterinary and general legal/attorney services.

At 90.5, the NFIB Small Business Optimism Index reached its highest reading of the year in May; however, the 0.8-point increase was not enough to overcome the 29th month below the historical average of 98. In addition, the Uncertainty Index rose nine points to 85 – its highest reading since November 2020.

Small business owners are navigating tough economic conditions, with 22% still pointing to inflation as the single most important challenge in operating their business. Overall, 60% reported hiring or trying to hire – up four points from April. A collective 51% (or 85% of those hiring or trying to hire) of owners noted few or no qualified applicants for open positions (unchanged). Reports of labor quality as the single most important problem for business owners rose one point to 20%, while labor cost decreased one point to 10% – only three points below the highest reading of 13% reached in December 2021.

“The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy,” says Bill Dunkelberg, NFIB chief economist. “But for 29 consecutive months, small business owners have expressed historically low optimism, and their views about future business conditions are at the worst levels seen in 50 years. Small business owners need relief, as inflation has not eased much on Main Street.”

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Top Takeaways:

- Economic activity in the manufacturing sector contracted in May for the second consecutive month and the 18th time in the last 19 months, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®. The Manufacturing PMI® registered 48.7% in May, down 0.5 percentage point from 49.2% a month prior.

- In May, the Consumer Price Index for All Urban Consumers (CPI-U) was unchanged on a seasonally-adjusted basis after rising 0.3% in April, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 3.3% before seasonal adjustment.

- Total new-vehicle sales for May 2024, including retail and non-retail transactions, are projected to reach 1,446,800 units – a 2.9% year-over-year increase on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

- RV wholesale shipments are projected to jump into the mid-300,000-unit range by year-end and even higher in 2025, according to the June 2024 issue of RV RoadSigns.

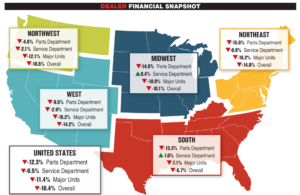

- Powersports Business says dealers across the country reported an overall combined revenue decline of 10.4% year-over-year in April, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 12.3% in parts, 11.4% in major units and .5% in service.