KPI — June 2023: State of the Economy

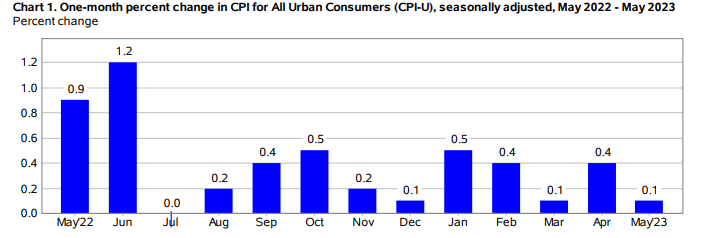

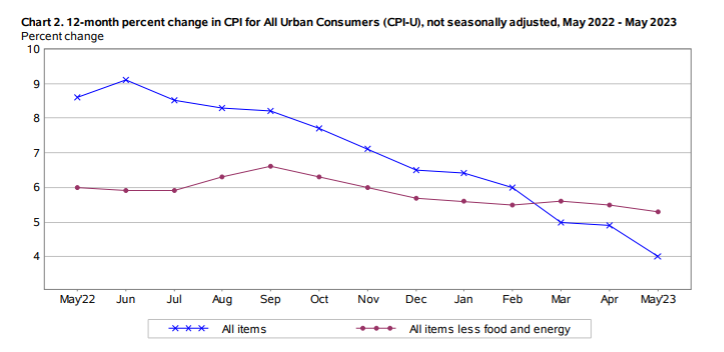

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in May on a seasonally adjusted basis, says the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 4% before seasonal adjustment.

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Categories on the rise include shelter, used cars and trucks, motor vehicle insurance, apparel and personal care. The index for household furnishings and operations, plus the index for airline fares, were among those to decrease.

- The all-items index increased 4% year-over-year – the smallest 12-month increase since March 2021. The energy index decreased 11.7% and the food index increased 6.7% over the last year, with the all items less food and energy index up 5.3%.

Employment

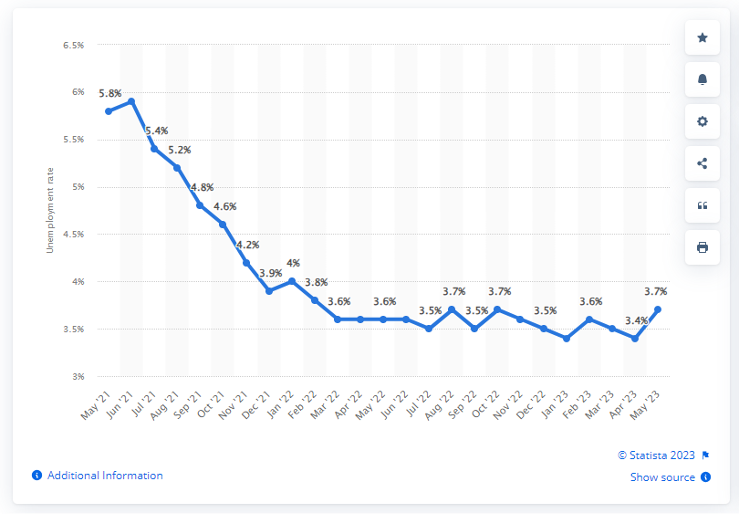

In May, the unemployment rate rose to 3.7% with the number of unemployed persons increasing by 440,000 to 6.1 million, according to the U.S. Bureau of Labor Statistics. The number of job losers and persons who completed temporary jobs increased by 318,000 month-over-month, with long-term unemployed accounting for 19.8% of the total unemployed. The labor force participation rate held at 62.6% in May and the employment-population ratio was little changed at 60.3%.

“As employment reports go, this one was more of a mixed bag,” says Mark Hamrick, senior economic analyst for Bankrate.

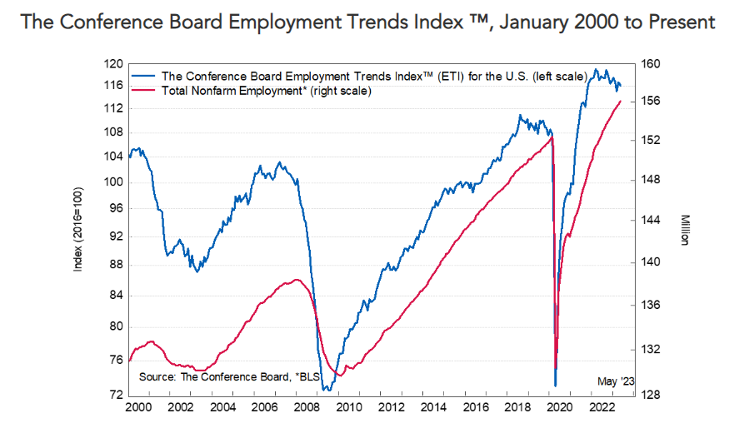

The Conference Board Employment Trends Index™ (ETI) decreased in May to 116.15, down from an upwardly revised 116.79 in April 2023. The Employment Trends Index is a leading composite index for employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

For Preston Caldwell, chief US economist at Morningstar, the jobs report and broader economic data rebukes recessionary discussion and suggests growth at a healthy pace. The Conference Board Employment Trends Index™, however, signals job gains that will likely continue but at a “somewhat slower pace” over the next few months, notes Selcuk Eren, senior economist at The Conference Board.

“The brunt of job losses is concentrated within a few sectors, while the economy at large continues to generate employment opportunities in industries grappling with labor shortages. Wage growth is slowing down but remains above its pre-pandemic rate,” he says. “We expect the Federal Reserve will raise interest rates at least one more time by 25 basis points to slow wage growth and reduce inflationary pressures. This will likely lead to job losses and a rise in unemployment levels later in 2023 through the early months of 2024.”

By Demographic

This month, unemployment rates among the major worker groups: adult women – 3.3%, adult men – 3.5%, teenagers – 10.3%, Asian – 2.9%, White – 3.3%, Hispanic – 4% and Black – 5.6%.

Last month, unemployment rates among the major worker groups: adult women – 3.1%, adult men – 3.3%, teenagers – 9.2%, Asian – 2.8%, White – 3.1%, Hispanic – 4.4% and Black – 4.7%.

By Industry

Total nonfarm payroll employment increased by 339,000 in May, following an upwardly revised April and more moderate job-growth predictions from leading economists. According to current data, job gains occurred in professional and business services, government, health care, construction, transportation and warehousing, as well as social assistance.

“For now, the labor market remains on strong footing with job growth continuing. However, some softening is visible across several labor indicators. Job openings and quits have declined, layoffs have ticked up and compensation growth is softening,” explains Frank Steemers, senior economist at The Conference Board. “Still, the labor market remains resilient and tighter than before the pandemic, complicating the Federal Reserve’s efforts to slow inflation.”

Important Takeaways, Courtesy of the U.S. Bureau of Labor Statistics:

- Employment in construction is up 25,000 jobs, including 11,000 jobs in heavy and civil engineering construction. Over the prior 12 months, construction added an average of 17,000 jobs per month.

- Employment in transportation and warehousing increased by 24,000. Transit and ground passenger transportation added 12,000 jobs, offsetting a decrease in the prior month. Employment also increased in couriers and messengers (+8,000) and air transportation (+3,000).

- Employment in professional and business services added 64,000 jobs. Growth continued in professional, scientific and technical services – up 43,000 jobs in May.

Review all employment statistics here.

“Overall, we remain in a very tight labor market, especially compared to pre-pandemic conditions. Job growth continues economy-wide, with in-person service sectors leading the way. Industries that have yet to fully recover from the pandemic – including leisure and hospitality, along with the government sector – are poised to continue adding jobs, while an aging US population will fuel sustained employment growth in the healthcare and social assistance industry,” Eren says. “For now, the labor market is cooling only in select industries – most notably the information sector, which includes most tech companies. However, weakness is starting to become visible across other labor indicators, including a decline in voluntary quits and a surge in layoff announcements over the first five months of 2023.”

The Conference Board says the unique combination of labor shortages and recession risk pose “difficult dilemmas” for employers. According to the Q2 2023 results of The Conference Board Measure of CEO Confidence™, 33% of CEOs expect to expand their workforce over the next 12 months, while 20% expect a net reduction in their workforce and 46% expect little change. The Conference Board has published a new Job Loss Risk Index to help business leaders better understand the risk of layoffs in their industry, in addition to the unique dynamics that the projected recession exposes them to in the process.

KPI — June 2023: Consumer Trends

Key Performance Indicators Report — June 2023