KPI — June 2021: The Brief

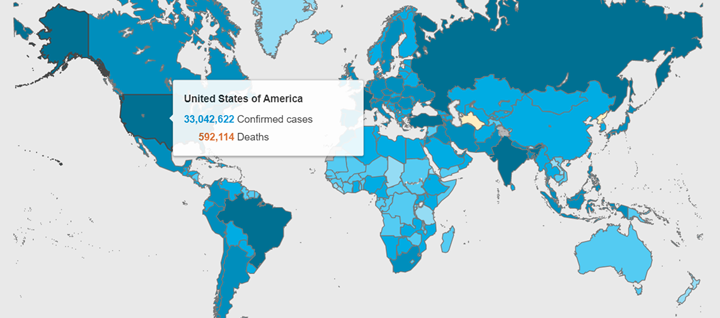

Nearly 173.4 million COVID-19 cases and 3.7 million deaths have been confirmed across 235+ countries, areas or territories.

Global vaccination efforts remain a top priority, with the ultimate goal of reaching herd immunity. A new Pew Research survey finds public intent to get vaccinated is on the rise. In fact, the number of Americans fully vaccinated now tops 139 million, according to the Centers for Disease Control and Prevention.

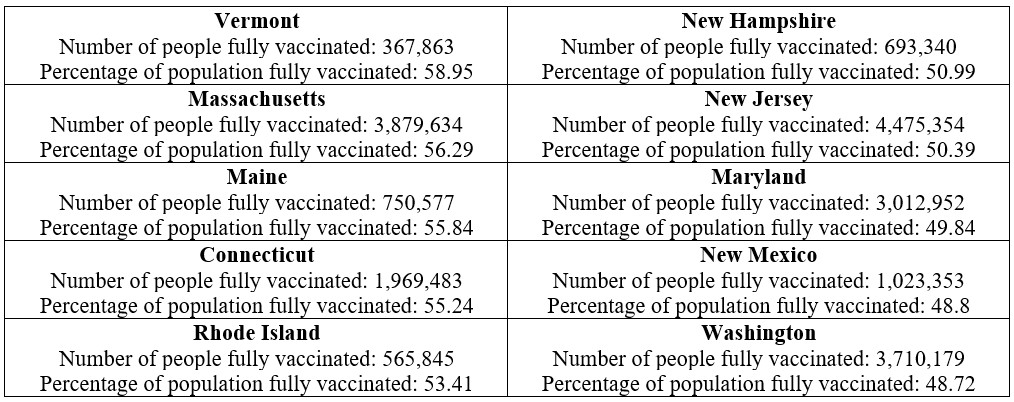

Below are the top 10 states ranked by the percentage of their population fully vaccinated against COVID-19. Review the full list here.

Though more than half of Americans are fully vaccinated, approximately 30% of Americans remain undecided or unwilling to receive the vaccine.

Concerns topping the list include rapid vaccine development – thus calling into question the lack of long-term studies – side effects and actual efficacy, according to a Pew Research Center Survey of 10,121 U.S. adults from February 16 to 21, 2021.

“Differences across demographic and political groups continue to characterize public views of COVID-19 vaccines. Yet these dynamics are fluid, and there have been some notable changes as intent has risen and vaccines become more widely available in the U.S.,” according to Pew Research.

COVID-19 Cases by Country

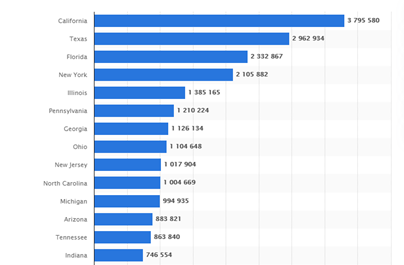

COVID-19 Cases by State

As of June 7, 2021, California is the state with the highest number of COVID-19 cases. Over 33 million cases have been reported across the U.S., with California, Texas, Florida and New York reporting the highest numbers. COVID-19 restrictions vary by state, county and even city. Review a comprehensive list of current restrictions here.

Vaccination rates may be on the rise, but consumer sentiment and confidence are beginning to simmer.

The Consumer Sentiment Index—a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions—finished at 82.9 in May, below its 88.3 reading in April.

May has the lowest consumer confidence level in three months, amid declines in both current conditions (89.4 vs 97.2 in April) and expectations (78.8 vs 82.7), according to the University of Michigan Survey of Consumers. Meanwhile, inflation expectations remain elevated for the year ahead (4.6% vs 3.4%) and the next five years (3% vs 2.7%).

“It is hardly surprising that the resurgent strength of the economy produced more immediate gains in demand than supply, causing consumers to expect a surge in inflation,” said Richard Curtin, chief economist at Survey for Consumers. “Record proportions of consumers reported higher prices across a wide range of discretionary purchases, including homes, vehicles and household durables – the average change in May vastly exceeds all prior monthly changes.”

Furthermore, after a modest increase in February and a “surge” in March and April, The Conference Board Consumer Confidence Index® held steady in May. The Index now stands at 117.2 (1985=100), down marginally from 117.5 in April.

Overall, economists are optimistic that as Americans get past the worst of the pandemic, they will be eager to act upon pent-up demand. NRF forecasts put 2021 retail sales between $4.33 trillion and $4.4 trillion. Online sales, which are included in the total, are expected to grow between 18% and 23% ($1.14 trillion and $1.19 trillion). Read the full report here.

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends.

Below are a few key data points explained in further detail throughout the report:

- The May Manufacturing PMI® registered 61.2%, a month-over-month increase of .5 percentage points. This figure indicates expansion in the overall economy for the 12th month in a row after a contraction in April 2020, according to the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

- The Conference Board forecasts U.S. real GDP growth will rise to 8.6% (annualized rate) in Q2 2021 and 6.4% (year-over-year) in 2021.

- The Consumer Price Index for All Urban Consumers (CPI-U) increased .8% in April on a seasonally adjusted basis after rising .6% in March, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all items index increased 4.2% before seasonal adjustment, which is the largest 12-month increase since a 4.9% increase during September 2008.

- Global Light Vehicle (LV) sales dropped to 86.5 mn units/year in April, according to LMC Automotive.

- TrueCar forecasts total new vehicle sales will reach 1,509,221 units in May 2021 – up 36% year-over-year and even with April 2021 when adjusted for the same number of selling days.

- Microchip shortages have dealerships scrambling and used prices soaring. The U.S. Senate looks to invest billions in domestic microchip production to help offset the lack of overseas shipments.

- RV shipments are projected to exceed 576,000 in 2021, pushing wholesale shipments to their highest historical total, according to ITR Economics.

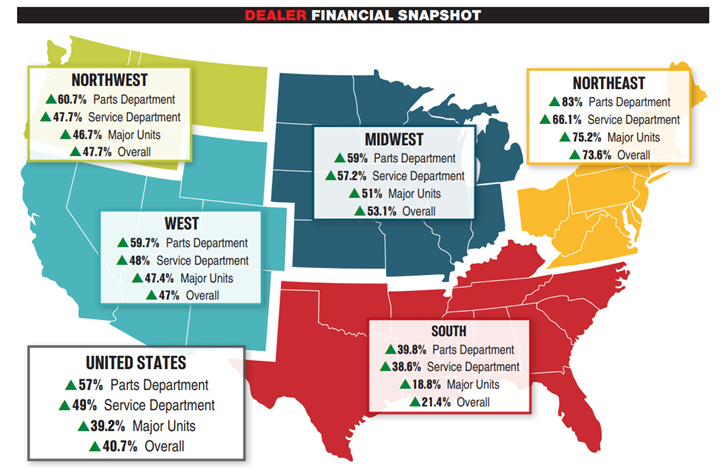

- The powersports market is riding a 39.2% year-over-year spike in sales during April 2021, according to composite data from more than 1,400 dealerships in the U.S. that use the CDK Lightspeed DMS.

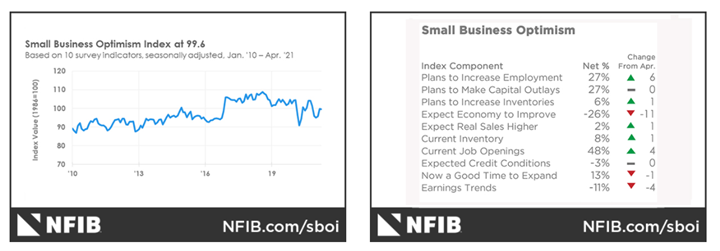

The NFIB Small Business Optimism Index rose to 99.8 in April, an increase of 1.6 points from March.

Two themes are apparent in this month’s index: labor is in short supply – thus holding back growth – and inflation is rampant on Main Street. “Small business owners are struggling at record levels trying to get workers back in open positions,” said Bill Dunkelberg. NFIB chief economist. “Owners are offering higher wages to try to remedy the labor shortage problem. Ultimately, higher labor costs are being passed on to customers in higher selling prices.”

Important takeaways, courtesy of NFIB:

- Strong job growth eased in May as small businesses struggled to find workers to fill open positions. Unfilled job openings increased from 44% to 48%, seasonally adjusted. May is the fourth consecutive month setting a new record high reading for unfilled job openings. May’s reading is 26 points higher than the 48-year historical average of 22%.

- Seasonally adjusted, a net 34% reported raising compensation (up three points), the highest level in the past 12 months. Raising compensation is about the only way owners have to remedy the labor shortage problem.

- The net percent of owners raising average selling prices increased four points to a net 40%, seasonally adjusted – the highest reading since April 1981.

“Neither consumers or business owners are exuberant about economic prospects for the rest of the year. There is much uncertainty – about COVID, economic policy (taxes, regulations, etc.) and politics… both globally and domestically,” according to commentary reports by NFIB.

The monthly Key Performance Indicator Report is your comprehensive source for industry insights, exclusive interviews, new and used vehicle data, manufacturing summaries, economic analysis, consumer reporting, relevant global affairs and more. We value your readership.