KPI – July 2025: State of Manufacturing

The contraction rate for manufacturing activity slowed in June, with improvements in inventories & production...

- KPI – July 2025: The Brief

- KPI – July 2025: State of Business – Automotive Industry

- KPI – July 2025: State of the Economy

- KPI – July 2025: Consumer Trends

- KPI – July 2025: Recent Vehicle Recalls

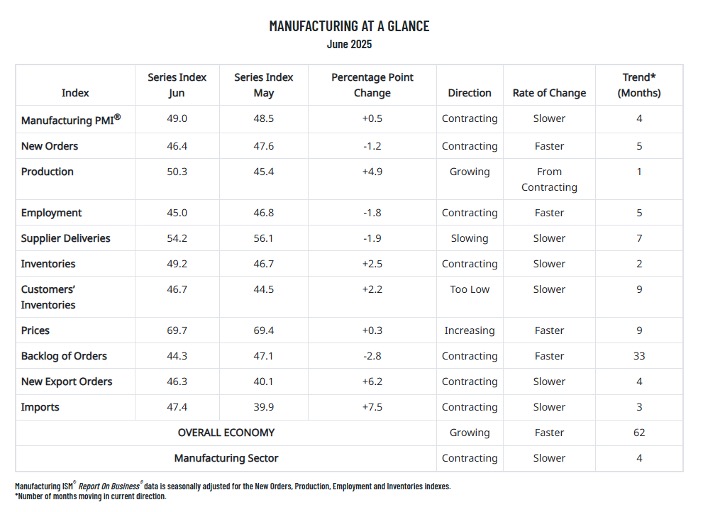

Economic activity in the manufacturing sector contracted for the fourth consecutive month, following a two-month expansion preceded by 26 straight months of contraction, according to the nation’s supply executives in the latest Manufacturing ISM Report On Business. The Manufacturing PMI registered 49% in June, a 0.5% increase compared to the 48.5% recorded in May.

“In June, U.S. manufacturing activity slowed its rate of contraction, with improvements in inventories and production the biggest factors in the 0.5 percentage point gain in the Manufacturing PMI,” says Susan Spence, MBA, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee.

Data shows 46% of the sector’s gross domestic product (GDP) contracted this month, down from 57% per month prior. However, 25% of GDP is strongly contracting (registering a composite PMI of 45% or lower), up from 5% in May.

“The share of sector GDP with a PMI at or below 45% is a good metric to gauge overall manufacturing weakness. Of the six largest manufacturing industries, four (Petroleum & Coal Products; Computer & Electronic Products; Machinery; and Food, Beverage & Tobacco Products) expanded in June, compared to two in May,” Spence explains.

Important Takeaways, Courtesy of the Manufacturing ISM Report On Business:

- Demand indicators remain mixed, with the New Orders and Backlog of Orders indexes contracting at faster rates, while the Customers’ Inventories and New Export Orders indexes contracted at slower rates. A “too low” status for the Customers’ Inventories Index is usually considered positive for future production.

- Regarding output, the Production Index increased month-over-month and is now in expansion territory; however, the Employment Index dropped further into contraction as managing head count is still the norm, as opposed to hiring. The mixed indicators in output suggest companies are still being cautious in their hiring, even with an increase in production.

- The Inventories Index remains in contraction territory (though at a slower rate compared to May) after expanding in April, as companies completed pull-forward activity ahead of tariffs. The Supplier Deliveries Index indicated slower deliveries but improved performance, indicating that the delays in clearing goods through ports of entry are largely complete. Tariffs-induced prices growth accelerated, while the Imports Index remained in contraction but regained the ground it lost the previous month.

What Respondents Are Saying, According to the Manufacturing ISM Report On Business:

- “Business has notably slowed in last four to six weeks. Customers do not want to make commitments in the wake of massive tariff uncertainty.” [Fabricated Metal Products]

- “Middle East unrest, as well as unstable long-term tariff positions, continue to impact second- and third-tier sources, which is applying pressure to material costs. Costs are up 6% to 10% over budgeted inflation — and the forecast accounted for the volatility expected with the current administration.” [Wood Products]

- “The biopharmaceutical space is starting to see more pronounced headwinds: Stock prices have significantly eroded, companies are facing hiring freezes and so on.” [Chemical Products]

- “The tariff mess has utterly stopped sales globally and domestically. Everyone is on pause. Orders have collapsed.” [Machinery]

- “Tariff volatility has impacted machinery, steel and specialized components. Also, potential shortages of skilled labor for construction, maintenance and installation.” [Food, Beverage & Tobacco Products]

- “Tariffs continue to cause confusion and uncertainty for long-term procurement decisions. The situation remains too volatile to firmly put such plans into place.” [Computer & Electronic Products]

- “Tariffs continue to impact material pricing.” [Petroleum & Coal Products]

- “Tariffs, chaos, sluggish economy, rising prices, Ukraine, Iran, geopolitical unrest around the world — all make for a landscape that is hellacious, and fatigue is setting in due to dealing with these issues across the spectrum. Unfortunately, this is just the beginning unless something drastically changes, but the supply chain implications will grow — depots will not be stocked, less material will be available and it will take years for domestic production to handle the needs (if companies even want to).” [Primary Metals]

- “The geopolitical environment remains volatile: (1) Ongoing shifts in U.S. tariff policy make it difficult to plan, (2) emerging conflicts in the Middle East could pose long-term commodity risks and (3) China measures on rare earth materials are causing challenges. Overall outlook for our company is positive; it’s just extremely hard to make near-term supply plans/strategies or budgets.” [Miscellaneous Manufacturing]

- “The word that best describes the current market outlook is ‘uncertainty.’ The erratic trade policy with on-again/off-again tariffs has led to price uncertainty for customers, who appear to be prepared to hold off large capital purchases until stability returns. This has resulted in further reductions in customer demand and softening sales for the balance of 2025. Operations has planned additional weeks of downtime at multiple plants to accommodate reduced orders. Next year’s forecast is not any better at this point. Additionally, most electric vehicle (EV) projects have been delayed or canceled, resulting in a significant amount of unutilized capital investment. EV technology launches for 2026-2028 have been delayed past 2030.” [Transportation Equipment]