KPI – July 2025: Consumer Trends

In June, consumer sentiment reached its highest level in five months, but it still remains below its historical average…

- KPI – July 2025: The Brief

- KPI – July 2025: State of Manufacturing

- KPI – July 2025: State of Business – Automotive Industry

- KPI – July 2025: State of the Economy

- KPI – July 2025: Recent Vehicle Recalls

Below is a synopsis of consumer confidence, sentiment, demand and income/spending trends.

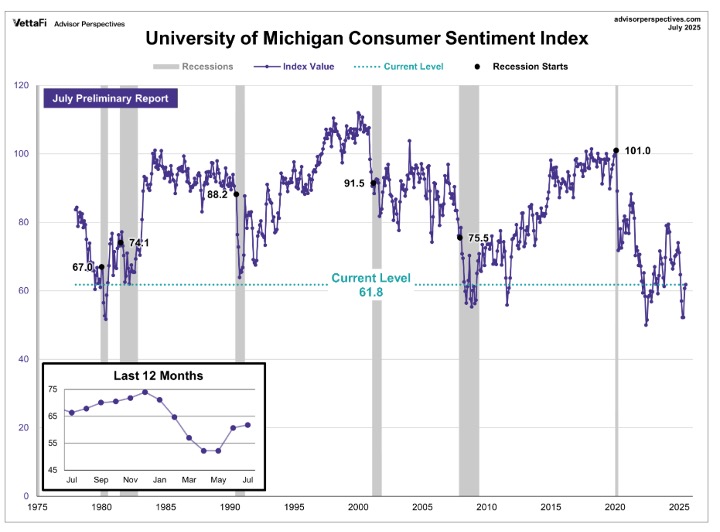

The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – registered 60.7 in June and posted a preliminary reading of 61.8 in July, up one index point.

“While sentiment reached its highest value in five months, it remains a substantial 16% below December 2024 and is well below its historical average,” according to Joanne Hsu, director of Surveys of Consumers.

Short-run business conditions improved approximately 8%, whereas expected personal finances decreased 4%. Data shows year-ahead inflation expectations fell for a second straight month, dropping from 5% last month to 4.4% this month.

In addition, long-run inflation expectations receded for the third consecutive month, declining from 4% in June to 3.6% in July. Both readings are the lowest since February 2025 but remain above December 2024, indicating consumers still fear substantial risk of increased inflation in the future.

“Consumers are unlikely to regain their confidence in the economy unless they feel assured that inflation is unlikely to worsen. For example, if trade policy stabilizes for the foreseeable future,” Hsu says. “At this time, the interviews reveal little evidence that other policy developments, including the recent passage of the tax and spending bill, moved the needle much on consumer sentiment.”

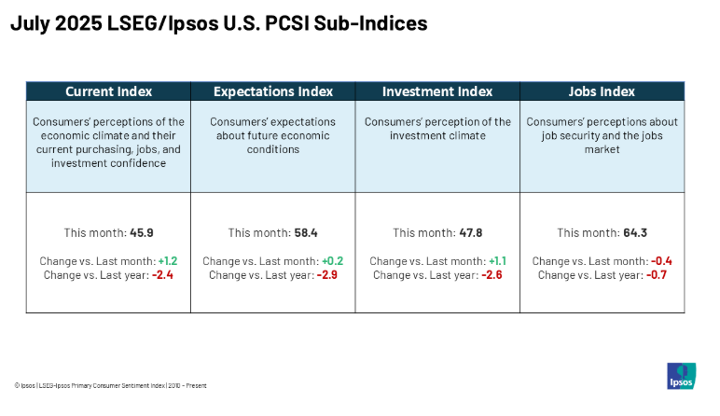

Caption: The LSEG/Ipsos Primary Consumer Sentiment Index for July 2025 is at 53.8. Fielded from June 20-30, 2025, the Index is stable (+0.4 point) compared to last month.

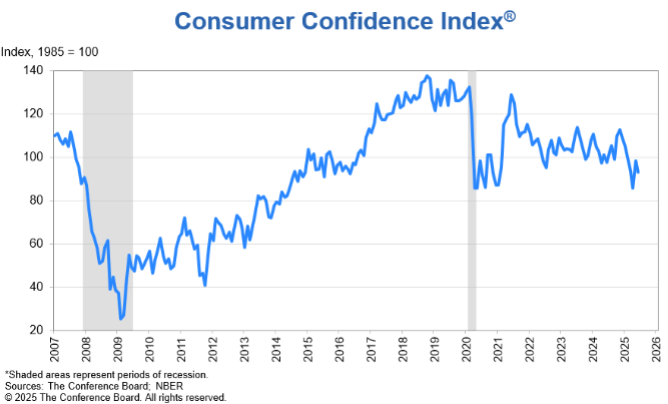

Unlike Survey of Consumers, The Conference Board Consumer Confidence Index “deteriorated” by 5.4 points, falling from 98.4 in May to 93.0 (1985=100) in June. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – fell 6.4 points to 129.1. Meanwhile, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – decreased 4.6 points to 69.0, well below the historic “recessionary threshold” of 80.

“Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” says Stephanie Guichard, senior economist of Global Indicators at The Conference Board. “Consumers were less positive about current business conditions. Their appraisal of current job availability weakened for the sixth consecutive month but remained in positive territory, in line with the still-solid labor market. The three components of the Expectations Index – business conditions, employment prospects and future income – all weakened. Consumers were more pessimistic about business conditions and job availability over the next six months, and optimism about future income prospects eroded slightly.”

Data shows the decline was broad-based across components, with consumers’ assessments of the present situation and their expectations for the future both contributing to the deterioration. In addition, this month’s decrease in confidence was shared across age and political affiliation, as well as most income groups.

Key Takeaways, Courtesy of The Conference Board:

- Consumers’ outlook on stock prices continued to recover from April’s 16-month low, with 45.6% expecting stock prices to increase over the next 12 months, up from 37.6% two months ago. Regarding interest rates, 57% expected rates to rise – the highest share since October 2023.

- Consumers’ views of their Family’s Current Financial Situation remained solid overall, albeit “deteriorating slightly,” while consumers’ expectations regarding their Family’s Future Financial Situation improved to a 4-month high.

- The share of consumers expecting a recession over the next 12 months rose slightly, remaining above 2024 levels.

- Purchasing plans for cars were steady (the highest level since December 2024), while purchasing plans for homes declined. Compared to May, more consumers were undecided about plans to buy big-ticket items overall. Buying plans for most appliances were slightly up, but plans to buy electronics goods were down. Consumers’ intentions to purchase more services in the months ahead weakened compared to May, with almost all services categories declining. Dining out remained number one among spending intentions in services. It was one of the few categories to see spending intentions rise in June, along with motor vehicle services, museum/historic sites and fitness. Vacation intentions were unchanged overall in the month. More consumers planned to travel abroad, while intentions to travel in the U.S. declined.

According to Guichard, consumers’ write-in responses revealed little change in the top issues impacting their views of the economy.

“Tariffs remained on top of consumers’ minds and were frequently associated with concerns about their negative impacts on the economy and prices. Inflation and high prices were another important concern cited by consumers in June. However, there were a few more mentions of easing inflation compared to last month. This is in line with a cooling in consumers’ average 12-month inflation expectations to 6.0% (down from 6.4% in May and 7% in April),” she says. “References to geopolitics and social unrest increased slightly from previous months but remained much lower on the list of topics affecting consumers’ views.”

Consumer Income & Spending

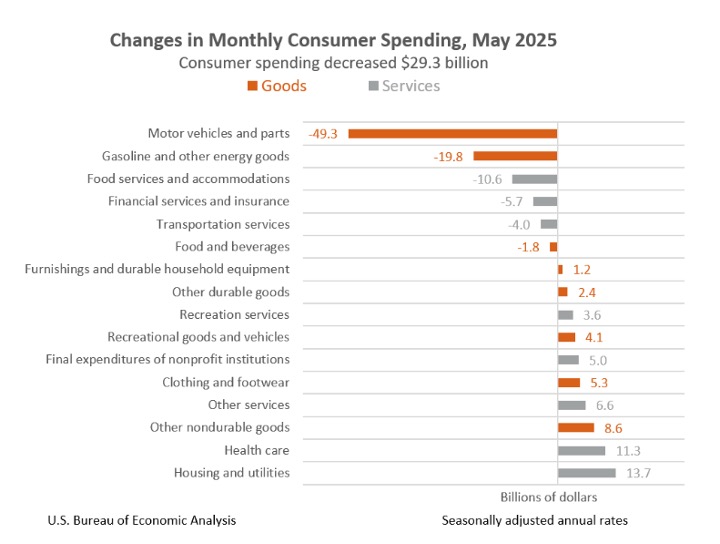

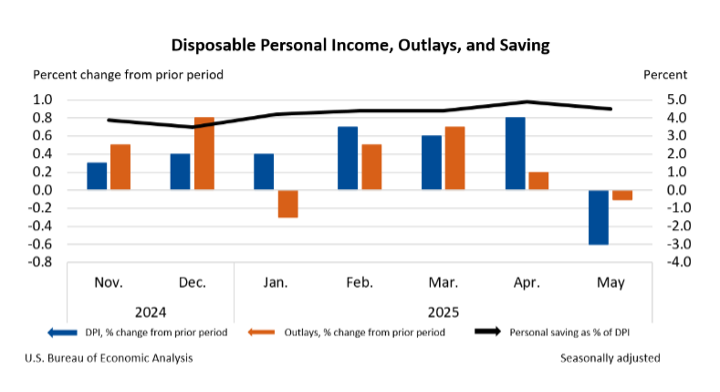

According to the U.S. Bureau of Economic Analysis (BEA), personal income decreased $109.6 billion (0.4% at a monthly rate) during May 2025. Disposable personal income (DPI) – personal income less personal current taxes – decreased $125 billion (0.6%) and personal consumption expenditures (PCE) decreased $29.3 billion (0.1%).

Personal outlays – the sum of PCE, personal interest payments and personal current transfer payments – decreased $27.6 billion in May. In addition, personal saving was $1.01 trillion and the personal saving rate, personal saving as a percentage of disposable personal income, registered 4.5%.

Important Takeaways, Courtesy of BEA:

- In May, the $29.3 billion decrease in current-dollar PCE reflected a decrease of $49.2 billion in spending on goods, which was partly offset by an increase of $19.9 billion in spending for services.

- Compared to the preceding month, the PCE price index increased 0.1%. Excluding food and energy, the PCE price index increased 0.2%.

- The PCE price index increased 2.3% year-over-year. Excluding food and energy, the PCE price index increased 2.7% from one year ago.