KPI — July 2022: State of the Economy

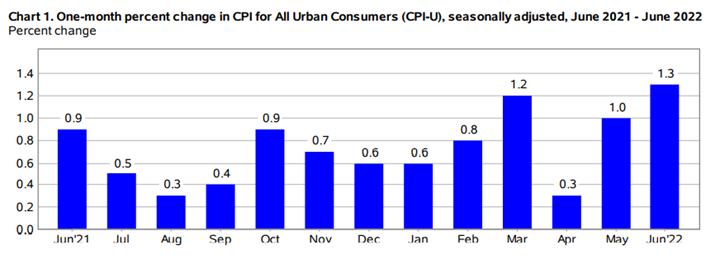

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3% in June on a seasonally-adjusted basis following a 1% rise in May, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 9.1% before seasonal adjustment – the largest 12-month increase since the period ending November 1981.

The increase was broad-based, with the indexes for gasoline, shelter and food serving as the largest contributors. The energy index rose 7.5% month-over-month and contributed to nearly half of the all-items increase, with the gasoline index rising 11.2% alongside other major component indexes. The food index increased 1%, as did the food-at-home index.

The index for all-items less food and energy rose .7%, after increasing .6% in the preceding two months. While almost all major component indexes increased month-over-month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

The all items less food and energy index rose 5.9% over the last 12 months. The energy index rose 41.6% year-over-year, the largest 12-month increase since the period ending April 1980. In addition, the food index increased 10.4% year-over-year, the largest 12-month increase since the period ending February 1981.

The White House points its finger at COVID and Putin for economic woes, but CNBC journalist Jeff Cox implies overall accountability is misplaced.

“Policymakers have struggled to come up with answer to a situation that is rooted in multiple factors, including clogged supply chains, outsized demand for goods over services and trillions of dollars in Covid-related stimulus spending that has made consumers both flush with cash and confronted with the highest prices since the early days of the Reagan administration,” he says.

The tug-of-war resulted in another hit to the bank account for workers. Inflation-adjusted incomes, based on average hourly earnings, fell 1% for the month and were down 3.6% year-over-year, according to recent data. The current inflation rate could shove the Federal Reserve into an even more aggressive position.

“U.S. inflation is above 9%, but it is the breadth of the price pressures that is really concerning for the Federal Reserve,” says James Knightley, ING’s chief international economist. “With supply conditions showing little sign of improvement, the onus is the on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions. The recession threat is rising.”

Employment

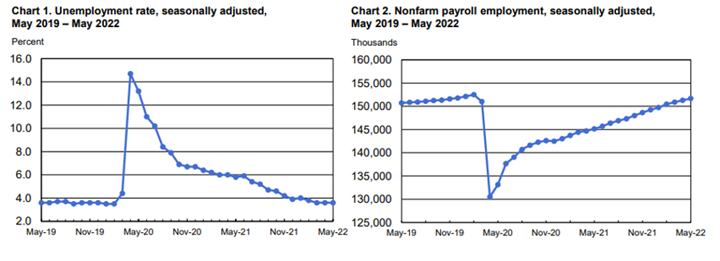

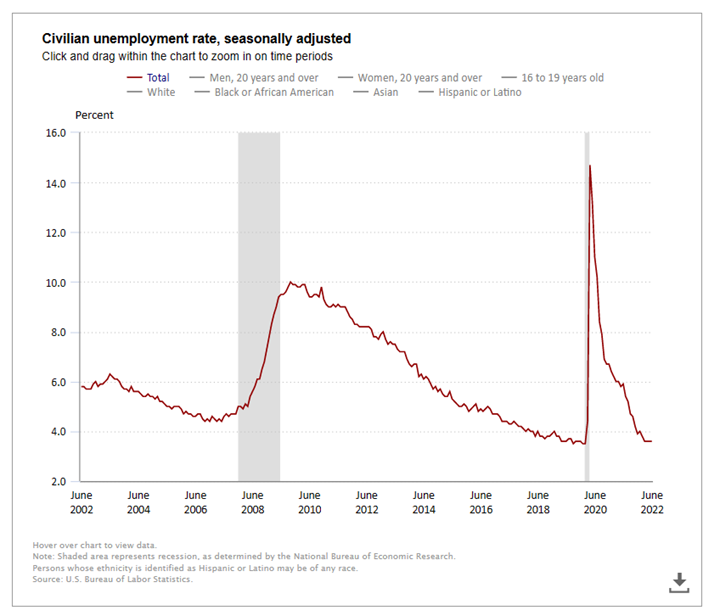

Total nonfarm payroll employment rose by 372,000 in June, while the unemployment rate remained steady at 3.6%. Andrew Hunter, senior U.S. economist at Capital Economics, believes a strong non-farm payroll performance in June “makes a mockery” of recession chatter.

“This report reflects that our labor market remains strong despite the challenges and headwinds, and it reflects the fact that the U.S. economy has got some room to face the challenges as the Fed negotiates inflation and as we deal with the war of Russia against Ukraine,” adds Cecilia Rouse, chair of the White House’s Council of Economic Advisers.

Important Takeaways, Courtesy of the Bureau of Labor Statistics:

- The number of people on temporary layoff registered 827,000, relatively unchanged month-over-month.

- Among the unemployed, the number of permanent job losers remained at 1.3 million.

- The number of long-term unemployed (those jobless for 27 weeks or more) edged down to 1.3 million.

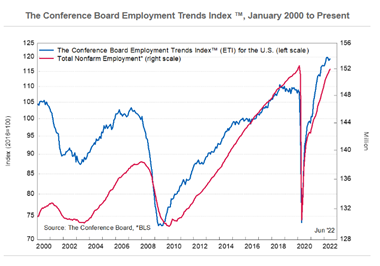

The Conference Board Employment Trends Index™ (ETI) increased in June to 119.38, up from a downwardly revised 118.88 in May 2022.

“While the Employment Trends Index rebounded in June, it remains below the index readings from March and April 2022,” says Frank Steemers, senior economist at The Conference Board. “Moreover, a range of other economic indicators beyond the Employment Trends Index point to an economy that is slowing. Usually, it takes a few months for hiring decisions to adjust to changes in economic activity. Therefore, we expect positive, but decelerating, job growth over the next months.”

By Demographic

Unemployment rates among the major worker groups: adult women – 3.3%; adult men – 3.3%; teenagers – 11%; Asian – 3%; White – 3.3%; Hispanic – 4.3% and Black – 5.8%.

By Industry

Total nonfarm payroll employment racked up 372,000 in June, with notable job gains in professional and business services, leisure and hospitality and health care. Total nonfarm employment remains down by 524,000, or .3%, from its pre-pandemic level in February 2020. Meanwhile, private-sector employment recovered the net job losses due to the pandemic and is 140,000 higher than in February 2020; government employment is 664,000 lower.

Important takeaways, courtesy of the U.S. Bureau of Labor Statistics:

- Employment in professional and business services continued to grow, with an increase of 74,000. Within the industry, job growth occurred in management of companies and enterprises (+12,000), computer systems design and related services (+10,000), office administrative services (+8,000) and scientific research and development services (+6,000). Employment in professional and business services is 880,000 higher than in February 2020.

- Employment in leisure and hospitality added 67,000 jobs, as growth continued in food services and drinking places (+41,000). Though employment in leisure and hospitality is down by 1.3 million, or 7.8%, since February 2020.

- Employment in health care rose by 57,000, including gains in ambulatory health care services (+28,000), hospitals (+21,000) and nursing and residential care facilities (+8,000). Employment in health care overall is below its February 2020 level by 176,000, or 1.1%

- Employment in transportation and warehousing added 36,000 jobs. Employment increased in warehousing and storage (+18,000) and air transportation (+8,000). Employment in transportation and warehousing is 759,000 above its February 2020 level.

- Employment in manufacturing increased by 29,000 and has returned to its February 2020 level.

“Currently, the labor market is still strong and labor shortages are severe. However, this picture could change towards the end of 2022 and early 2023,” says Steemers. “With inflation still elevated and the Fed expected to continue to raise interest rates rapidly, the risk of a short and mild recession is growing. In such a scenario, employers may reduce hiring – and possibly implement furloughs and layoffs, depending on the severity of a potential economic contraction. By early 2023, there could possibly be monthly job losses – and in that case, the unemployment rate would tick up.”

Review all employment statistics here.

KPI — July 2022: Consumer Trends

Key Performance Indicators Report — July 2022