- KPI – January 2026: The Brief

- KPI – January 2026: State of Business – Automotive Industry

- KPI – January 2026: State of Manufacturing

- KPI – January 2026: Consumer Trends

- KPI – January 2026: Recent Vehicle Recalls

Employment

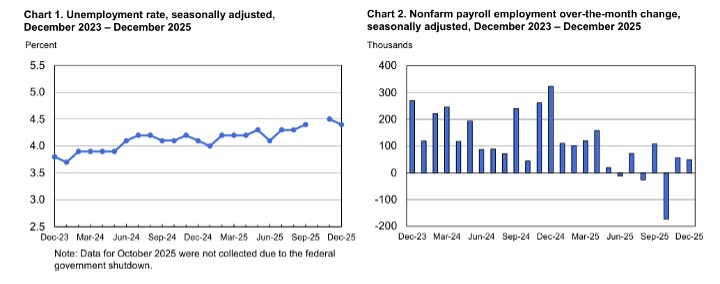

Total nonfarm payroll employment was 50,000 in December—below the downwardly revised 56,000 in November and short of the Dow Jones estimate of 73,000. Employment continued to trend up in food services and drinking places, health care and social assistance. Retail trade and the manufacturing sector shed jobs, the latter of which was a steeper decline than expected.

According to the U.S. Bureau of Labor Statistics, the unemployment rate and number of unemployed persons was 4.4% and 7.5 million, respectively. In addition, the labor force participation and long-term unemployed (those jobless for 27 weeks or more) rates registered 62.4% and 26%, respectively. While the number of long-term unemployed (those jobless for 27 weeks or more) changed little month-over-month at 1.9 million, it is up 397,000 over the year.

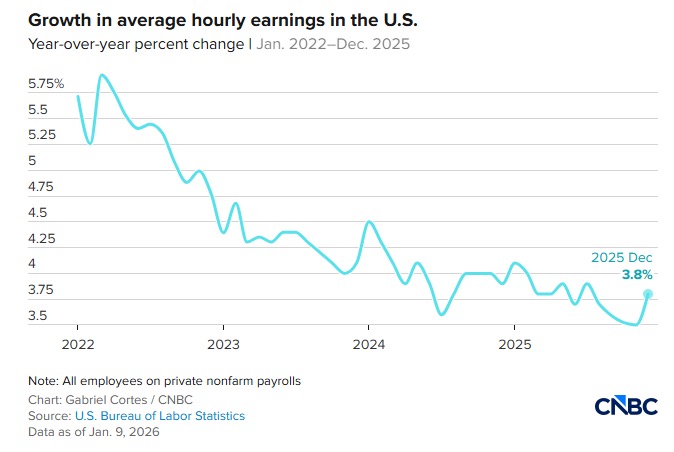

“Today’s report confirms what we think has been evident for some time—the labor market is no longer working in favor of jobseekers,” says Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management. “Until the data provide a clearer direction, a divided Fed is likely to stay that way. Lower rates are likely coming this year, but the markets may have to be patient.”

Seema Shah, chief global strategist at Principal Asset Management, notes the prospect of a January Fed rate cut has all but vanished following the unexpected drop in the unemployment rate, as it is difficult to argue that the labor market is collapsing and in urgent need of monetary support.

“However, the picture remains far from clear: payroll growth undershot expectations and downward revisions to prior months have pushed the three-month moving average into negative territory,” Shah adds. “The U.S. economy likely requires additional support from the Fed—just not immediately.”

Caption: According to Fox Business reports, job gains during the prior two months were both revised in the September report. Job creation in July was revised down by 7,000, from a gain of 79,000 to 72,000. Likewise, job creation for August was revised down by 26,000, from a gain of 22,000 to a loss of 4,000.

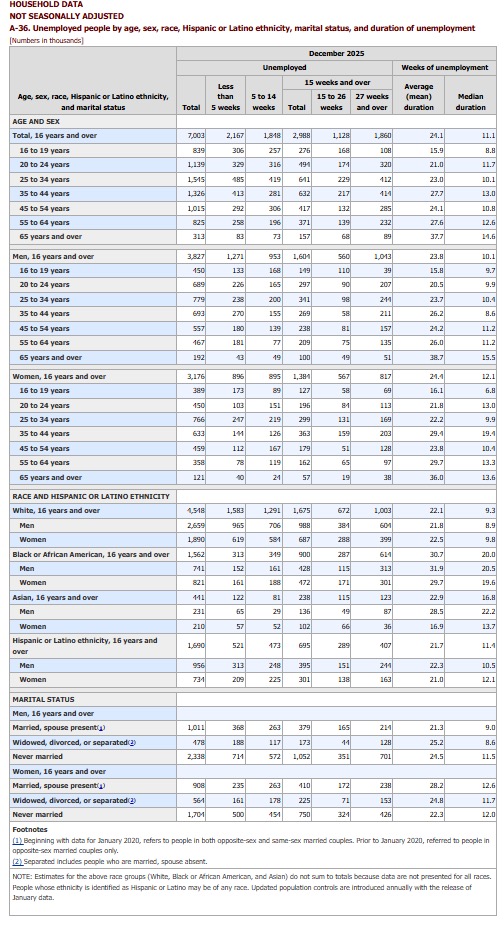

By Demographic

This month, unemployment among the major worker groups: adult women – 3.9%; adult men – 3.9%; teenagers – 15.7%; Asians – 3.6%; Whites – 3.8%; Hispanics – 4.9%; and Blacks – 7.5%.

Last month, unemployment among the major worker groups: adult women – 4.1%; adult men – 4.1%; teenagers – 16.3%; Asians – 3.6%; Whites – 3.9%; Hispanics – 5%; and Blacks – 8.3%.

![]()

By Industry

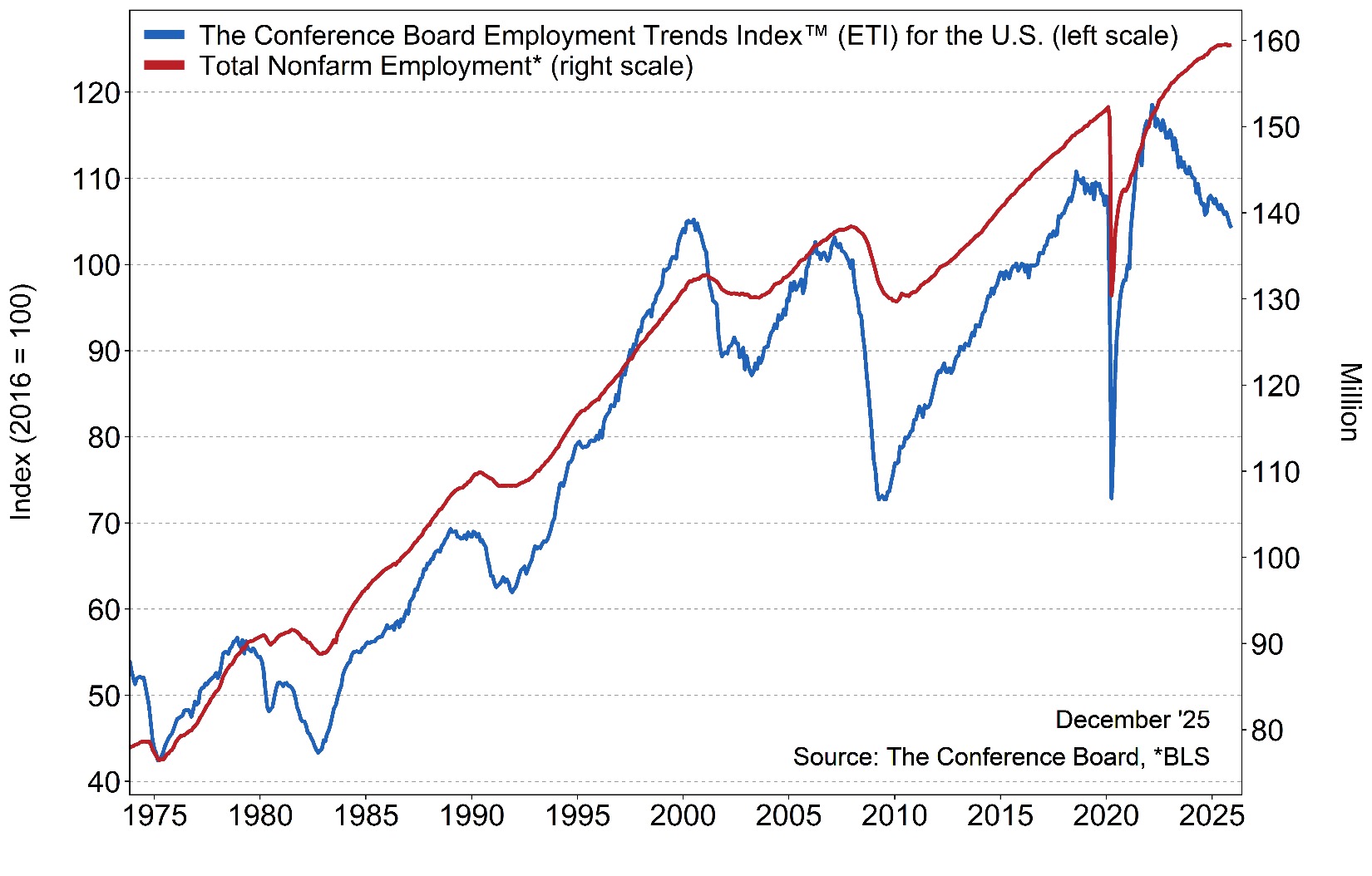

The Conference Board Employment Trends Index (ETI) declined slightly from a downwardly revised 104.64 in November to 104.27 in December.

December’s decrease in the Employment Trends Index was a result of negative contributions from six of its eight components: the Percentage of Respondents Who Say They Find “Jobs Hard to Get,” Initial Claims for Unemployment Insurance, the Number of Employees Hired by the Temporary-Help Industry, the Ratio of Involuntarily Part-time to All Part-time Workers, Real Manufacturing and Trade Sales and Industrial Production. Only Job Openings contributed positively, and the Percentage of Firms with Positions Not Able to Fill Right Now was unchanged.

“The ETI slid further in December, reflecting low labor market confidence in the outlooks for hiring and job-finding,” says Mitchell Barnes, economist at The Conference Board.

Caption: The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

He cites the share of consumers who report “jobs are hard to get”—an ETI component from the Consumer Confidence Survey—rose to 20.8% in December, reaching the highest point since early 2021. The share of small firms reporting that jobs are “not able to be filled right now” held at 33%, near the post-pandemic low reached in July. Meanwhile, the share of involuntary part-time workers rose to 19.4%, the highest rate since early 2021.

“The state of the U.S. labor market was little changed at the end of 2025, as the low-hire, low-fire dynamic persisted, allowing most Americans to continue to work,” Barnes says. “Nonetheless, the ETI portends smaller payroll employment gains ahead.”

Key Takeaways, Courtesy of ETI:

- Initial claims for unemployment insurance rose marginally in December, but that followed consecutive monthly declines in October and November.

- Job openings declined by 303,000, falling to the lowest level since 2020.

- Real manufacturing and trade sales and industrial production were steady during the final months of 2025, but surveys of manufacturing activity and employment across goods-producing sectors continued to contract.

Click here to view more detailed information by industry.