- KPI – January 2026: The Brief

- KPI – January 2026: State of Manufacturing

- KPI – January 2026: State of the Economy

- KPI – January 2026: Consumer Trends

- KPI – January 2026: Recent Vehicle Recalls

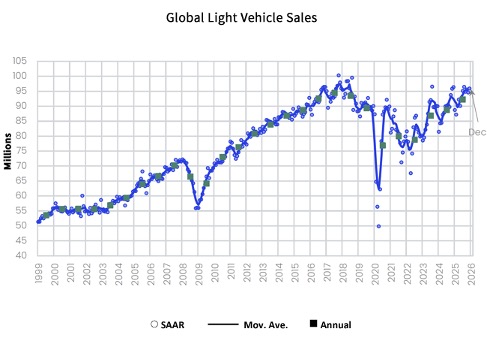

Global Light Vehicle Sales

In December, the Global Light Vehicle (LV) selling rate fell to 93 million units per year, primarily attributed to a deceleration in the Chinese PV market. The market fell 2.5% year-over-year, as sales totaled 8.4 million units globally. The U.S., Western Europe and China posted mixed results.

“The pace of sales cooled significantly in China during December, though this was not unexpected. The government has now confirmed that the scrappage incentive scheme will be extended to the end of 2026, and consumers appeared to anticipate this move in December, reducing the urgency to make purchases,” says David Oakley, manager of Americas vehicle sales forecasts at GlobalData. “Elsewhere, most markets saw year-over-year growth, with Europe contributing a healthy gain, thanks to positive momentum in markets such as Germany and Turkey.”

With 91.9 million units sold, 2025 results were up 3.6% overall compared to 2024. Moreover, January sales are expected to increase 4.1% year-over-year, according to Oakley. Analysts expect growth in China, India and other emerging markets across Asia. Modest expansion is forecast in Europe, while Japan could post a contraction year-over-year, as consumers grapple with financing pressures. The global selling rate is expected to reach 85.7 million units in January, down from a rate of 88.8 million units a year prior.

“Our initial forecast for total global sales in 2026 stands at 93.7 million units, up 1.9% year-over-year. China should still see year-over-year growth, but at a slower rate than in 2025, as changes to the scrappage incentive scheme are set to discourage OEMs from engaging in a price war. The recent escalation in trade tensions between the U.S. and Europe over the issue of Greenland underlines downside risks that could impact on vehicle sales, either through direct tariffs or an erosion in economic strength,” Oakley says.

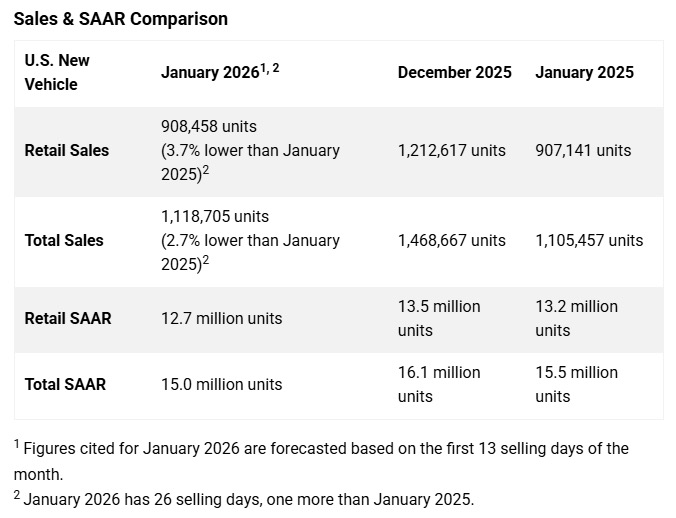

U.S. New Vehicle Market

Total new vehicle sales for January 2026, including retail and non-retail transactions, are projected to reach 1,118,700—a 2.7% decrease year-over-year, according to a joint forecast from J.D. Power and GlobalData.

“January is historically the lowest volume sales month of the year, and also is historically the least indicative of full-year sales performance. Nevertheless, January opens 2026 with a modest performance, with retail sales expected to increase by 1,317 units compared to a year ago,” says Thomas King, president of the data and analytics division at J.D. Power.

“As with every January, winter storms have the potential to create some disruption to sales patterns, but the key factors in assessing January’s performance are the co-mingling of lower EV sales, higher incentives on internal combustion engine (ICE) vehicles and ongoing profit pressure from tariffs,” he continues.

Key Takeaways, Courtesy of J.D. Power:

- Retail buyers are on pace to spend $39.7 billion on new vehicles, up $0.5 billion year-over-year.

- Internal combustion engine (ICE) vehicles are projected to account for 77.7% of new vehicle retail sales, an increase of 2.7 percentage points from a year ago. Plug-in hybrid vehicles (PHEV), electric vehicles (EVs) and hybrid electric vehicles (HEVs) are on pace to make up 0.9%, 6.6% and 14.7% of new vehicle retail sales, respectively.

- Trucks/SUVs are on pace to account for 83.1% of new vehicle retail sales, up 1.5 percentage points from a year ago.

- Leasing is expected to account for 21.7% of sales this month, down 2.1 percentage points year-over-year.

- The average new vehicle retail transaction price in January is expected to reach $45,880, up $512 from a year ago.

- Average monthly finance payments are on pace to be $760, up $24 year-over-year. The average interest rate for new-vehicle loans is expected to be 6.29%, down 0.48 percentage points from a year ago.

- Total retailer profit per unit—which includes vehicle gross plus finance and insurance income—is expected to be $2,148, down $62 from January 2025, but up $224 from December 2025. Total aggregate retailer profit from new-vehicle sales for this month is projected to total $1.9 billion, down 2.6% from last year.

- Fleet sales are expected to total 210,247 units, up 1.9% year-over-year. Fleet volume is expected to account for 18.8% of total light vehicle sales, up 0.9 percentage points from a year ago.

“Despite a moderate start to the year, the full-year outlook remains relatively positive. Rising lease-return volumes, plus the expectation of lower interest rates, present meaningful tailwinds to the industry,” King says.

“More importantly, as OEMs and dealers navigate the evolving economics of EVs, there is likely to be an opportunity to improve affordability of ICE vehicles as production schedules shift towards a more profitable mix of vehicles for both OEMs and Dealers. Similarly, supply chain changes present the opportunity to partially mitigate tariffs, although tariff-related profit pressure for OEMs will persist throughout the year,” he continues.

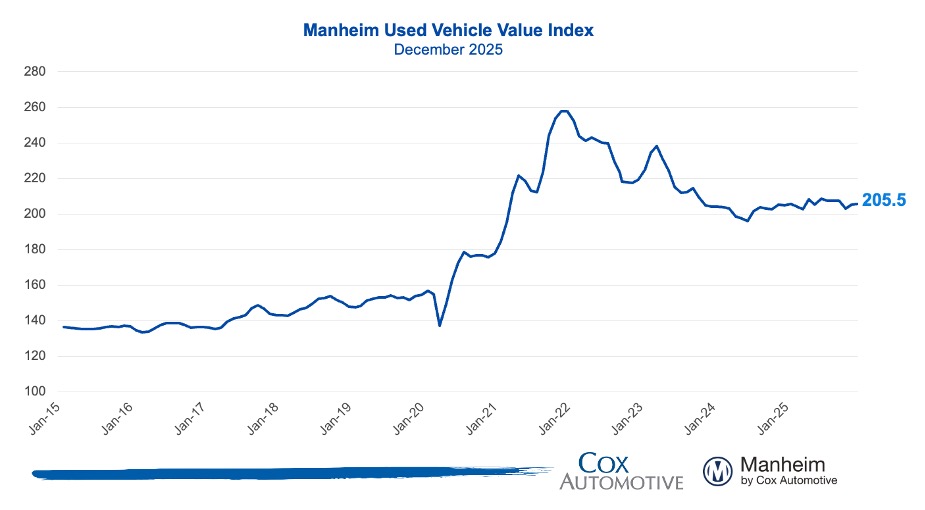

U.S. Used Market

The Manheim Used Vehicle Value Index (MUVVI) increased to 205.5, reflecting a 0.4% increase for wholesale used-vehicle prices (adjusted for mix, mileage and seasonality) compared to December 2024. The December index is up 0.1% month-over-month. The long-term average monthly move for December is flat, showing no change from month-to-month.

“Consumer spending trends showed signs of a slowdown in December, as affordability concerns caused many to pull back on the spending reins, translating to depreciation trends catching up a bit in wholesale markets over the month. As we moved into the holiday period, we saw seasonal patterns in used retail sales slowing down, while new retail sales increased against November trends but remained lower compared to 2024,” says Jeremy Robb, interim chief economist at Cox Automotive.

“Consumer sentiment rose throughout December, but five consecutive weeks of lower year-over-year consumer spending kept the pace of sales in check. At Manheim, the year ended with days’ supply rising over the month, as is seasonally normal during the year-end holiday period. As we move into 2026, a few positive indicators are emerging: New and used auto loan rates have fallen to the lowest level in a year, and consumers will soon see increased tax refunds hit their wallets. As this plays out, we are expecting to see stronger demand in the auto market as the year gets underway,” he continues.

Click here to view results by segment.