KPI – January 2025: The Brief

Expectations for economic growth, lower inflation & positive business conditions increased…

- KPI – January 2025: Consumer Trends

- KPI – January 2025: State of Manufacturing

- KPI – January 2025: State of Business – Automotive Industry

- KPI – January 2025: State of the Economy

- KPI – January 2025: Recent Vehicle Recalls

The Conference Board Consumer Confidence Index slid from 111.7 in November to 104.7 (1985=100) in December – an 8.1-point difference. The Present Situation Index –based on consumers’ assessment of current business and labor market conditions – dropped 1.2 points (140.2).

Meanwhile, the Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – nosedived 12.6 points to 81.1, just above the threshold of 80 which usually signals a recession ahead.

“The recent rebound in consumer confidence was not sustained in December, as the Index dropped back to the middle of the range that has prevailed over the past two years,” says Dana M. Peterson, chief economist at The Conference Board.

While consumers remain frustrated with rising rent, utilities and insurance, alongside elevated grocery costs and fluctuating mortgage rates, some key data looks bright. The University of Michigan Survey of Consumers – a survey consisting of approximately 50 core questions covering consumers’ assessments of their personal financial situation, buying attitudes and overall economic conditions – was 74 in December, up from 71.8 a month prior. The preliminary January reading is 73.2.

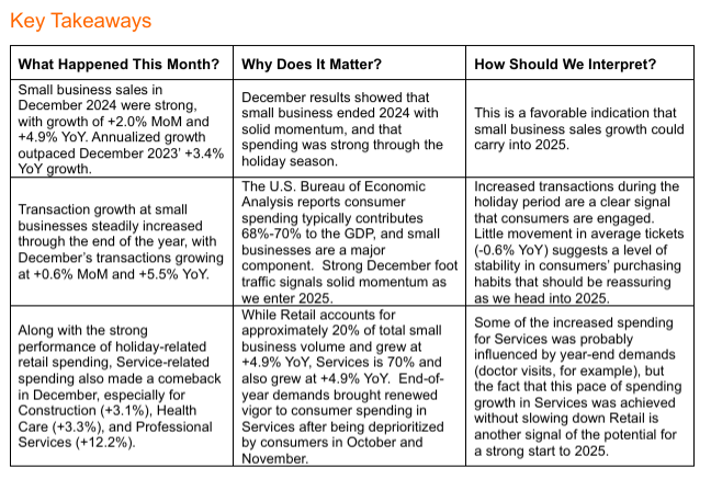

Moreover, the seasonally adjusted Fiserv Small Business Index registered 146 for December, up 3 points month-over-month. Small business sales (+4.9%) and total transactions (+5.5%) grew significantly year-over-year, while retail posted strong month-over-month numbers as well (+1%).

“Small business sales continued their growth in December despite consumer spending patterns beginning to shift,” says Prasanna Dhore, chief data officer at Fiserv. “Notably, consumers diverted more spend to service-based business; retail spending continued to display strength; and consumers spent less dining out as average restaurant ticket sizes continued to decline.”

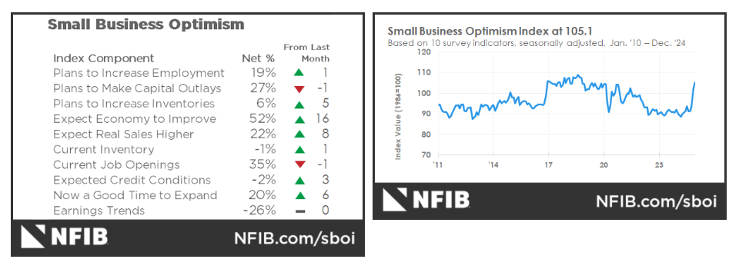

The NFIB Small Business Optimism Index supports the trend in small business confidence. In December, the Index registered 105.1 – up 3.4 points from the month prior and the highest reading since October 2018. Of the 10 Optimism Index components, seven increased, two decreased and one was unchanged.

Important takeaways, courtesy of NFIB:

- The net percentage of owners expecting the economy to improve rose 16 points to a net 52% (seasonally adjusted) – the highest since the fourth quarter of 1983.

- The percentage of small business owners believing it is a good time to expand their business rose 6 points to 20% (seasonally adjusted) – the highest reading since February 2020.

- The net percentage of owners expecting higher real sales volumes rose 8 points to a net 22% (seasonally adjusted) – the highest reading since January 2020.

- A net 6% (seasonally adjusted) of owners plan inventory investment in the coming months – up five points from November and the highest reading since December 2021.

- One-in-five owners reported that inflation was their single most important problem in operating their business (higher input and labor costs) – unchanged from November and leading labor quality as the top issue by one point.

“Optimism on Main Street continues to grow with the improved economic outlook following the election,” says Bill Dunkelberg, NFIB chief economist. “Small business owners feel more certain and hopeful about the economic agenda of the new administration. Expectations for economic growth, lower inflation and positive business conditions have increased in anticipation of pro-business policies and legislation in the new year.”

Image Source: NFIB Small Business Optimism Index

Professionals in the automotive, RV and powersports industries remain steadfast in their efforts to evolve their business models and grow their brands in the face of adversity. As such, the monthly Key Performance Indicator Report serves as an objective wellness check on the overall health of our nation, from the state of manufacturing and vehicle sales to current economic conditions and consumer trends. Below are a few key data points explained in further detail throughout the report.

Key data points:

- Economic activity in the manufacturing sector contracted in December for the ninth consecutive month and the 25th time in the last 26 months, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

- In December, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4% on a seasonally adjusted basis after rising 0.3% in November, according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all-items index increased 2.9% before seasonal adjustment.

- Total new-vehicle sales for December 2024, including retail and non-retail transactions, are projected to reach 1,520,000 – a 7.3% year-over-year increase on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.

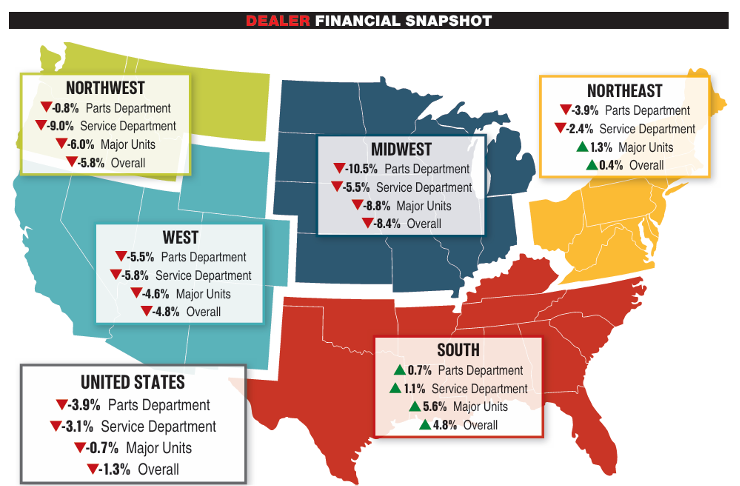

- Powersports Business says dealers across the country reported an overall combined revenue decline of 1.3% year-over-year in October, according to composite data from more than 1,700 dealerships in the U.S. that utilize CDK Lightspeed DMS. On average, dealerships were down 3.9% in parts, 0.7% in major units and 3.1% in service.

Image Source: Powersports Business